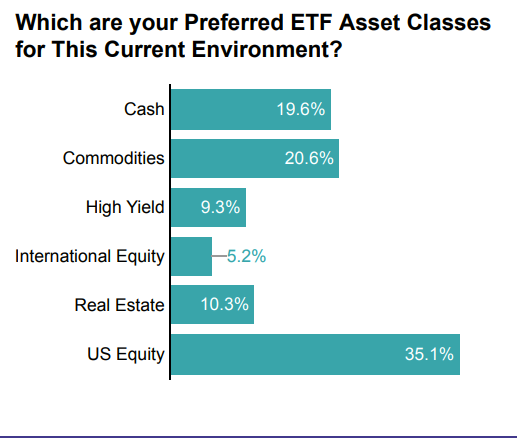

International equities are out of favor with many advisors in 2022. During a late June webcast VettaFi hosted with DWS about international investing, just 5.2% of those surveyed chose international equity as their preferred asset class for this current environment. The selection was last, which might be surprising given the topic for the webcast, behind U.S. equity (35%), commodities (21%), cash (20%), real estate (10%), and high yield (9.3%).

While VettaFi did not ask why international equities were so unloved, a home bias, performance challenges, and a focus on just broad products provide a likely explanation. Despite consistently being told about the diversification benefits of investing in international equities, the 19% decline in value year-to-date for the iShares Core MSCI EAFE ETF (IEFA) and the Vanguard FTSE Developed Markets ETF (VEA) offered little benefit to an advisor that held an S&P 500 Index-based ETF like the iShares S&P 500 Index ETF (IVV) as its core; IVV was also down 19% for the year.

Advisors often build portfolios with a healthy mix of U.S. equity ETFs, including some broad market products like IVV, and some more narrowly focused smart-beta ETFs like the Invesco S&P 500 Low Volatility ETF (SPLV), the iShares MSCI USA Min Vol Factor ETF (USMV), and the Vanguard High Dividend Yield Index ETF (VYM). Indeed, the 20% of surveyed advisors that preferred cash was a sign that they were recently seeking a more conservative approach when building portfolios.

However, the smaller developed international equity slice of a client portfolio tends to be more diversified through IEFA, VEA, and similar products. Meanwhile, lower-risk international equity versions of popular U.S. smart-beta ETFs are under the radar despite strong recent relative performance.

For example the Vanguard International High Dividend Yield ETF (VYMI) was down just 10% year-to-date through July 1, significantly less than the broader developed market ETFs. The ETF owns high-yielding stocks like Royal Bank of Canada, Novartis, Shell, and Toyota Motor. Despite $1.3 billion of net inflows this year, there’s just $3.9 billion in assets, less than 10% of VYM’s base.

The Invesco S&P International Developed Low Volatility ETF (IDLV) declined just 11% thus far in 2022 by owning the least volatile stocks within the broader international equity benchmark, regardless of country or sector classification. Recent positions include BCE, Fortis, Hydro One, and Orange. However, there’s just over $500 million invested in this low-risk ETF, or close to 5% of the asset base for the more popular Invesco family member SPLV. IDLV has actually had approximately $130 million of net outflows this year.

The iShares MSCI EAFE Min Vol Factor ETF (EFAV) was down just 16% this year, a narrower loss than that of IEFA. Like fellow iShares ETF USMV, EFAV holds lower-risk stocks from within the parent index, with some limitations to avoid taking on unintended risks. The ETF holds top stakes in companies like National Grid, Roche, Softbank, and Swisscom.

Nonetheless, EFAV’s $5.8 billion in assets is less than 25% of USMV’s. EFAV incurred $1.0 billion of redemptions this year, while the relatively performance-challenged IEFA pulled in $2.9 billion of new money.

Advisors should look beyond the broad benchmark-based ETFs to support their internationally focused asset allocation. If their clients are risk-conscious, there are strong alternatives to consider that follow a similar smart-beta rulebook regarding what they are using to round out their domestic equity exposures.

To see more of Todd’s research, reports, and commentary on a regular basis, please subscribe here.

For more news, information, and strategy, visit the Innovative ETFs Channel.