After rising during the first year of the pandemic, lumber prices have fallen dramatically. The Wall Street Journal is reporting that lumber futures for July delivery ended Friday at $695.10 per thousand board feet, down 52% from a high in early March.

On-the-spot wood prices have also dropped. According to pricing service Random Lengths, its framing composite index, which tracks cash sales, fell about 12% last week to end at $794, down from $1,334 in March.

This is after the sector was seeing growing demand at the start of the pandemic. In the summer of 2020, wood prices soared as Americans under lockdown remodeled and demand for suburban houses skyrocketed. By last spring, lumber cost more than twice the pre-pandemic high.

However, higher interest rates and a limited supply of houses for sale and high asking prices are taking their toll. Single-family home completions, starts, and building permits each dropped in April, according to the Census Bureau. In turn, lumber buyers are slowing orders, causing wood to pile up at mills, leading to reduced prices.

Lumber producer Canfor Corp. recently announced that it is is extending reduced operating schedules at its sawmills in Western Canada and will implement two-week rotating downtimes this summer because lumber is stacking up in its yards. Since late March, Canfor’s Canadian sawmills have been operating at 80% of production capacity.

Canfor Corp. announced that it would continue its reduced operating schedules at its Western Canadian sawmills due to the ongoing global supply chain challenges. The company will also implement two weeks of rotating downtime across its primary sawmills this summer. Canfor has been operating at roughly 80% of production capacity since late March.

“The global supply challenges are continuing to significantly limit our ability to transport products to our customers and our inventory levels remain very high,” said Canfor president and CEO Don Kayne in a news release announcing the company’s plans. “We are working to bring our inventory levels back into balance by reducing our production, while also working to meet the needs of our customers.”

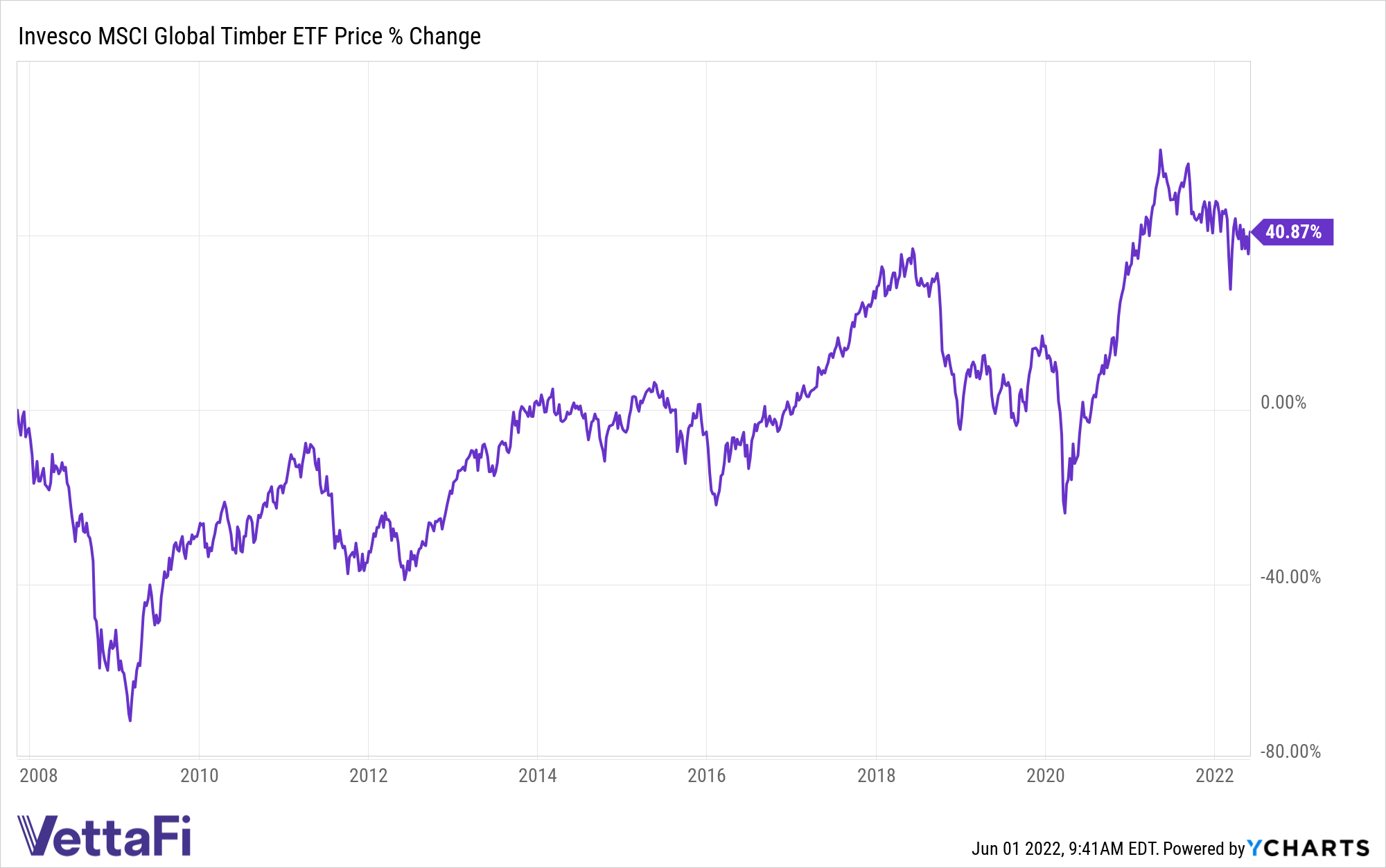

The Invesco MSCI Global Timber ETF (CUT) follows the MSCI ACWI IMI Timber Select Capped Index, which “measures the performance of securities engaged in the ownership and management of forests, timberlands and production of products using timber as raw materials,” according to the issuer. “The index is computed using the net return, which withholds applicable taxes for non-resident investors. The Fund and the Index are rebalanced quarterly.”

Since its inception in 2007, CUT’s value has gone up nearly 41%.

CUT has an expense ratio of 0.61%.

For more news, information, and strategy, visit the Innovative ETFs Channel.