For European investors, investing in high yield has been paying dividends — in certain cases, they’ve been paying better than stock dividends. U.S. investors don’t have to be left out with high yield options from Invesco.

In the meantime, European investors have been reaping the rewards of the high yield debt market.

“Taking a punt on the riskiest class of junk bonds is paying off handsomely for Europe’s investors this year,” a Bloomberg article said. “The lowest rank of junk bonds, those rated CCC and below, are handing investors annualized returns of 16.3%, outstripping last year’s 11.7%. It puts them among the best performing asset classes in 2021, according to Bank of America Corp. analysts.”

In the U.S., high yield bond ETFs from Invesco can help them seek added yield that safe haven government bonds like Treasury notes can’t offer.

Three High Yield Options to Consider

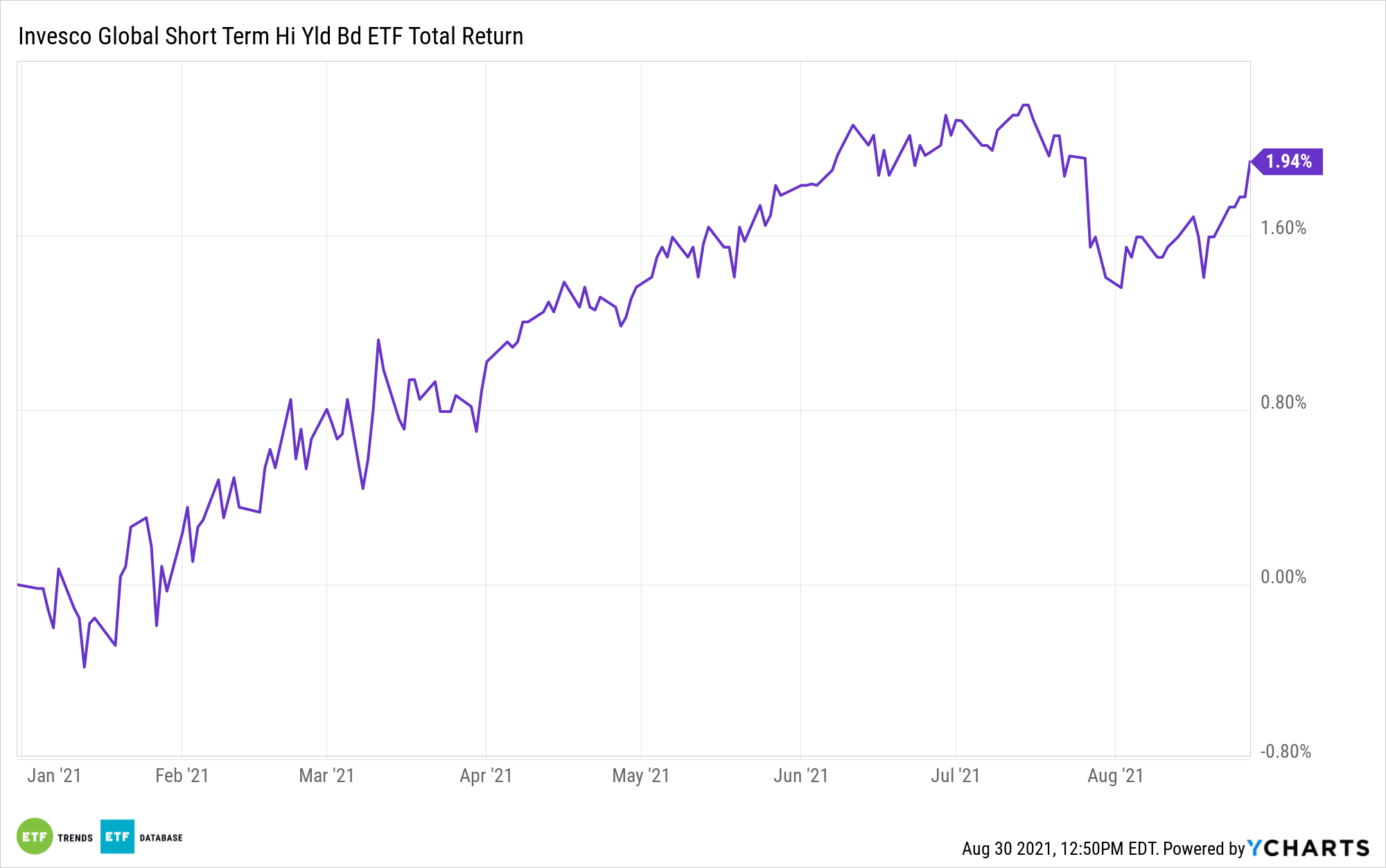

Investors who want high yield but also want to limit duration can opt for the Invesco Global Short Term High Yield Bond ETF (PGHY). PGHY seeks to track the investment results (before fees and expenses) of the DB Global Short Maturity High Yield Bond Index.

