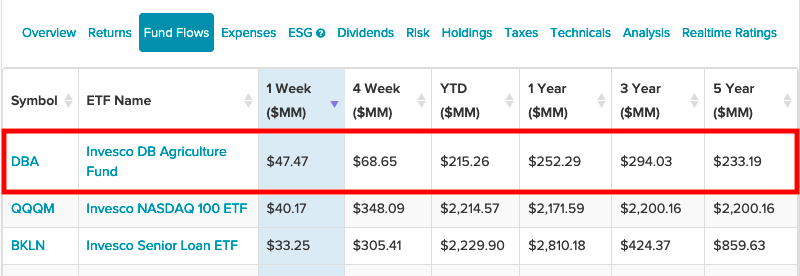

Inflation fears continue to persist in the capital markets, as evidenced by the latest inflows into Invesco exchange traded funds (ETFs), particularly the Invesco DB Agriculture Fund (DBA).

The consumer price index (CPI) rose to a three-decade high during the month of October, highlighting the need for inflation hedges. One way to achieve them is via commodities as prices continue to head upwards.

Investors can use DBA in anticipation of continually rising prices. Though the U.S. Federal Reserve has acknowledged that inflationary pressures exist, rising interest rates are a possibility in 2022.

In the meantime, investors can use DBA as a hedge against other assets in their portfolio that could be prone to rising rates. That group could include fixed income assets like bonds.

“This ETF is one of the most popular options for achieving exposure to agricultural commodities; DBA invests in a diversified basket of various agricultural natural resources, and as such can be a useful diversifying agent or inflation hedge,” an ETF Database analysis says. “The targeted focus of this fund makes it often more appropriate for investors looking to implement a shorter term tactical tilt, though DBA may also be useful as a component of a long-term, buy-and-hold portfolio.”

Inflows Into Tech and Senior Loans

While the Invesco QQQ Trust (QQQ) gets the majority of the spotlight, investors shouldn’t forget the Invesco NASDAQ 100 ETF (QQQM). QQQM is based on the NASDAQ-100 Index, which includes securities of 100 of the largest domestic and international non-financial companies listed on the Nasdaq.

At a 0.15% expense ratio, the fund can also be used as a trader’s tool like its bigger QQQ brother. Tech continues to come into the forefront after the pandemic further stressed the need for reliance on technology.

Lastly, investors appear to be heading into the Invesco Senior Loan ETF (BKLN), which seeks to track the investment results of the S&P/LSTA U.S. Leveraged Loan 100 Index. The advisor and the fund’s sub-advisor define senior loans to include loans referred to as leveraged loans, bank loans, and/or floating-rate loans.

Banks and other lending institutions generally issue senior loans to corporations, partnerships, or other entities. Senior loans are typically used for business recapitalizations, acquisitions, leveraged buyouts, and re-financings. BKLN’s loan portfolio will include the purchase of loans from banks or other financial institutions through assignments or participations.

In the search for yield, senior loans are also an option besides safe haven government debt. With a 12-month distribution rate of around 3%, this gives investors more yield than benchmark Treasury notes.

For more news, information, and strategy, visit the Innovative ETFs Channel.