Small-cap equities can make amplified moves in the market, which might not be the best option in a downturn, but despite the latest market volatility, one ETF led Invesco’s fund flows the past week.

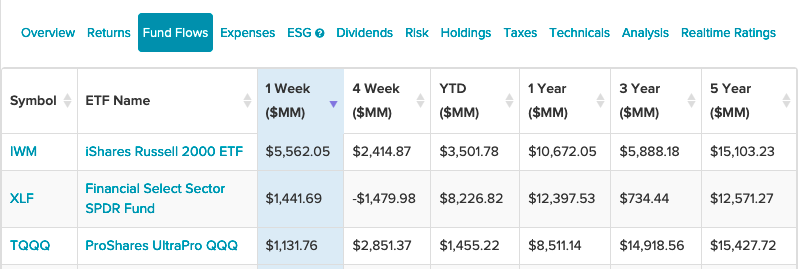

In particular, it’s been the iShares Russell 2000 ETF (IWM) atop the leader board. Performance-wise, the fund is up about 13% on the year.

IWM seeks to track the investment results of the Russell 2000® Index, which measures the performance of the small-capitalization sector of the U.S. equity market. The fund generally invests at least 90% of its assets in securities of the underlying index and in depositary receipts representing securities of the underlying index.

It may invest the remainder of its assets in certain futures, options and swap contracts, and cash and cash equivalents, as well as in securities not included in the underlying index, but which the advisor believes will help the fund track the underlying index. With its relatively low 0.19% expense ratio, IWM gives investors:

- Exposure to small public U.S. companies

- Access to 2000 small-cap domestic stocks in a single fund

- Ability to diversify a U.S. stock allocation and seek long-term growth in a portfolio

More Volatility Ahead?

Rising yields have been the culprit this week for much of the market volatility. However, another bucket of volatility could be dumped on the markets as federal government funding is a topic of discussion on Capitol Hill.

As it navigates avoiding a government shutdown to pushing a trillion-dollar infrastructure through the House of Representatives, Capitol Hill could draw investors’ attention while they read the pulse of the stock market.

“The climate in Washington is such that you cannot rule out the possibility of a standoff that ends with something really, really bad, and the market is not anticipating that,” said Scott Clemons, CIO at Brown Brothers Harriman.

“We’ve seen this dance so many times. We’re accustomed to it being awkward but ending well,” Clemons added. “The heightened tension in Washington is such that it’s a nonzero probability that something really goes wrong and is the source of substantial price volatility in the markets.”

While small-cap equities can make amplified moves in the market, IWM’s 30-day rolling volatility has been staid compared to larger funds like Invesco’s QQQ.

For more news, information, and strategy, visit the Innovative ETFs Channel.