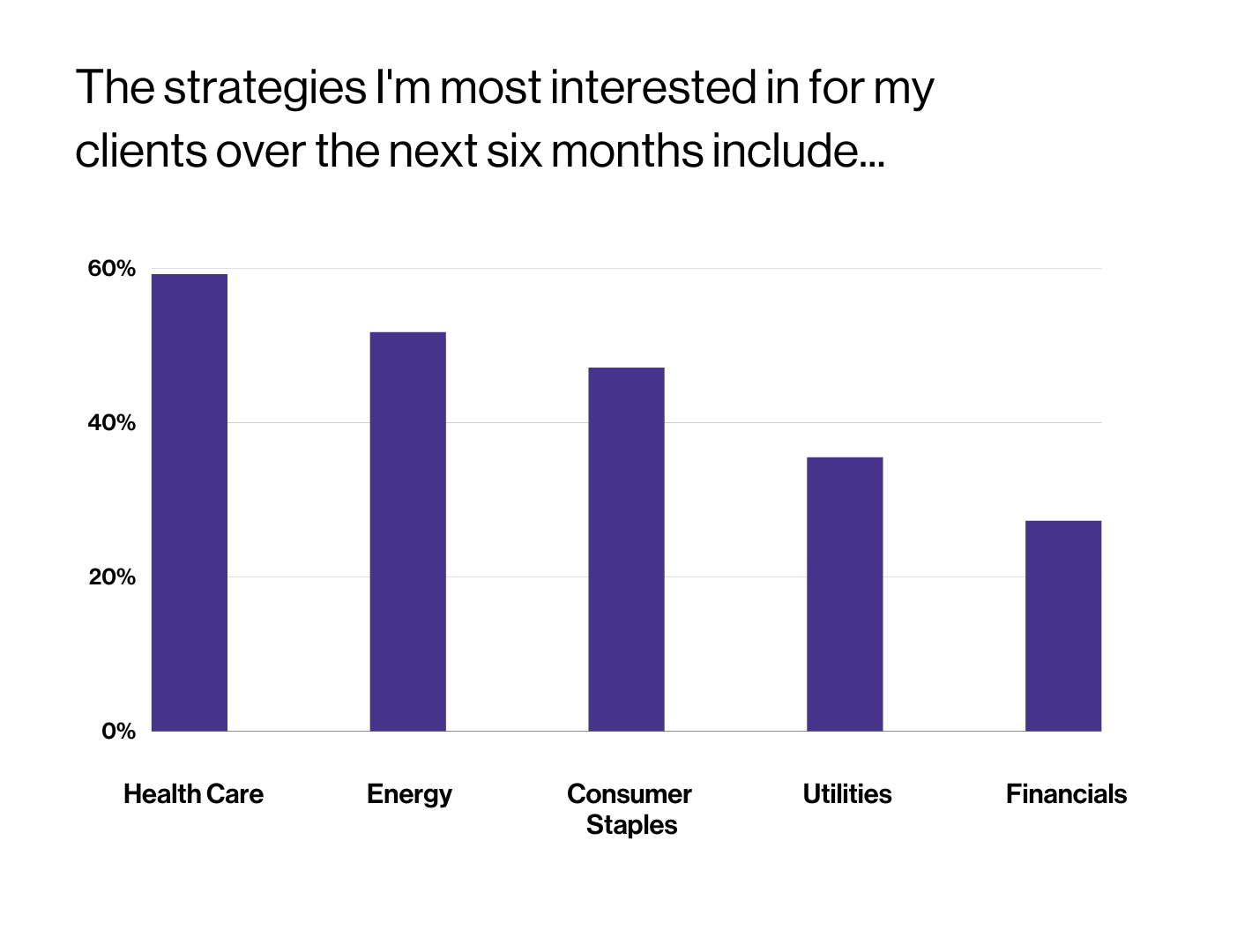

With the S&P 500 Index recently down 20% for the year, some advisors have been looking to augment a broader portfolio with sector strategies. During a November webcast with State Street Global Advisors, VettaFi asked advisors to list what sector strategies they were most interested in for clients over the next six months. Advisors were able to select more than one sector.

There was a clear preference for the more value-oriented sectors over traditional growth ones, likely due to a combination of what has been working in 2022 and the rising rate environment many still expect heading into 2023. Health Care (59%), Consumer Staples (47%), and Energy (52%) were favored by the majority of respondents, followed by Utilities and Financials, while Information Technology (10%), Communications Services (4.6%), and Consumer Discretionary (3.7%) were the most unloved by those making a choice.

Advisors are already providing clients meaningful exposure to the healthcare sector through core equity strategies. The sector is the second largest in the SPDR S&P 500 ETF (SPY), at 16% of assets, behind only the out-of-favor information technology (25%) and ahead of much less popular financial (12%) and consumer discretionary (11%). For those seeking to overweight the healthcare sector, it helps to understand better what’s inside the ETFs.

The Health Care Select Sector SPDR (XLV) is the largest of the ETFs in the sector, with $40 billion in assets. For advisors using SPY or peer S&P 500 Index-based ETFs, XLV is the most logical to implement since it holds only the healthcare stocks within the broader benchmark in an identical market-cap manner. The result is a portfolio with 31% in pharmaceuticals, 24% in health care providers & services companies, 17% in health care equipment & supplies, 16% in biotechnology, and 12% in life sciences tools & services UnitedHealth Group (10%), Johnson & Johnson (9%) and Eli Lilly (6%) are the largest positions.

The Vanguard Health Care ETF (VHT) is another popular industry-diversified, market-cap weighted alternative, but the ETF is constructed differently than XLV. The $17 billion VHT has over 400 positions-more than sixfold the among found in XLV–due to the addition of small- and mid-caps not included in the S&P 500. VHT recently had slightly less in pharmaceuticals (28%) and more exposure to biotechnology (18%) based on the latest available data.

Though the Invesco S&P 500 Equal Weight Health Care ETF (RYH) holds the same stocks as XLV, it’s $920 million in assets is spread across the holdings differently. As the equal weight in the ETF’s name infers, RYH owns approximately the same stakes in mega-caps like Merck and Eli Lilly as it does in more moderately sized companies ABIOMED and Dexcom. From an industry perspective, RYH has more exposure to healthcare equipment & supplies (28%) and fewer pharmaceuticals (14%).

Based on the above industry exposure, some advisors might want to take a more targeted approach and favor the potentially faster-growing biotech companies. Here too, they will find choices to consider.

For example, the iShares Biotechnology ETF (IBB) and the SPDR S&P Biotechnology ETF (XBI) take different approaches to targeting the industry. The $8.3 billion IBB holds more than 300 stocks but is concentrated in mega-caps like Gilead Sciences (10% of assets), Amgen (9%), and Vertex Pharmaceuticals (8%). The $7.3 billion XBI holds less than half the number of stocks as IBB, but its largest recent position in Biogen comprised just 1.5% of assets. XBI had similar stakes in smaller companies like United Therapeutics and Veracyte. The larger-cap focused IBB has held up better in 2022, outperforming XBI by more than 1,000 basis points.

Understanding what’s inside an ETF is paramount for advisors to make healthy decisions for clients, which is why due diligence will be part of our educational content at the Exchange conference taking place in Florida in February 2023. Register now and save.

For more news, information, and strategy, visit the Innovative ETFs Channel.