Several key economic indicators are released every week to help provide insight into the overall health of the U.S. economy. Last week, a handful of releases shed light on the state of the housing market, and this article takes a deeper look into three of them – existing home sales, building permits, and housing starts. These indicators will have an impact on home builders and residential real estate ETFs such as Invesco Dynamic Building & Construction ETF (PKB), iShares U.S. Home Construction ETF (ITB), SPDR S&P Homebuilders ETF (XHB), and iShares Residential and Multisector Real Estate ETF (REZ).

Economic indicators are closely watched by policymakers and advisors trying to understand the direction of interest rates because the data can have a significant impact on business decisions and financial markets. In the week ending on April 20th, the SPDR S&P 500 ETF Trust (SPY) fell 0.4% while the Invesco S&P 500® Equal Weight ETF (RSP) was down 0.3%.

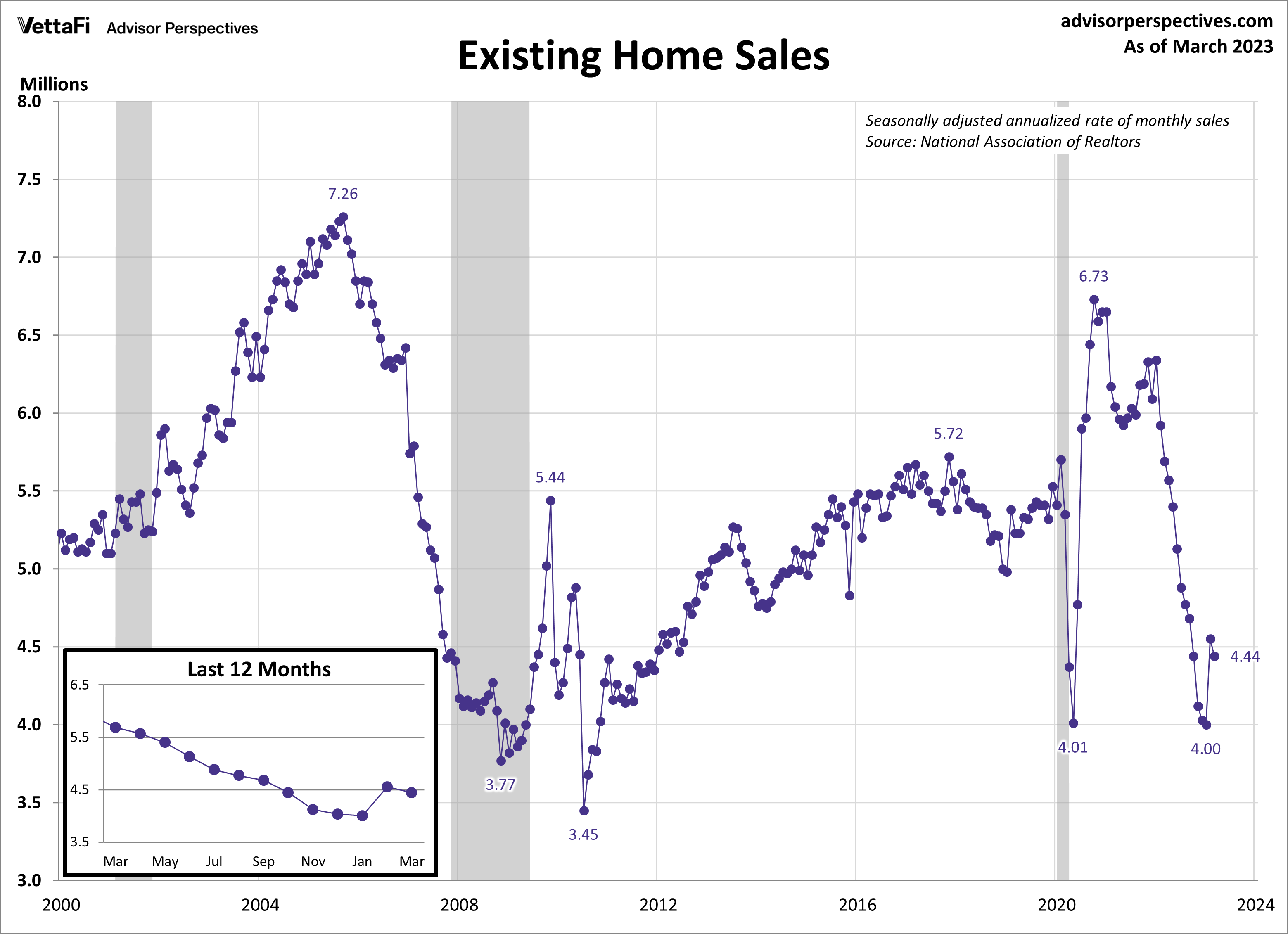

Existing Home Sales

Existing home sales retreated in March by 2.6% from February to a seasonally adjusted annual rate of 4.44 million units, well below expectations of 5.0% month-over-month growth to 4.50 million units. Sales are down 22.0% compared to a year ago, its smallest 12-month change in the last seven months. Additionally, the median price for existing homes continued to rise for the second straight month to $375,700, a 3.4% increase from February and the largest monthly jump in almost a year. Low levels of inventory have led to competition among homebuyers, resulting in multiple offers and subsequent price hikes on available homes. With that being sad, those same homebuyers are still trying to navigate with volatile mortgage rates, making for a very unique situation in the existing homes market.

