With relatively low rates and volatility still ahead in 2022, getting multi-asset exposure with an ETF like the Invesco Zacks Multi-Asset Income ETF (CVY) could help address the two issues.

In times of market uncertainty, getting multi-asset exposure can help diversify a portfolio by adding uncorrelated assets to the mix in order to mitigate concentration risk in a particular asset class. But when an investor wants multi-asset exposure and income at the same time, it’s CVY to the rescue.

With a 30-day SEC yield of almost 4%, CVY outpaces benchmark safe haven Treasury notes. Compared to the 30-year Treasury yield of 1.9%, CVY is almost double that.

Per its fund description, CVY is based on the Zacks Multi-Asset Income Index. The fund will invest at least 90% of its total assets in securities and depositary receipts that comprise the index.

The index is comprised of domestic and international companies, including U.S.-listed common stocks, American depositary receipts (ADRs) paying dividends, real estate investment trusts (REITs), master limited partnerships (MLPs), closed-end funds, and traditional preferred stocks. The index is computed using the gross total return, which reflects dividends paid.

Diversification Is Key in 2022

With market volatility ahead in the new year with the Omicron variant and inflation as major factors, investors can use multi-asset exposure to hedge against major market moves, especially when it’s to the downside. This is especially the case since various asset classes rotate yearly when it comes to assessing winners and losers.

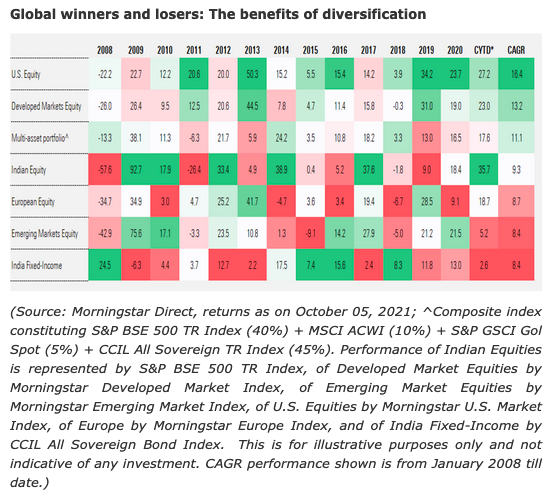

“Asset class performance varies across time periods making it difficult to predict losers and winners on a year-on-year basis,” a Morningstar article says. “The image below outlines the calendar year-wise returns (in INR) for various asset classes/markets.”

“The best performing asset for each year is marked in a dark green shade and the worst performer in red,” the article adds. “A closer look at the chart indicates that winners in certain years were losers in subsequent periods and vice-versa.”

That said, getting exposure to multiple asset classes can prevent investors from over-concentrating on one asset that may or may not perform.

“For instance, Indian equity outperformed in 2009 and 2010 but turned out as the worst performer in 2011,” the article adds further. “When global equity markets witnessed sharp corrections in 2008, Debt outshined. In 2013 and 2019, when Indian equity generated poor returns, international equity markets such as US and Europe witnessed superior performance. On a CAGR basis, developed markets driven by US equities have outperformed Indian equity since 2008.”

For more news, information, and strategy, visit the Innovative ETFs Channel.