China is one of the biggest purveyors of blockchain-based technology and now its biggest player in the search engine space, Baidu, is getting into the game in an effort to support the creation and development of decentralized applications.

As one of its top 10 holdings, this latest foray by Baidu could help boost the Emerging Markets Internet & Ecommerce ETF (NYSEArca: EMQQ) , which marries the idea of technology and EM in one ETF. EMQQ invests in companies with exposure to the ecommerce and Internet sectors in emerging markets.

“The Baidu Blockchain Engine (BBE) is essentially an operating system for dApp development and is part of the company’s cloud computing unit, Baidu Cloud,” the fund wrote in an email. “BBE is an open source platform to simplify dApp development. It provides developers with services such as multi-chain and multi-tier frameworks, smart contract, and dApp templates. It also comes with enhanced data security and privacy protection and will be compatible with Baidu’s existing cloud services.”

Purchasing EMQQ provides exposure to companies that are positioned to benefit as emerging economies mature, the consumer class expands, and their populations increases their utilization of the Internet and ECommerce.

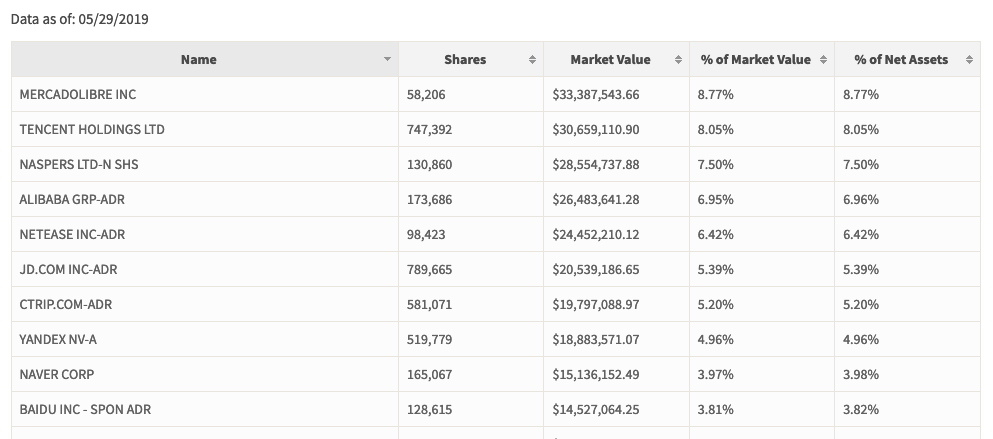

The fund provides broad-based exposure to the big names in tech overseas like Baidu. Just take a look at its top 10 holdings:

To the outside world, these names may not be familiar, but in the global marketplace, they represent the equivalent of the Googles and Amazons in the U.S. In a late market cycle, it could be these equities investors may look to internationally once the U.S. exits out of this extended bull run.

The U.S.-China trade impasse heavily discounted a lot of U.S. equities the past few weeks, but it also put the red tag sale on emerging markets (EM). Combine the tariff battles with a cautious U.S. Federal Reserve, and it puts the EM space at an attractive valuation relative to its peers.

While most investors might have been driven away by the losses in EM during much of 2018, savvy investors who were quick to see the opportunity viewed EM as a substantial markdown. From a fundamental standpoint, low price-to-earnings ratios in emerging markets ETFs have made them prime value plays as capital inflows continue in 2019.

“Emerging markets have been so unloved lately,” noted Morningstar’s senior analyst for equity strategies, Christopher Franz. “This would be a great time for investors to rebalance EM stocks back into their portfolio.”

Ongoing U.S.-China trade negotiations and geopolitical tensions put emerging markets in a state of unease in 2018, but investors can now look to their resurgence through other broad-exposure ETFs like the iShares MSCI Emerging Markets ETF (NYSEArca: EEM) or iShares Core MSCI Emerging Markets ETF (NYSEArca: IEMG).

Investors are increasingly emphasizing low cost a prime motivator for allocating capital in 2019, which makes ETFs like IEMG an attractive option. The fund provides this core EM exposure at a paltry 0.14 percent expense ratio.

For more market trends, visit the Innovative ETFs Channel.