From a valuation perspective, now is a great entry point for the Invesco KBW Bank ETF (KBWB).

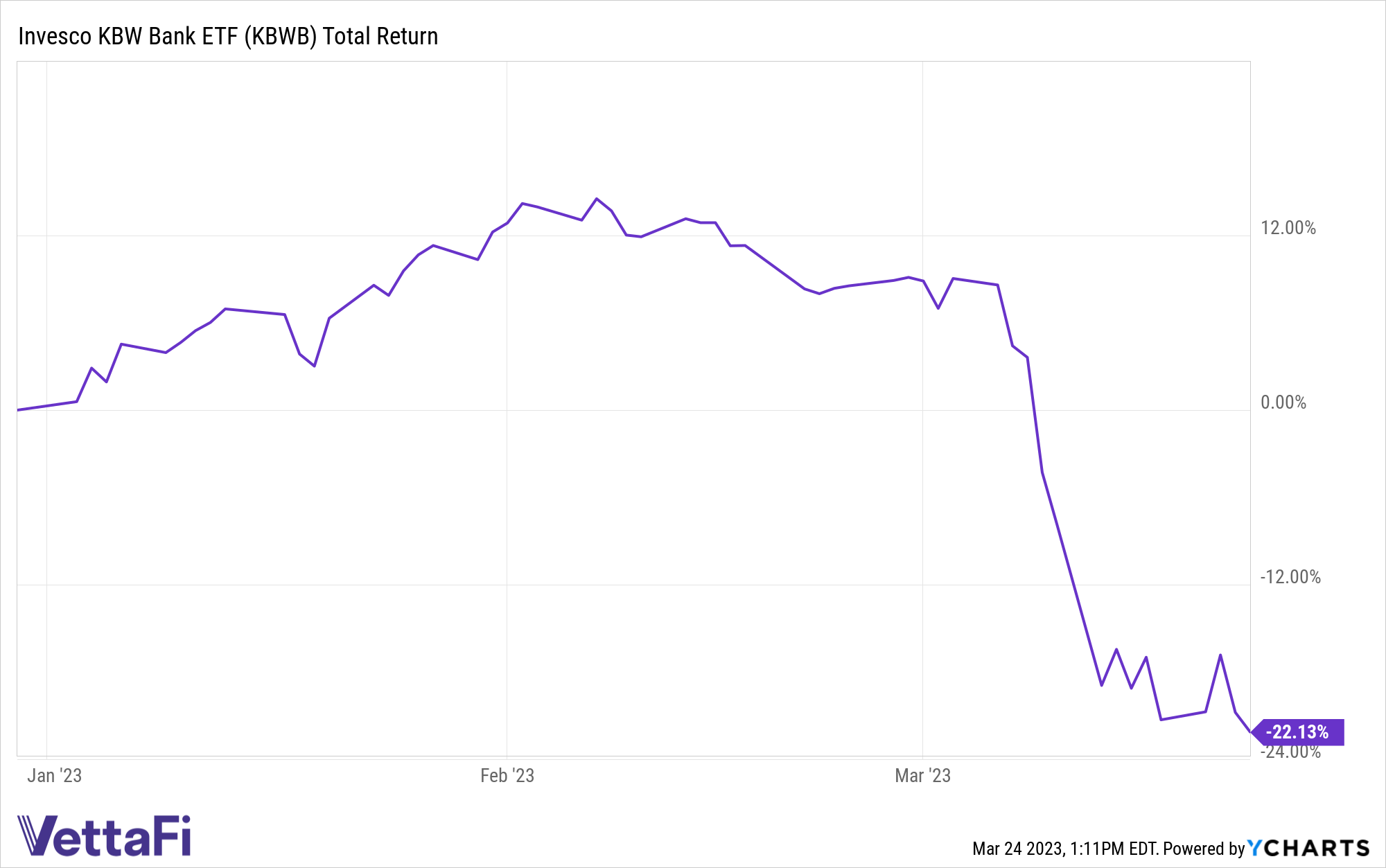

As the banking crisis spurred a broad sell off in recent weeks, KBWB is down approximately 24% since March 6. KBWB offers exposure to banks, delivering targeted exposure to a unique corner of the U.S. financials sector.

The fund was up around 9% in January, propelled by markets recognizing banks may be a safe haven in the rising rate environment, as net interest margins could improve. The fund dwindled a bit in February, as all equity markets struggled, but March is when the fund declined sharply on news of bank failures, according to Rene Reyna, head of Thematic & Specialty Product Strategy at Invesco.

“We saw a huge sell off, a little bit of a baby with the bathwater approach, but the fund’s down 24%,” Reyna said. “We look at performance and it is sort of barbell. Names like JP Morgan only down 8%, versus some of the large regionals.”

See more: Invesco KBWR Regional Banking ETF Rallies Nearly 6% in Past Week

“The sell off could potentially be an entry point,” Reyna added. “I think the concerns that we all have right now, are clearly regulation. Policymakers, are they going to, for example, increase capital requirements? Are banks going to focus more on quality versus growth? And so does that mean potentially less lending, and how does that affect the broader economy? I think that’s where there is a preference to have more of your large so-called universal banks as exposure.”

KBWB offers exposure to the larger banks, including JP Morgan, Bank of America, Wells Fargo, and then goes down the market cap spectrum.

“You can get a little bit of that protection while still trying to play a little bit of the recovery from some of these smaller regionals, if you will,” Reyna said.

KBWB has $1.3 billion in assets under management and charges 35 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.