Getting international exposure amid a volatile U.S. equities environment could capture upside and income in other parts of the globe while offering an escape from the rate-hiking bonanza by the U.S. Federal Reserve.

Investors can achieve all of this in one fund: the Invesco S&P International Developed High Dividend Low Volatility ETF (IDHD). Despite this, global markets aren’t immune to the effects of rising inflation, so investors still have to navigate the murky market environment carefully when looking at opportunities abroad.

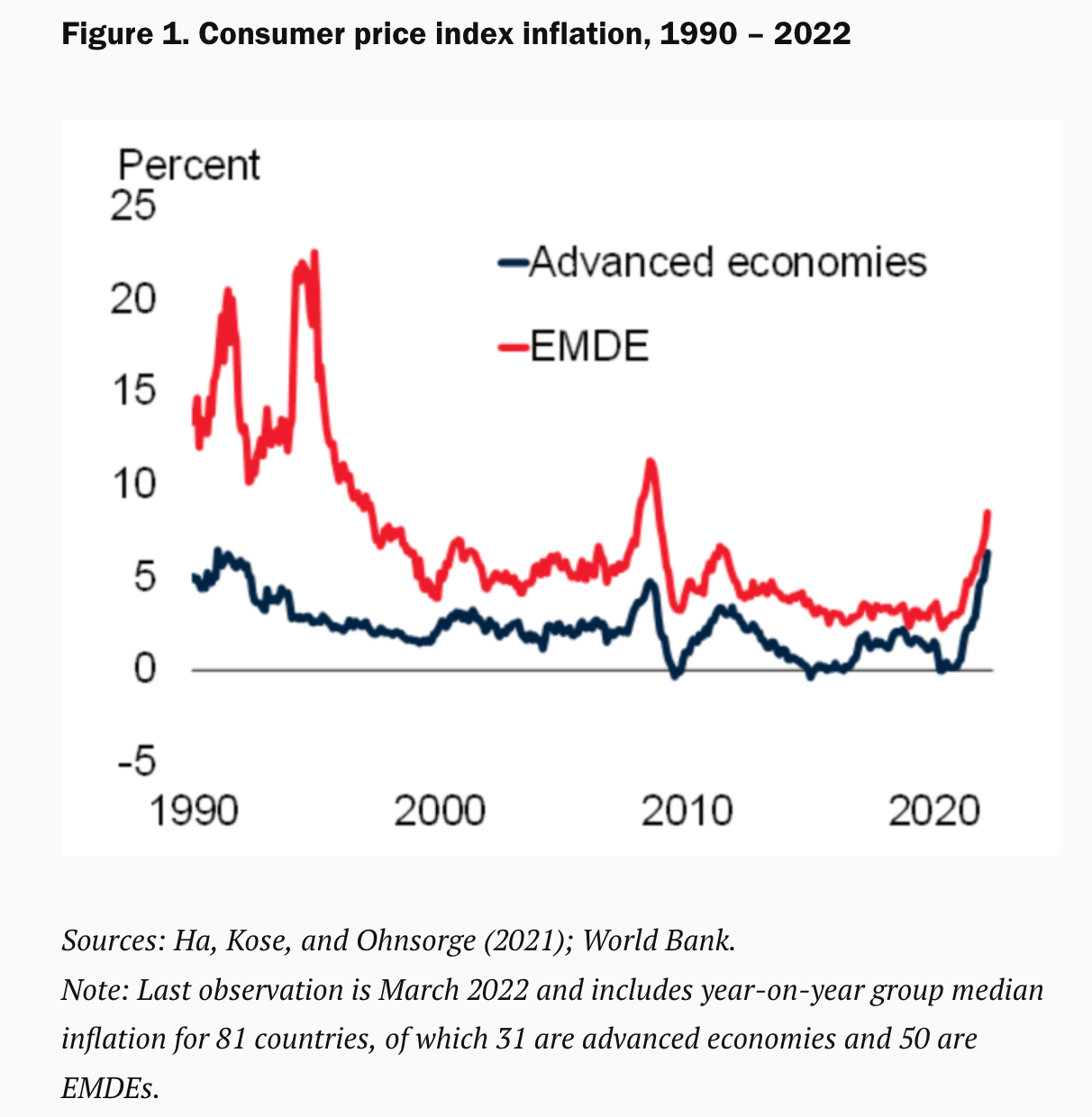

“Gone are the days of low inflation and easy global financial conditions,” a Brookings Institution article notes. “Many emerging market and developing economies (EMDEs) have recently been experiencing an unpleasant combination of elevated inflation and rising borrowing costs. At 8.5 percent in March 2022, inflation in EMDEs has reached its highest level since 2008 (Figure 1).”

“In advanced economies, inflation is now at its highest level since 1991,” the article adds. “Global financing conditions are tightening, as major advanced economy central banks are expected to raise policy interest rates at a faster pace than previously anticipated to contain inflationary pressures.”

Peace of Mind and Income With IDHD

IDHD is based on the S&P EPAC Ex-KoreaLow Volatility High Dividend Index. The fund will invest at least 90% of its total assets in securities that comprise the index.

The index is composed of 100 securities in the S&P EPAC Ex-Korea LargeMidCap Index that have historically provided high dividend yields with lower volatility over the past 12 months. That should give investors a degree of peace when it comes to getting exposure to international markets.

As the index explicitly says, to help mute volatility, the fund focuses over 60% of its assets (as of April 28) on large-cap equities that comprise a value and blended style. To capture some upside growth, the fund also invests in mid-cap equities, which offer a medium between the low volatility of large-caps and the higher market movements of small-caps.

For income, a quarterly distribution is offered for investors. As of May 5, the 30-day SEC yield is pegged at 2.75%, the distribution rate is at 3.18%, and the 12-month distribution rate is at 4.85%.

For more news, information, and strategy, visit the Innovative ETFs Channel.