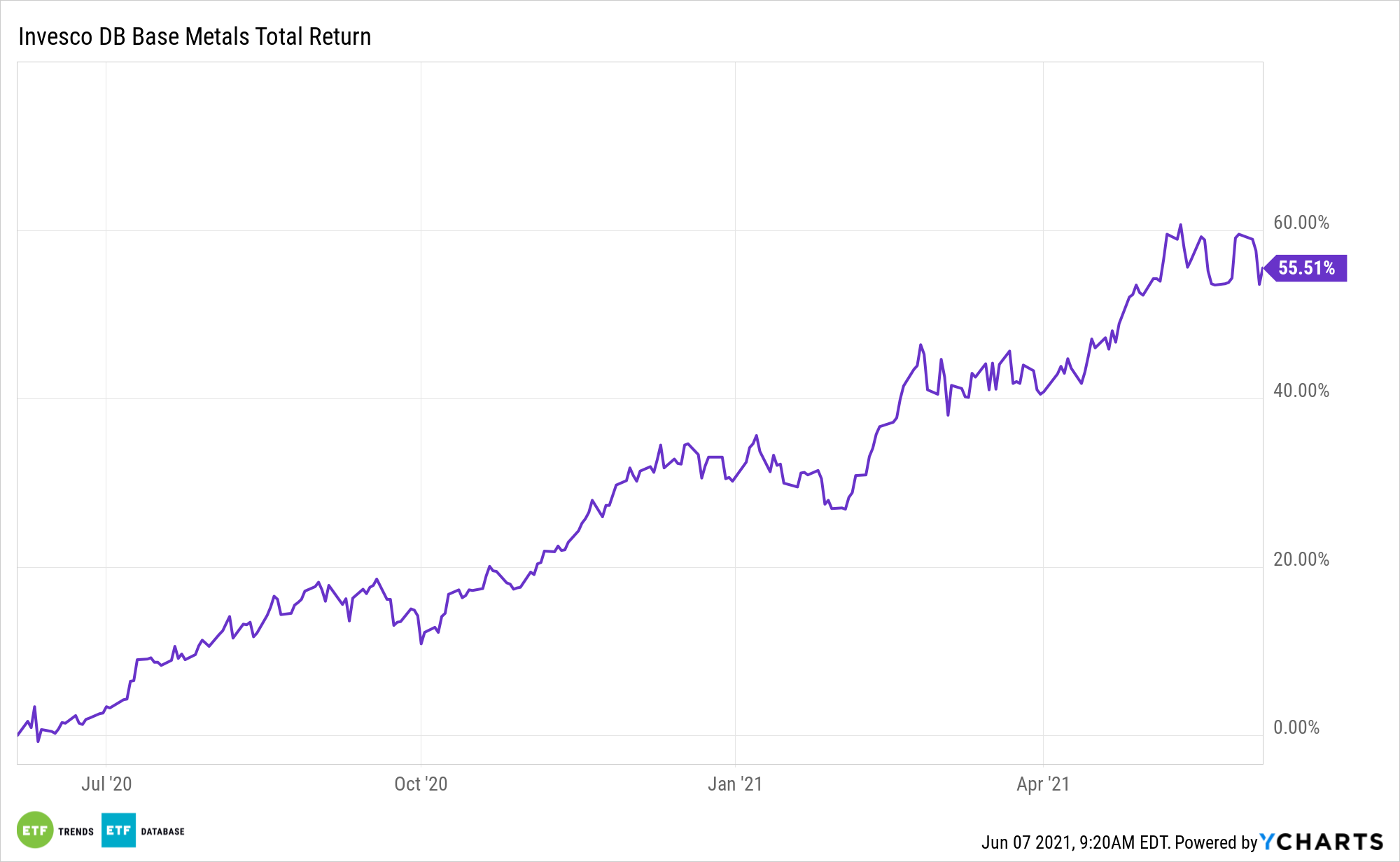

Precious metals might be missing out on the commodities rally, but base metals like copper can help fuel assets such as the Invesco DB Base Metals Fund (DBB).

Copper comprises the majority of DBB’s holdings in futures. As a percentage of net assets, copper futures stand at almost 40%.

One of the main catalysts fueling base metals is the high demand for copper. China, in particular, is a major consumer of copper, which could help keep prices elevated.

“Like other commodities, the price of copper is influenced by factors of supply and demand,” an Investorplace article said. “Although extracting and refining copper is expensive, the past year has seen increased demand worldwide. China is the biggest importer and user of the metal. Metrics show that the copper consumption is around 24.4 million metric tons.”

DBB seeks to track changes, whether positive or negative, in the level of the DBIQ Optimum Yield Industrial Metals Index Excess Return™ (DBIQ Opt Yield Industrial Metals Index ER or Index) plus the interest income from the Fund’s holdings of primarily US Treasury securities and money market income less the Fund’s expenses.

The Fund is designed for investors who want a cost-effective and convenient way to invest in commodity futures. The Index is a rules-based index composed of futures contracts on some of the most liquid and widely used base metals — aluminum, zinc, and copper (grade A).

Copper’s Flexibility in Various Industries

From a fundamental perspective, copper’s flexible usage makes it a prime choice in the post-pandemic economic recovery. Various industries benefiting from the re-opening can help keep demand for copper high.

“Over the past year, optimistic post-pandemic scenarios have dominated Wall Street,” the article said further. “The markets have been pricing in a substantial recovery in the global economy and an increased demand for copper. Copper exhibits high electrical conductivity, durability and malleability. Therefore, due to copper’s unique properties, it is used in numerous industries and products, ranging from buildings, to electric vehicles (EVs), to solar panels and smartphones. Thus analysts expect copper demand to stay robust, especially from China.”

For more news and information, visit the Innovative ETFs Channel.