The fund invests at least 80% of its total assets in securities that comprise the underlying index. The underlying index is composed of bonds issued by corporations, as well as sovereign, sub-sovereign, or quasi-government entities that are denominated in U.S. dollars, are rated below investment grade, have not been marked as defaulted by any rating agency, have three years or less to maturity, have a minimum outstanding amount of at least $250 million, and have a fixed coupon.

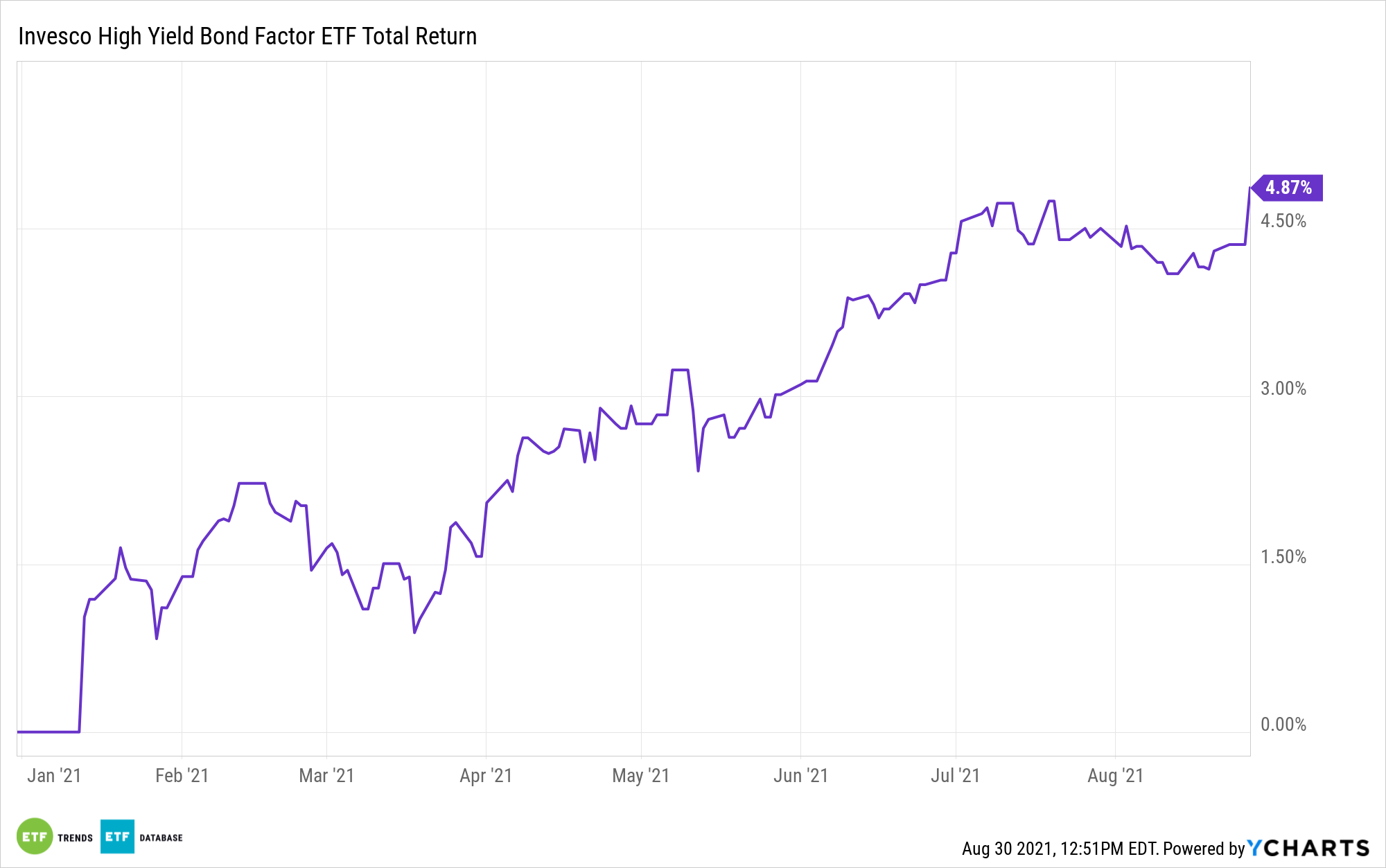

For a factor-based solution, there’s the Invesco High Yield Bond Factor ETF (IHYF). IHYF seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in high-yield, below-investment grade, fixed-income securities, and in derivatives and other instruments that have economic characteristics similar to such securities.

