Exchange traded fund investors can focus on innovation across the various market segments and industries to capture rising growth opportunities of tomorrow.

“Through our partnership with NASDAQ, Invesco has redefined the way investors can access innovative companies with a commitment to research and development. Our new QQQ Innovation Suite offers access to the NASDAQ-100 and the NASDAQ Next Generation 100 indexes, both of which invest in some of the most innovative growth companies in the world (including market leaders such Apple, Microsoft, and Amazon, and emerging innovators such as Roku, Marvell Technology Group Ltd., and Garmin, Ltd.) Once small entrepreneurial start-ups, these companies have continued to consistently and significantly invest in research and development — and in doing so have redefined themselves, their sectors, and the face of innovation itself,” John Feyerer, Senior Director of Equity ETF Product Strategy, Invesco, said in a research note.

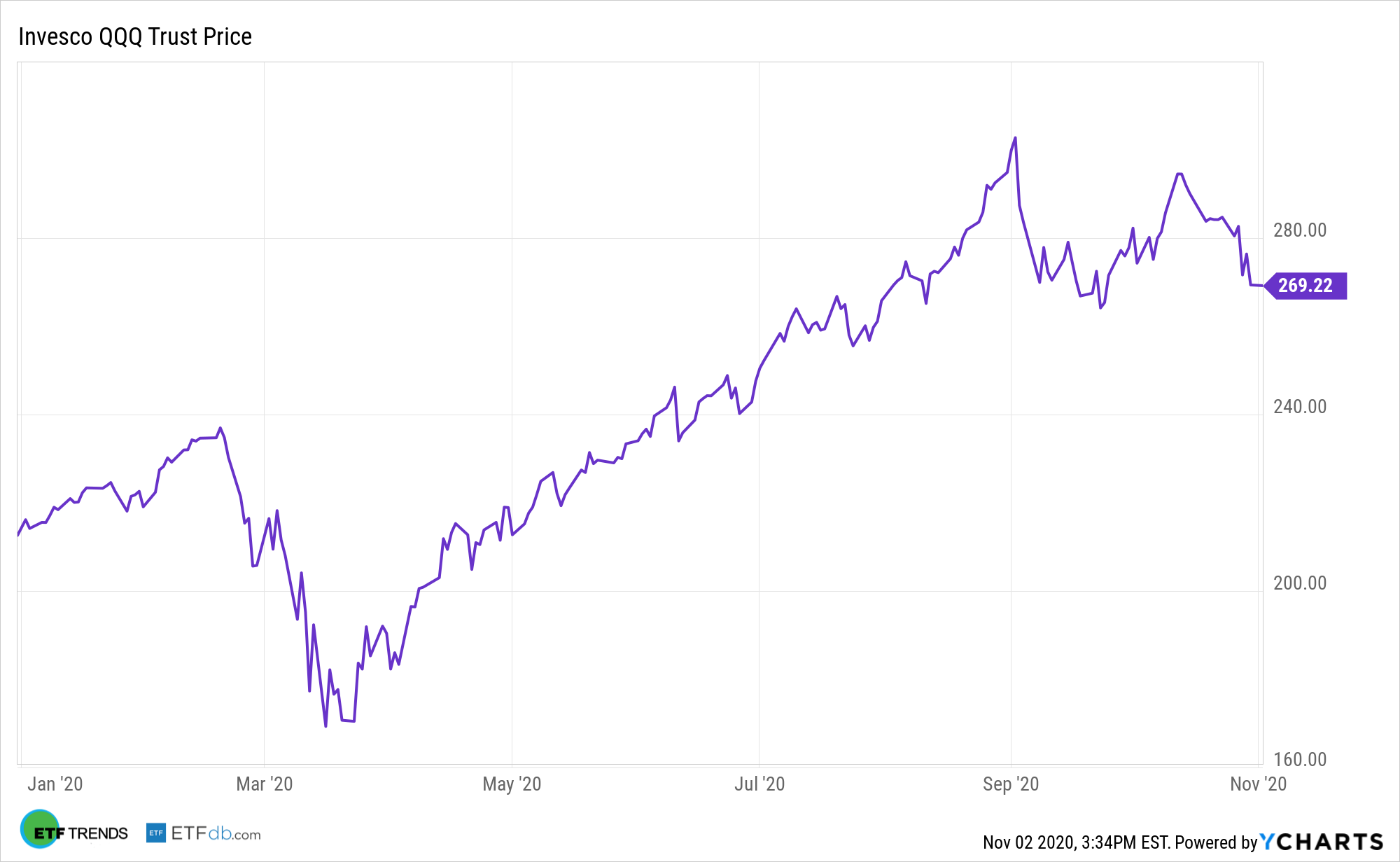

For example, the popular Invesco QQQ Trust (NASDAQ: QQQ), which tracks the Nasdaq-100, 100 of the largest domestic and international nonfinancial companies listed on the Nasdaq Stock Market, has been the go-to play to access some of the largest innovative companies in the U.S. markets.

The NASDAQ-100 Index constituents spent considerably more on R&D than the S&P 500 and Russell 1000 Growth indices, with patent contributions ranging across disruptive technologies, such as 3D graphics, natural language processing, cloud computing, virtual reality, big data, cyber security, deep learning, and more.

