While the Federal Reserve raised interest rates notably in the first eight months of 2022, helping push down the net asset value of most bond ETFs, many advisors are expecting even further hikes into 2023.

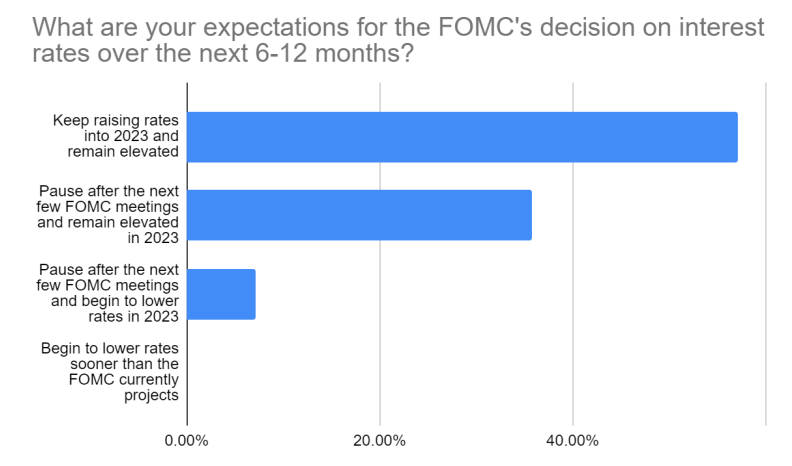

During a VettaFi webcast with Swan Global last week, before the freshest data on inflation came out, 57% of advisors that responded to a poll question we asked think that the Fed will keep raising rates into 2023 and that rates will remain elevated. A smaller yet meaningful percentage (36%) expected that the Fed will pause after the next few Federal Open Market Committee (FOMC) meetings, but that rates will remain elevated in 2023.

These more hawkish views contrast with the just 7.1% of advisors that expected that after the pause, the Fed will begin to lower rates in 2023. No advisors responded to VettaFi believing that the Fed will begin to lower rates sooner than the FOMC currently projects.

Given the expectations of higher rates, which should further pressure the more interest rate-sensitive bond ETFs, we anticipate many advisors will continue to turn to shorter-duration products. Thankfully, there are many short-term ETFs to consider.

For those investors seeking diversified exposure to Treasury bonds, ETFs like the iShares 1-3 Year Treasury Bond ETF (SHY), the Vanguard Short-Term Treasury ETF (VGSH), the Schwab Short-Term Treasury ETF (SCHO), and the SPDR Portfolio Short Term Treasury ETF (SPTS) could be potential options. While SHY is the most expensive of the quarter, with a 0.15% expense ratio, the iShares ETF is also the largest at $26 billion. All of the ETFs were down between 4.1% and 4.2% this year, as of September 9, compared to the 13% decline for the iShares 7-10 Year Treasury Bond ETF (IEF), which has greater interest rate sensitivity.

Meanwhile, those preferring to take some additional credit risk with investment-grade bonds can choose among products like the Vanguard Short-Term Corporate Bond ETF (VCSH), the iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB), and the SPDR Portfolio Short-Term Corporate Bond ETF (SPSB), which all cost 0.06% or less. SPSB is the best performer of the trio this year, declining only 3.4%, more than 200 basis points less than IGSB and VCSH. The SPDR ETF has an average duration of approximately one year less than its peers, which has protected its downside. Advisors can further manage the risk of higher rates by owning a portfolio of only bonds maturing in one year. One example is the Invesco BulletShares 2025 Corporate Bond ETF (BSCH), which charges a 0.10% fee.

Lastly, for the sake of brevity, those advisors who want a mix of government and corporate bonds have even more options to consider. If they prefer an index-based approach, ETFs like the iShares Core 1-5 Year USD Bond ETF (IUSB) and the Vanguard Short-Term Bond ETF (BSV) are worthy of a look. But if they seek out active management to sort through the universe of short-term bonds, the Fidelity Limited Term Bond ETF (FLTB) and the PIMCO Enhanced Low Duration Active ETF (LDUR) are two examples.

The above are just a sample of the bond ETFs that advisors can research using VettaFi’s ETF Database, which made the short list for an ETF award, if they are like the majority of their surveyed peers who expect interest rates to stay elevated into 2023.

For more news, information, and strategy, visit the Innovative ETFs Channel.