IHYF may invest up to 20% of its net assets in U.S. Treasury and agency securities. The fund may also invest up to 10% of its net assets in certain collateralized debt obligations.

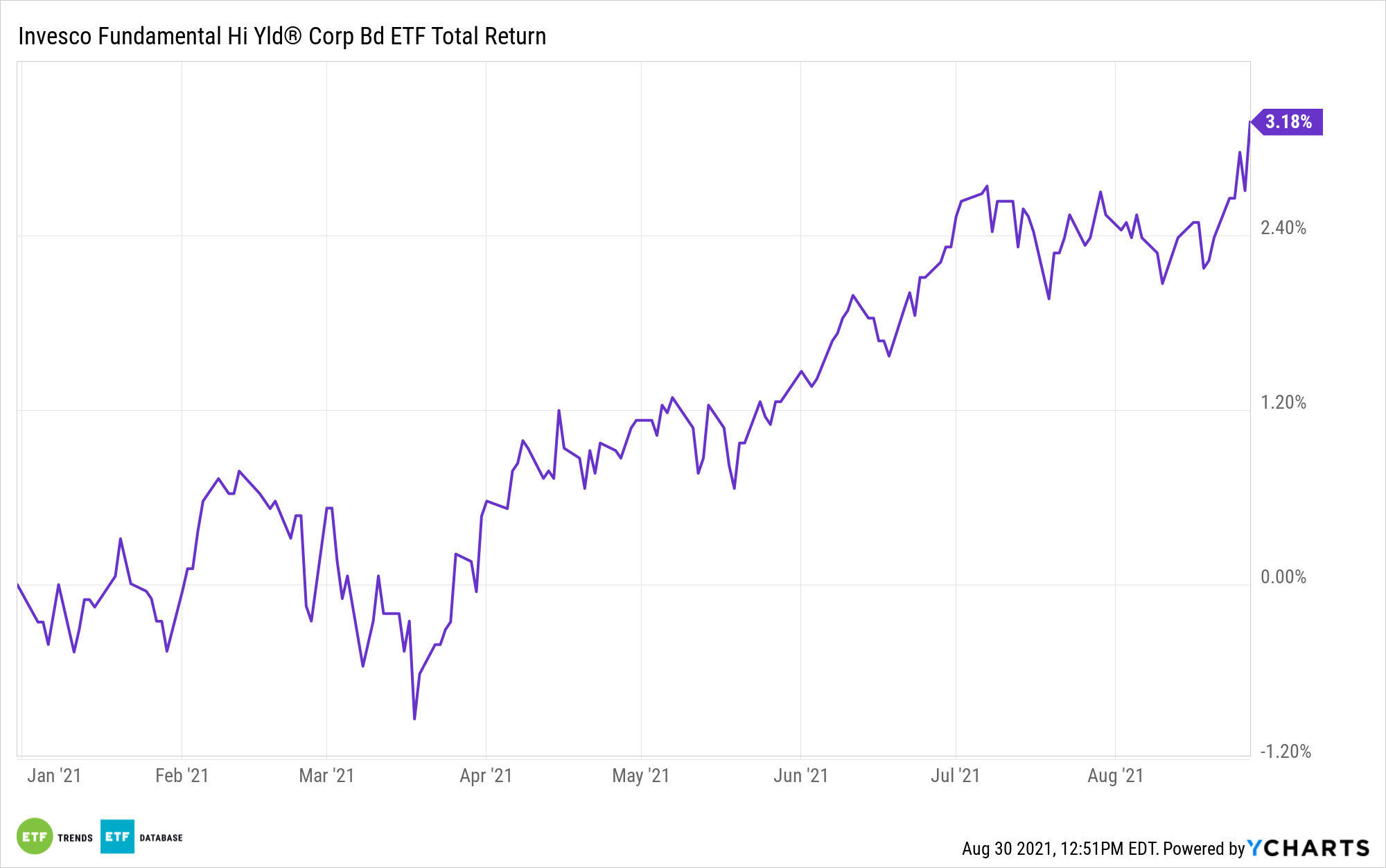

Lastly, there’s the Invesco Fundamental High Yield Corporate Bond ETF (PHB), which tracks the RAFI® Bonds US High Yield 1-10 Index (Index). The Index is comprised of US dollar-denominated high yield corporate bonds that are SEC-registered or Rule 144A securities with registration rights and whose issuers are public companies listed on a major US stock exchange. Only investible non-convertible, non-exchangeable, non-zero, fixed coupon, high-yield corporate bonds qualify for inclusion in the Index.

For more news and information, visit the Innovative ETFs Channel.