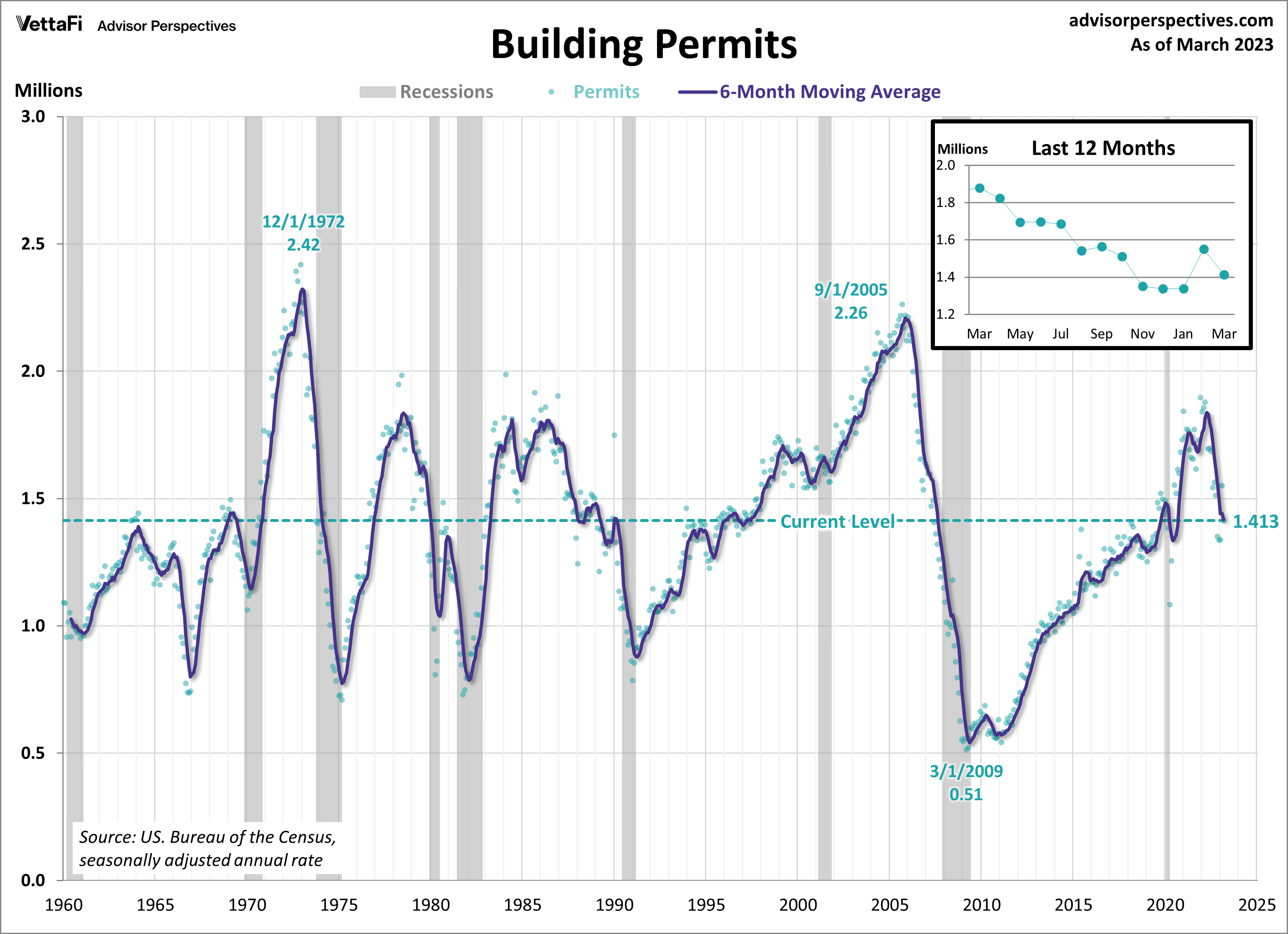

Building Permits

New residential building permits slowed down in March after falling 8.8% from February to a seasonally adjusted annual rate of 1.413 million units. The latest reading is worse than the expected 6.0% monthly decline to 1.450 million units. This is the largest monthly drop since November and comes on the heels of one of the strongest monthly gains of the series. Permits are down 24.8% compared to one year ago, marking the eighth consecutive month of annual declines. Despite these gloomy statistics, it’s worth mentioning that builder confidence rose last week for the fourth straight month to its highest level in seven months. Builders are cautiously optimistic that demand for new construction homes will continue to remain high even with material issues and increased interest rates.

