The energy sector has been defying a September drawdown, opening up opportunities for investors to energize their portfolios with ETFs such as the Invesco DB Energy Fund (DBE).

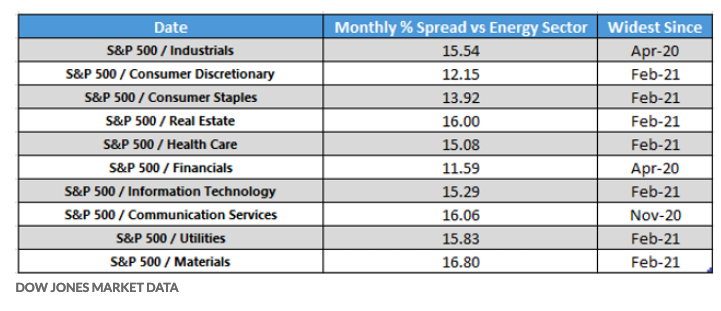

“The energy sector surged 9.3% in September, representing the best monthly return since a 21.5% gain in February, FactSet data shows, but what was also notable were the gains for the sector compared against everything else,” a MarketWatch report said.

“The next best sector in September was financials, down roughly 2%, meaning the energy sector outperformed the second-best sector in September by over 11 percentage points,” the report added.

The report also noted that the energy sector outperformed even some tried and true heavy hitters in a downturn, like healthcare and utilities. The report also noted that “The folks at Dow Jones Market Data say that it is the first time that the energy sector was the only sector up in a month since June 2008.”

DBE seeks to track the DBIQ Optimum Yield Energy Index Excess Return, which is intended to reflect the changes in market value of the energy sector.

The index commodities consist of light, sweet crude oil (WTI), heating oil, Brent crude oil, RBOB gasoline, and natural gas. The fund invests in futures contracts in an attempt to track its index.

Providing an Inflation Hedge

Inflation has been top-of-mind this year as the economy continues to recover from the effects of the pandemic. Consumer prices have been on the move in a reflationary environment where stimulus dollars are being pumped into the economy.

The Federal Reserve has already noted the improvement in the economic data that they’ve been seeing as of late and are ready to scale back stimulus measures. As such, they’ll be looking to start raising rates in 2022.

Rising commodity prices like oil and natural gas give investors an added component to hedge against inflation. That can be had with funds like DBE.

“This ETF provides exposure to some of the most popular commodities futures in the world. This includes light sweet crude, heating oil, Brent crude oil, RBOB gasoline, and Natural gas,” a ETF Database analysis suggested. “Commodity exposure in a portfolio used to be a binary choice, either one invested in them, or they did not. Now, commodities have been proven as powerful inflation hedging tools with the power to generate powerful returns for an individual portfolio.”

For more news, information, and strategy, visit the Innovative ETFs Channel.