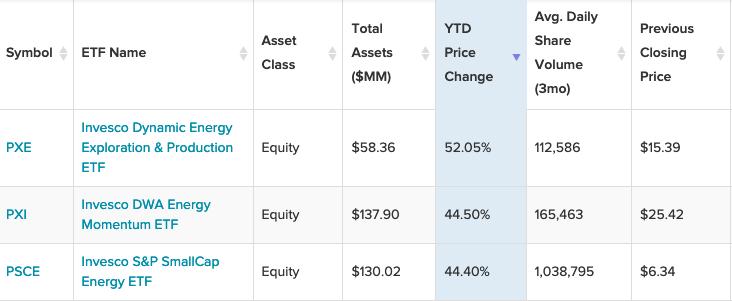

When it comes to looking at ETF provider Invesco’s top-performing funds, energy is rising above the rest.

ETF investors can get energy exposure with an exploration & production tilt, or a momentum-based or small cap strategy. Investors can choose any one of the three strategies and they’ll see strong year-to-date performance.

A rebound in oil prices is helping to spur an energy rally, which is feeding into strength for funds like the Invesco Dynamic Energy Exploration & Production ETF (PXE), which tops the list. The fund is up over 50% so far in 2021.

PXE seeks to track the investment results of the Dynamic Energy Exploration & Production IntellidexSM Index. The fund invests at least 90% of its total assets in the securities that comprise the underlying intellidex.

The intellidex is composed of common stocks of U.S. companies involved in the exploration and production of natural resources used to produce energy. These companies are engaged principally in the exploration, extraction, and production of crude oil and natural gas from land-based or offshore wells.

Next up is a factor-based energy fund, the Invesco DWA Energy Momentum ETF (PXI). The energy rally is certainly feeding into momentum in the energy sector, with the S&P 500 Energy index up over 30% year-to-date.

PXI is part of the suite of Intellidex products from PowerShares, which means that the fund is linked to an index designed to outperform traditional cap-weighted benchmarks. Those who believe this methodology has the potential to generate excess returns may find PXI to be the ideal way to access the U.S. energy market.

Last but not least is the Invesco S&P SmallCap Energy ETF (PSCE). Small caps are another space that has been gaining strength since late last year. These equities tend to exhibit larger movements relative to the broad market.

PSCE seeks to track the investment results of the S&P SmallCap 600® Capped Energy Index. The fund generally will invest at least 90% of its total assets in the securities of small-capitalization U.S. energy companies that comprise the underlying index.

These companies are principally engaged in the business of producing, distributing, or servicing energy related products, including oil and gas exploration and production, refining, oil services, and pipelines. The fund’s expense ratio comes in at 0.29%, which is a relative bargain given its category average of 0.47%.

For more news and information, visit the Innovative ETFs Channel.