The CBOE Volatility Index (VIX) has jumped the past week as high yields are causing investors to fret, but amid the market fluctuations, energy exchange traded funds (ETFs) from Invesco are performing well.

In general, the energy sector has been seeing strong upside the whole year. The S&P 500 Energy index is up 40% on the year, recovering nicely from last year’s tumult that saw oil prices drop below $0.

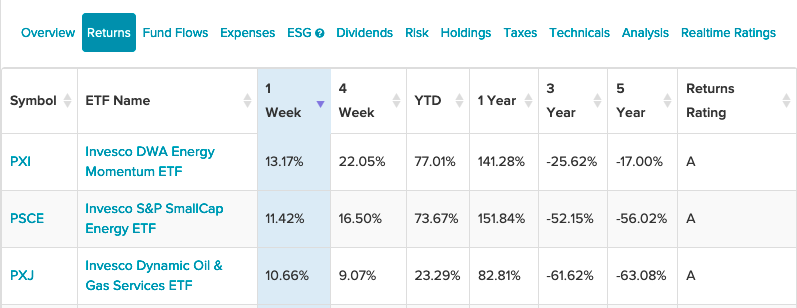

As such, three energy ETFs from Invesco have been like Teflon despite the markets being awash in volatility. Not only that, they’re all up over 10%.

Energy ETFs can also be a prime option given the inflationary pressures on the market lately. With rising consumer prices in commodities like oil, energy ETFs can provide a hedging component.

Three Flavors of Energy ETFs

For the factor-based investment seeker, there’s the Invesco DWA Energy Momentum ETF (PXI), which feeds off momentum in the energy sector. PXI seeks to track the investment results of the Dorsey Wright® Energy Technical Leaders Index, which is composed of at least 30 securities of companies in the energy sector that have powerful relative strength or “momentum” characteristics.

Next up is a growth opportunity in energy with the Invesco S&P SmallCap Energy ETF (PSCE). PSCE seeks to track the investment results of the S&P SmallCap 600® Capped Energy Index, which will invest at least 90% of its total assets in the securities of small-capitalization U.S. energy companies that comprise the underlying index.

These companies are principally engaged in the business of producing, distributing, or servicing energy-related products, including oil and gas exploration and production, refining, oil services, and pipelines. The fund’s expense ratio comes in at 0.29%, which is a relative bargain given its category average of 0.47%.

Lastly, there’s the Invesco Dynamic Oil & Gas Services ETF (PXJ), which seeks to track the investment results of the Dynamic Oil Services Intellidex Index. The exchange traded fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is composed of common stocks of U.S. companies that assist in the production, processing, and distribution of oil and gas. The fund is up a healthy 20% thus far in 2021.

For more news, information, and strategy, visit the Innovative ETFs Channel.