The NASDAQ-100 also boasts strong fundamentals. Since 2009, NASDAQ-100 constituents have generated higher growth rates across revenue, earnings and dividends than those of the S&P 500 and Russell 1000 Growth Indices. NASDAQ-100 companies also show strong brand equity, valuable patents and economies of scale that may drive product demand and pricing power.

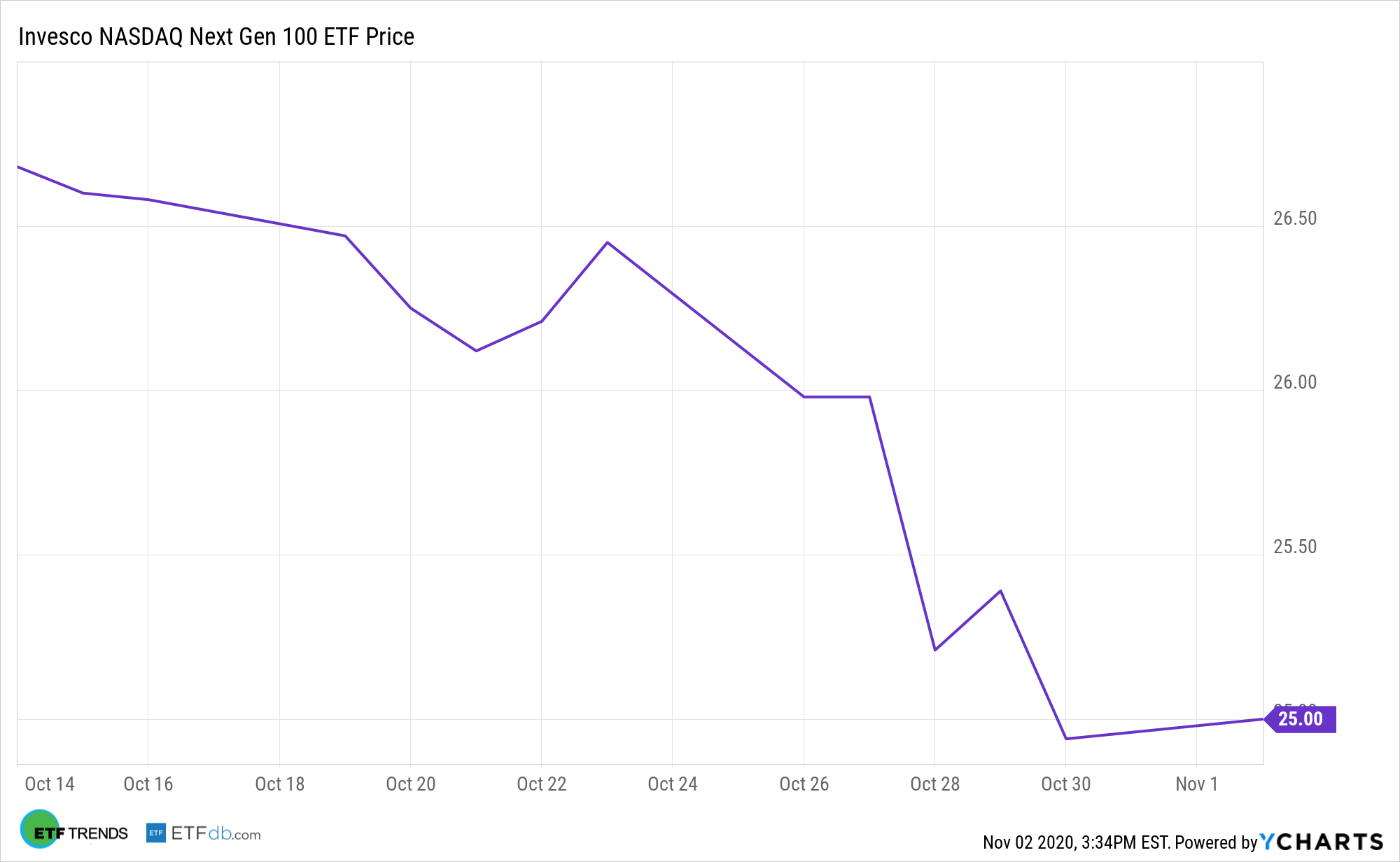

Additionally, both longer- and shorter-term investors looking for exposure to the next generation of innovative companies to be listed on the Nasdaq may opt for the Invesco NASDAQ Next Gen 100 ETF (QQQJ). QQQJ extends this concept further by offering access to the “next 100” non-financial companies listed on the Nasdaq, outside of the NASDAQ-100 Index, offering a mid-cap alternative to the NASDAQ-100.

QQQJ offers early exposure to forward-thinking growth companies before they graduate to the NASDAQ-100. Since 2011 54 NGX constituents have “graduated” to the NASDAQ-100 and currently comprise over one third of the NDX index. The ETF’s components exhibit robust innovation and growth fueled by consistent and substantial investment in R&D. Additionally, the Invesco NASDAQ Next Gen 100 ETF tracks profitable growing companies with strong fundamentals, with revenue and dividend growth rates that surpass that of the S&P 400 and Russell Mid-Cap Growth indices.

For more news and information, visit the Innovative ETFs Channel.