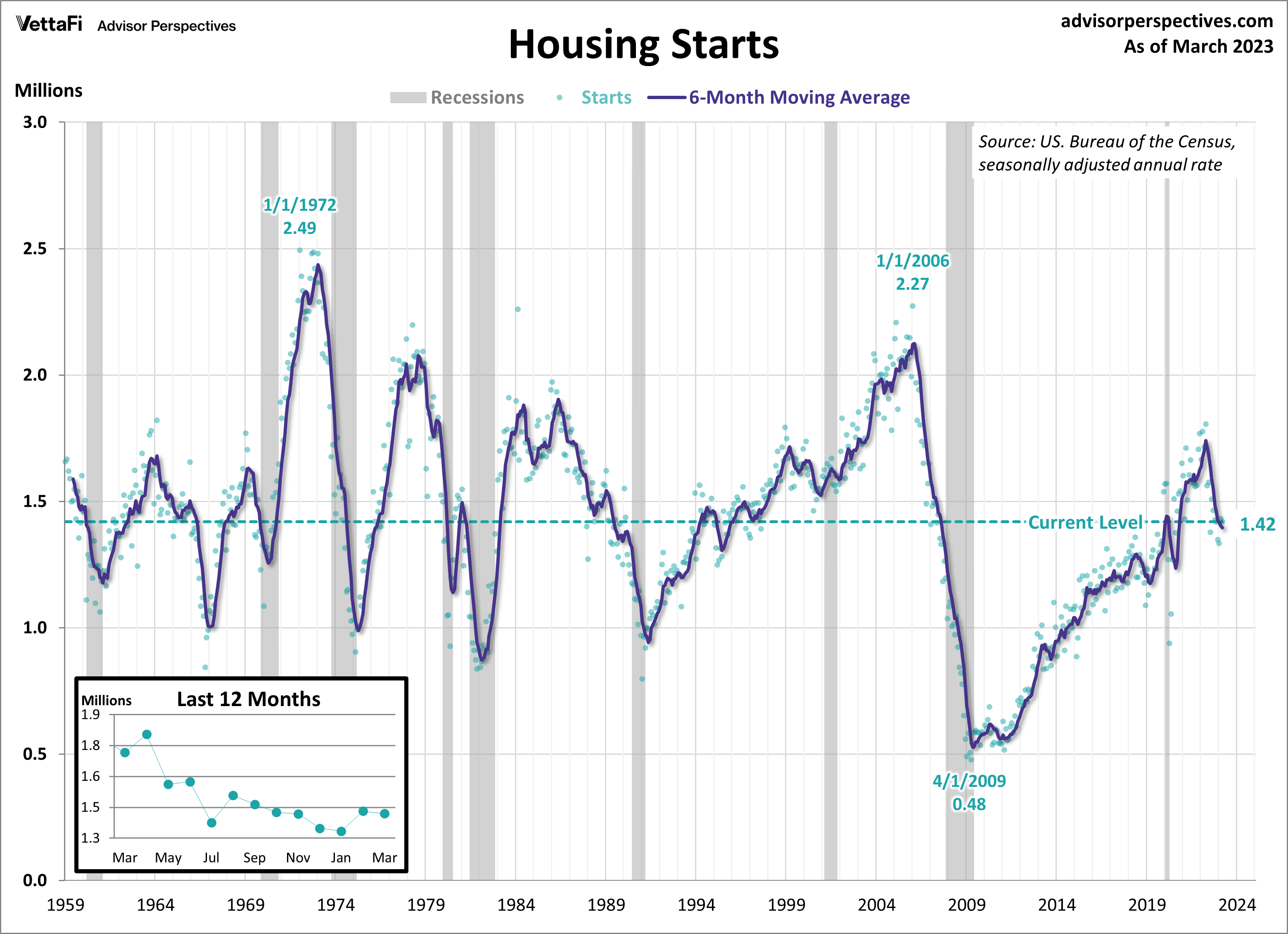

Housing Starts

Housing starts fell 0.8% in March from the surge in February to a seasonally adjusted annual rate of 1.420 million units, marking the seventh month-over-month decline in the last eight. While the latest reading resumed the downward trend in housing starts after a strong showing in February, there are some relatively positive signs within the data. Single-family homes increased for the second straight month by 2.7%, reflecting consumers’ increased attention to this type of housing due to stabilized mortgage rates and limited inventory in existing homes. On the flip side, multi-family units, such as apartments and condos, dropped by 6.7% from last month, contributing to this month’s overall decline. Starts are down 17.2% from March of last year, the eleventh consecutive month of annual declines, however the smallest since November, suggesting that the housing market may somewhat be stabilizing albeit at depressed levels.

This week, keep an eye out for the highly anticipated 2023 Q1 GDP advanced estimate, March’s data on the personal consumption expenditures (PCE) index, and April’s reading of the Conference Board’s Consumer Confidence Index®. Such data will reveal if economic growth is continuing to slow down and how consumers are feeling towards the overall state of the economy. The 2023 Q1 advanced estimate is forecasted to come in at 2.0%, down from the 2022 Q4 third estimate of 2.6%. The core PCE price index (excluding food and energy) is expected to come in at 4.5% year-over-year, down from last month, and 0.3% month-over-month, unchanged from last month. The Conference Board’s Consumer Confidence Index® is predicted to remain steady at 104.2 after last month’s modest increase and could impact interest in the Consumer Discretionary Select Sector SPDR ETF (XLY).

For more news, information, and analysis, visit the Innovative ETFs Channel.