By Michael A. Gayed, CFA

- Long derided as the producer of fake products, China is reinventing its image as the leader of innovation, especially in the fintech arena.

- China is leading the fintech revolution with new processes being replicated globally, marking the transition to a ‘Copy From China’ model.

- The disruption caused by Chinese fintech companies does not only have implications to the Chinese banking system but is also a cause for concern for U.S. bankers.

China is a sleeping giant. Let her sleep, for when she wakes she will move the world. – Napoleon Bonaparte

China is losing its status as the world’s factory with labor prices rising due to unprecedented growth in the last three decades. The ‘Copy to China’ model is coming to an end as well. Long derided as the producer of fake products, China is reinventing its image as the leader of innovation, especially in the fintech arena. Fintech is the marriage of financial services and information technology. It refers to technology-enabled financial solutions.

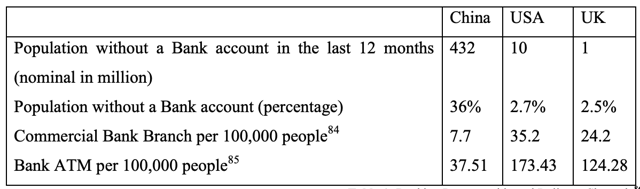

The success of Chinese fintech companies such as Tencent (TCEHY) and Ant Financial is highly attributable to the distinctive characteristic of the Chinese market. The physical and digital infrastructure mismatch in the country makes it a fertile ground for fintech to thrive. China is late in developing Western-level physical banking infrastructure, but the rise of fintech means it probably will never need to catch up.

Figure 1: Banking Demographics and Delivery Channels

Source: Arner, Barberis, and Buckley, 2015

Figure 2: Technology Penetration in China

Source: Arner, Barberis, and Buckley, 2015

China accounts for nearly half of the global digital payment market as well as three-quarters of online lending transactions. Alipay and WeChat boast of over 1.5 billion users combined. $2.9 trillion purchases were processed inside the two systems in 2016, equivalent to about half of all consumer goods sold in China. China is leading the fintech revolution with new processes being replicated globally, marking the transition to a ‘Copy From China’ model. It is rapidly becoming the world’s first cashless society.