Even as the U.S. equity markets have partially recovered in the past month, advisors are still in defensive mode. After some strong calendar years, the S&P 500 Index was recently down 16% and is more likely than not to finish in the red for 2022.

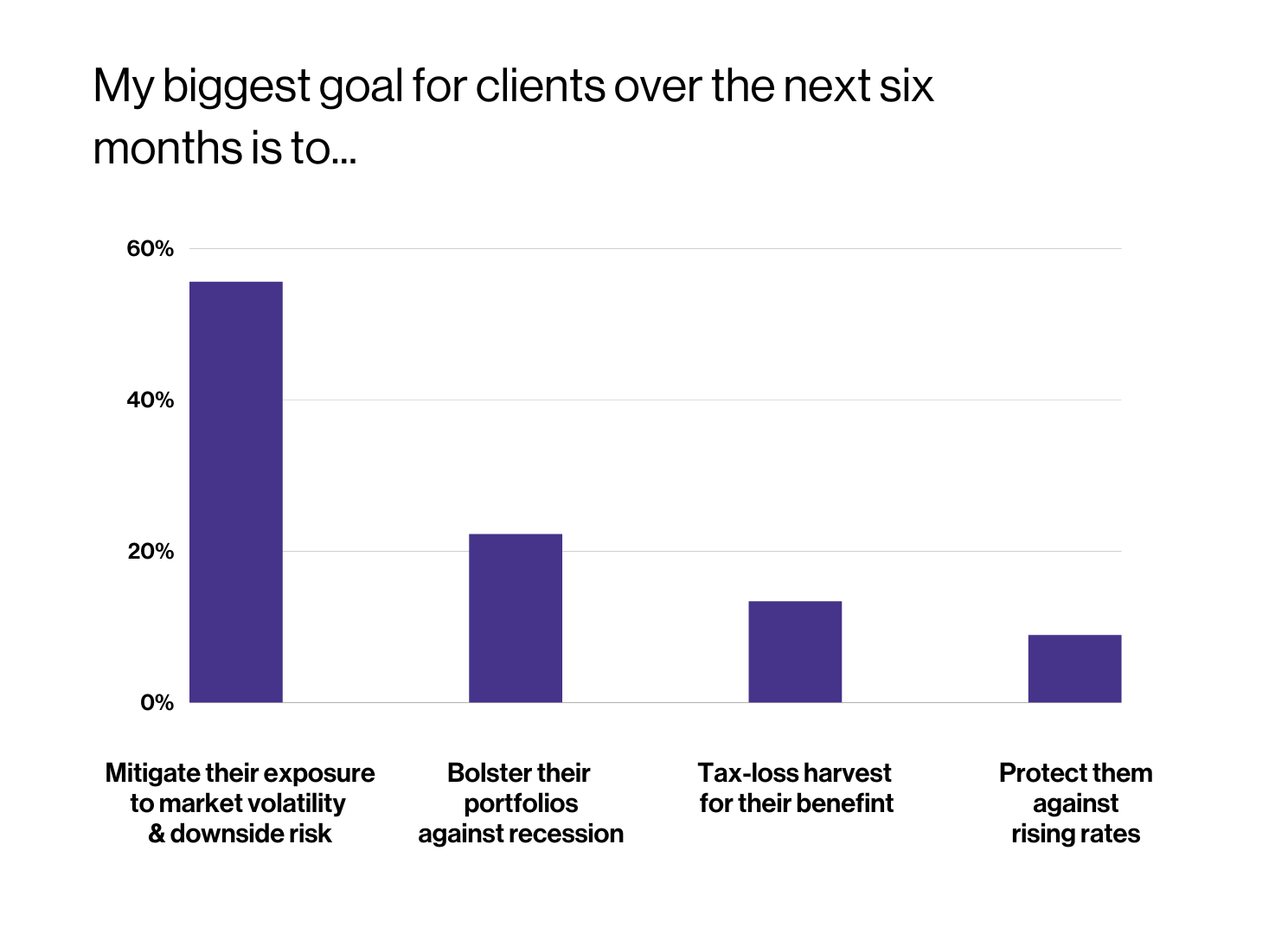

VettaFi asked advisors in early November during a webcast with State Street Global Advisors what their biggest goal for clients was over the next six months. The majority (56%) chose to “mitigate their exposure to market volatility & downside risk,” while another 22% selected to “bolster their portfolios against a recession.” The more offensive approach, to “tax-loss harvest for their benefit,” garnered only 13%.

There’s a wide array of ETFs for advisors to consider which offer some form of downside protection while also providing participation in equity market gains should bullish sentiment prevail.

The traditionally more popular risk-mitigation ETFs involved owning recently less volatile equities, in anticipation these securities would hold up best during selloffs in the near future. The universe of lower-volatility ETFs includes the iShares MSCI USA Min Vol Factor ETF (USMV) and the Invesco S&P 500 Low Volatility ETF (SPLV). USMV takes a more sector neutral approach than SPLV, which typically results in more exposure to cyclical sectors like information technology and less exposure to defensive sectors utilities than SPLV. However, both ETFs have protected against market volatility and downside risk in 2023. SPLV and USMV were recently down approximately 8% and 10%, respectively.

Advisors also can gain access to more institutional level strategies through ETFs. These include covered call strategies and defined outcome (aka buffer) ETFs. Let’s discuss them separately.

We wrote about covered calls recently, as some of the more popular products in 2022 are actively managed. To recap, a covered call-based ETF like the JPMorgan Equity Premium Income ETF (JEPI) selects stocks based on proprietary research, and enhances the income generated through call options. However, other popular strategies like the Global X S&P 500 Covered Call ETF (XYLD) take a passive, index-based approach. JEPI owns approximately one-fifth the number of stocks inside XYLD, with more meaningful stakes in Bristol-Myers Squibb and Progressive Corp than found in the broader S&P 500. JEPI and QYLD declined only 5% and 12%, respectively thus far in 2022.

Defined outcome ETFs provide protection against a set percentage of equity market losses in exchange for capped upside over a 12-month period, using options and not stocks. For example, the Innovator U.S Equity Buffer ETF (BNOV), which first launched in 2019, started on November 1 with a 9% buffer and a cap of 29% (as of November 14 the buffered remained but the cap was 26%). BNOV has also held up well in 2022, declining 8%.

While Innovator launched the first of these defined outcome products, others are available, including the AllianzIM U.S. Large Cap Buffer10 ETF (NVBT), which began trading in 2022. NVBT’s starting downside/upside limits were 10% and 27%.

For many advisors, 2022 has been a reminder that navigating clients through a down market is harder than an up one. Some clients that claimed to be able to stomach market volatility struggle to do so when it is a reality, not a theory. Thankfully, there’s lots of ETFs worthy of further due diligence that can help.

For more news, information, and strategy, visit the Innovative ETFs Channel.