The Federal Reserve is armed with trillions of dollars and ready to go on a bond shopping spree, which includes purchases in high yield–a move that should also have a ripple effect into the debt of companies that have fallen out of investment-grade favor or “fallen angels.”

Companies like Ford have experienced downgrades from investment grade status to high yield status via credit ratings agencies like Moody’s.

“The Federal Reserve is making its first-ever foray into the junk-rated corporate bond market, saying it will consider buying noninvestment-grade corporate bonds and exchange-traded funds,” noted a Barron’s report. “As part of an effort to make available $2.3 trillion in new loans amid the coronavirus crisis , the central bank said Thursday that it would buy the bonds of ‘fallen angel’ companies or companies that get downgraded from investment grade to junk. Companies will qualify if they had an investment-grade rating on March 22 and have since been downgraded to one of the top three tiers of the high-yield bond market (BB+, BB or BB-).”

Hopping on the Bond Buying Train

Investors who are ready to hop on board the Fed’s bond-buying train can start with the VanEck Vectors Fallen Angel High Yield Bond ETF (BATS: ANGL). ANGL seeks to replicate as closely as possible the price and yield performance of the ICE BofAML US Fallen Angel High Yield Index, which is comprised of below investment grade corporate bonds denominated in U.S. dollars that were rated investment grade at the time of issuance. ANGL essentially focuses on debt that has fallen out of investment-grade favor and is now repurposed for high yield returns with the downgraded-to-junk status.

For another high yield option, take a look at the Goldman Sachs Access High Yield Corporate Bond ETF (GHYB). GHYB seeks to provide investment results that closely correspond, before fees and expenses, to the performance of the FTSE Goldman Sachs High Yield Corporate Bond Index.

The fund seeks to achieve its investment objective by investing at least 80% of its assets (exclusive of collateral held from securities lending) in securities included in its underlying index. The index is a rules-based index that is designed to measure the performance of high yield corporate bonds denominated in U.S. dollars that meet certain liquidity and fundamental screening criteria.

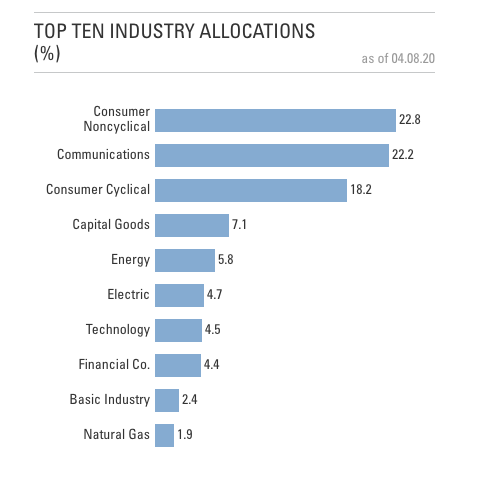

One interesting thing to note with GHYB is that it’s second-highest industry allocation is within the communications sector. The sector may actually be one of the shining stars in the first quarter as social distancing has increased reliance on remote interaction amid the coronavirus pandemic.

For more market trends, visit ETF Trends.