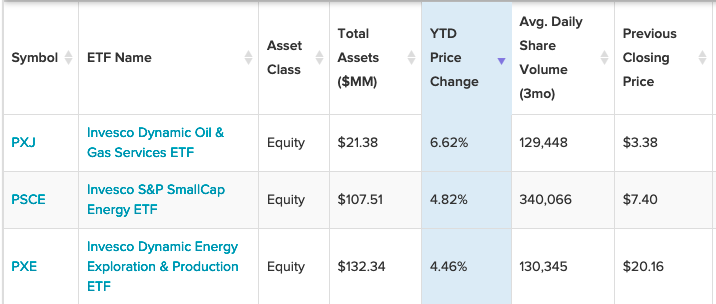

Energy continues to be a strong mover for Invesco’s energy exchange traded funds (ETFs), rounding out the top three gainers so far in 2022.

2021 saw oil prices rebound after the previous year saw prices drop below $0. The energy sector overall saw gains across the board with global inflation only pushing prices even higher.

At the top of the list is the Invesco Dynamic Oil & Gas Services ETF (PXJ). PXJ seeks to track the investment results of the Dynamic Oil Services Intellidex Index. The exchange traded fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is composed of common stocks of U.S. companies that assist in the production, processing, and distribution of oil and gas. The fund is up a healthy 37% thus far in 2021.

“PXJ is likely too targeted for those with a long-term focus, but can be useful as a tactical overlay or as part of a sector rotation strategy,” an ETF Database analysis points out. “PXJ is part of the suite of Intellidex product from PowerShares, meaning that this ETF is linked to an index designed to outperform traditional cap-weighted benchmarks. Those who believe this methodology has the potential to generate excess returns may find PXJ to be the ideal way to access this corner of the U.S. energy market.”

A Small-Cap and Dynamic Option

Next up is the Invesco S&P SmallCap Energy ETF (PSCE), which seeks to track the investment results of the S&P SmallCap 600® Capped Energy Index. The fund generally will invest at least 90% of its total assets in the securities of small-capitalization U.S. energy companies that comprise the underlying index.

These companies are principally engaged in the business of producing, distributing, or servicing energy-related products, including oil and gas exploration and production, refining, oil services, and pipelines. The fund’s expense ratio comes in at 0.29%, which is a relative bargain given its category average of 0.47%.

Rounding out the top three is the Invesco Dynamic Energy Exploration & Production ETF (PXE), which seeks to track the investment results of the Dynamic Energy Exploration & Production IntellidexSM Index. The fund invests at least 90% of its total assets in the securities that comprise the underlying intellidex.

The intellidex is composed of common stocks of U.S. companies involved in the exploration and production of fossil fuels. These companies are engaged principally in the exploration, extraction, and production of crude oil and natural gas from land-based or offshore wells.

For more news, information, and strategy, visit the Innovative ETFs Channel.