Shares of Apple rose following its latest earnings results for the fiscal first quarter. The tech giant is a darling of many ETFs irrespective of whether they focus on the technology sector or not–one of them being the Invesco QQQ Trust (NasdaqGM: QQQ).

Apple Earnings Results Versus Expectations:

- EPS: $4.18 versus $4.17 expected per Refinitiv consensus estimates

- Revenue: $84.3 billion versus $83.97 billion expected per Refinitiv consensus estimates

- iPhone revenue: $51.98 versus $52.67 billion expected per Refinitiv consensus estimates

- Services revenue: $10.9 versus $10.87 billion expected per Refinitiv consensus estimates

It’s been a month since shares of Apple were battered as a result of weaker guidance as the tech giant projected lower revenue due to weaker demand for its iPhone. Analyst downgrades hurt the stock as most pointed to less-than-stellar iPhone sales as a weak link for 2019.

That number was reflected in the final first-quarter earnings results as the iPhone maker beat expectations in earnings per share, revenue and services revenue, but as expected, fell short on iPhone revenue.

“Our customers are holding on to their older iPhones a bit longer than in the past. When you paired this with the macroeconomic factors particularly in emerging markets, it resulted in iPhone revenue that was down 15 percent from last year,” said CEO Tim Cook during the company’s earnings call.

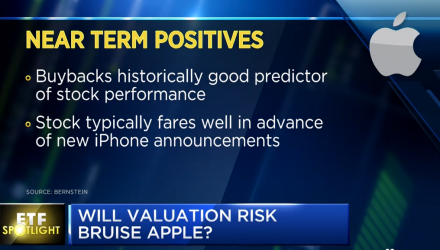

The video below discusses Apple’s valuation and the tech giant’s impact on various ETFs.

For more market trends, visit the Innovative ETFs Channel.