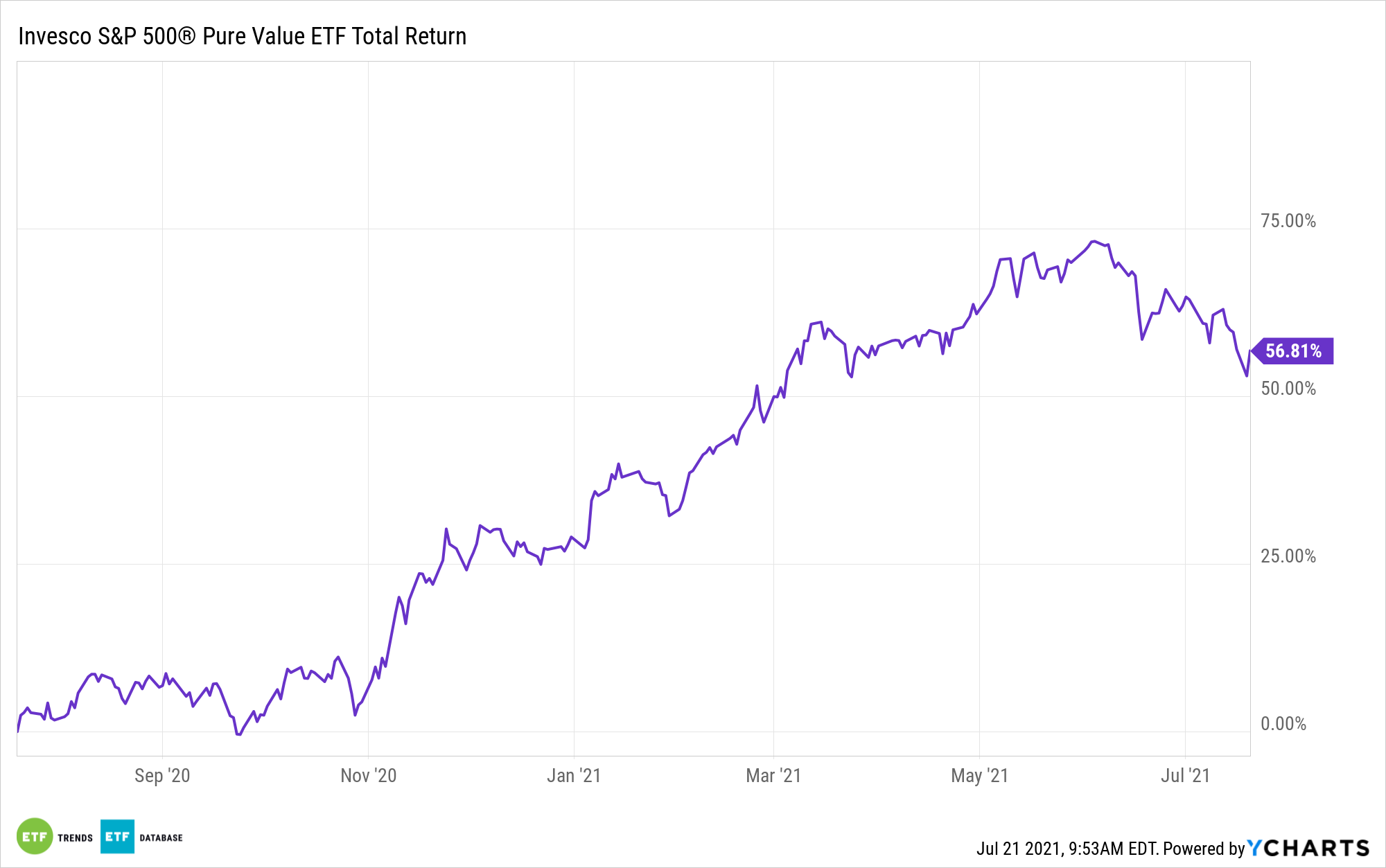

Recent bouts of market volatility and continued inflationary uncertainty have led many investors to consider value stocks and the Invesco S&P 500 Pure Value ETF (RPV).

“Investments and spending by companies is surging, and consumer spending is set to accelerate with more easing of government lockdown restrictions,” Invesco noted on its website. “As a result of this increased spending activity, certain companies stand to benefit from potential growth in their earnings (e.g. more investment and consumer spending results in higher earnings). In particular, companies whose stock are deemed “value stocks” may perform well, which investors may want to consider allocating to in their portfolio.”

RPV seeks to track the investment results of the S&P 500® Pure Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is composed of a subset of securities from the S&P 500® Index that exhibit strong value characteristics. Invesco’s strategy includes:

- Assigning securities two “style scores” – one for value and one for growth – based on the characteristics of the issuer. The “value score” is measured using three factors: book-value-to-price ratio, earnings-to-price ratio, and sales-to-price ratio. The “growth score” is measured using three other factors: three-year sales per share growth, the three-year ratio of earnings per share change to price per share, and momentum (the 12-month percentage change in price).

- The ratio between the growth score and the value score is used to rank each stock as either deep value, blend, or deep growth, and only the deep value stocks are selected and are factor weighted such that securities demonstrating the strongest value characteristics receive proportionally greater weights.

Why Value During an Economic Expansion?

History is on the side of value when it comes to an economic expansion. This is especially the case when looking at the S&P 500, particularly its value indices.

“When considering value stocks, it’s important to understand what they are and why they have performed well during economic expansion,” Invesco’s website said. “In the chart below, you can see that the S&P 500 Pure Value index has outperformed both the S&P 500 Value Index and the S&P 500 Index. Why? Because, not all value is created equally, and the S&P 500 Pure Value strategy gives you almost 2x the amount of value exposure versus the traditional value index.”

For more news and information, visit the Innovative ETFs Channel.