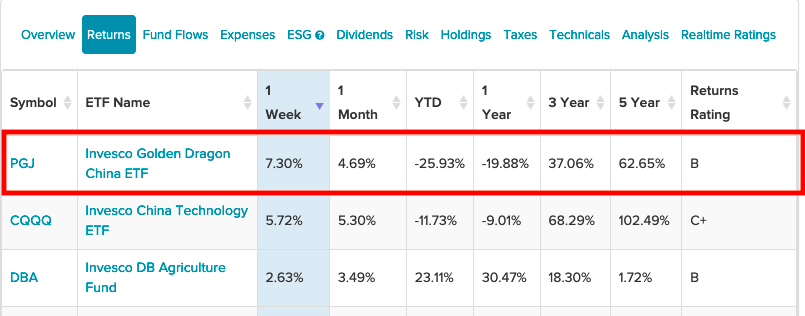

China may have put the Evergrande crisis behind it, causing the Invesco Golden Dragon China ETF (PGJ) to rise 7% within the past week.

PGJ seeks to track the investment results of the NASDAQ Golden Dragon China Index. The underlying index is composed of securities of U.S. exchange-listed companies that are headquartered or incorporated in the People’s Republic of China.

One sign of a recovery is the higher retail sales number during the month of October. In addition to the Evergrande crisis, global inflation, a recent uptick in COVID cases, and energy rationing are putting downward pressure on Chinese equities.

“China’s economy performed better than expected in October as retail sales climbed and energy shortages eased, though a slump in property and rising Covid outbreaks show the recovery isn’t on solid ground yet,” Bloomberg reports.

“Industrial output rose 3.5% in October from a year earlier, while retail sales growth accelerated to 4.9%, beating economists’ forecasts,” Bloomberg adds. “Growth in fixed-asset investment eased to 6.1% in the first 10 months of the year, with tighter curbs on the real estate market continuing to weigh on the sector. The surveyed jobless rate was steady at 4.9%.”

Nonetheless, China isn’t out of the weeds just yet. The International Monetary Fund (IMF) said that the Chinese government would have to implement certain economic reforms and supportive policies in order to boost its current recovery from the pandemic.

“China’s recovery is well advanced, but it is unbalanced and the momentum is slowing, even as downside risks are accumulating,” said Geoffrey Okamoto, the IMF’s first deputy managing director.

Large-Cap Safety

PGJ gives investors the safety of large-cap exposure, especially given the headwinds for China in the current economic environment. Names include prominent mega-cap names such as JD.com, Baidu, and Alibaba as part of its top holdings.

That’s not to say that PGJ shies away from the growth component of small-cap equities. However, it diversifies away the risks by accumulating a large number of holdings as opposed to over-concentrating in a select few names.

“PGJ is tilted towards mega cap companies, but does include some degree of exposure to smaller Chinese firms as well,” an ETF Database analysis notes. “And this ETF casts a wide net, investing in more than 200 names (though ten of those account for about half of total assets).”

For more news, information, and strategy, visit the Innovative ETFs Channel.