Bull vs. Bear is a weekly feature where the VettaFi writers’ room takes opposite sides for a debate on controversial stocks, strategies, or market ideas — with plenty of discussion of ETF ideas to play either angle. For this edition of Bull vs. Bear, Karrie Gordon and Elle Caruso debate whether equities are the best way to capture the energy transition globally.

Elle Caruso, staff writer, VettaFi: Karrie, I was just poking around and saw that since our last iteration of the column together — Bull vs Bear: Does Meta Stock Have Legs? — on November 8, when I took the bull case and highlighted a ripe buy-in opportunity, shares of Meta are up over 54% (as of January 27). I’m looking forward to again advocating for the less popular side of an investment case – after all, that’s where investors can find untapped opportunities.

We’ve been talking a lot in the writers’ room about the different ways investors can get exposure to the energy transition. With countries representing 80% of the global population and 91% of global GDP committed to an energy transition, moving from fossil fuels to renewable sources of energy, investors have a huge opportunity in front of them. But many folks are still unsure of whether they should gain exposure via commodity equities or commodity futures.

Karrie Gordon, staff writer, VettaFi: I’m a huge proponent of capturing the energy transition through equities, both in the near- and long-term.

For starters, the future particularly looks bright for renewable energy producers, as renewables are projected to account for 90% of new electricity expansion worldwide in the next five years, according to the International Energy Agency. Globally, renewable energy capacity is anticipated to grow as much in the next five years as it did in the previous two decades, up to an estimated 2,400 gigawatts — or roughly equivalent to China’s entire electricity capacity today.

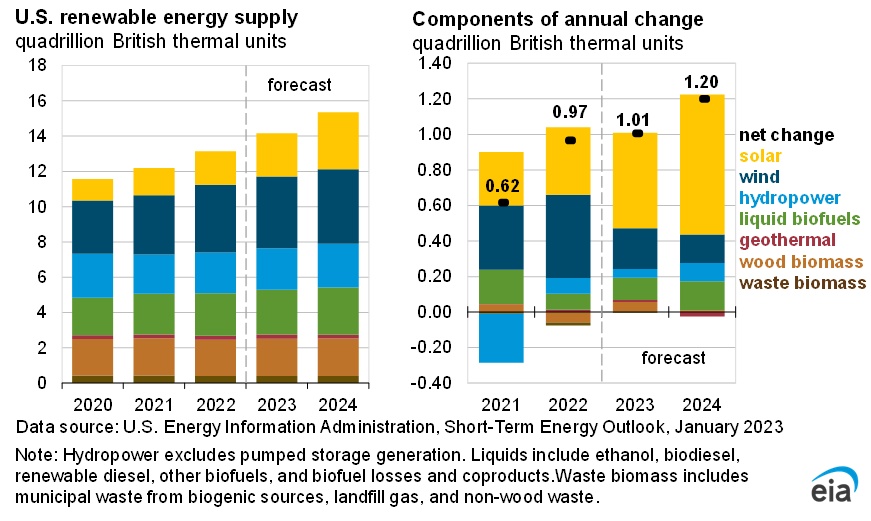

Within the U.S., renewable energy continues to carve out market share: the U.S. Energy Information Administration estimates that renewables will account for 22% of all electricity generated in the U.S. in 2022 and will grow to 24% in 2023, including significant expansions in solar.

To me, that says the greatest opportunity is in equities, and you see it in how clean energy ETFs have been supercharged recently. Of the top six ETFs by 5-year returns, half are funds investing in renewable energy equities. The Invesco Solar ETF (TAN) remains at the top spot and continues to maintain an impressive lead over the competition with 5-year returns of 216%. Other top-performing ETFs include the First Trust NASDAQ Clean Edge Green Energy Index Fund (QCLN) and the iShares Global Clean Energy ETF (ICLN).

On a side note, it’s worth pointing out that the other three ETFs in the top six are semiconductor funds. Clean energy ETFs also have plenty of semis exposure, too, since semiconductors play a pivotal role in renewable energy conversion, storage, and more.

Caruso: Yes, those ETFs boast standout returns; however, I’m concerned about their future growth potential. Is their strongest performance in the rearview mirror? Besides, investing in equities inherently is a bet on which of the underlying technologies will prevail. The end state of the energy transition is too uncertain for that.

On the other hand, raw commodities (copper, aluminum, etc.) will be necessary, regardless of which technology wins out. Considering the world is structurally short of many of the commodities necessary for the energy transition, supply and demand economics suggest this shortfall can only be corrected by incentivizing greater production via higher commodity prices.

That’s why I think commodity futures are the way to go. If commodities must increase in price to generate new supply (or incentivize other technologies), then futures offer convenient access to that trend. Meanwhile, equity investments, such as commodity producers and renewable power manufacturers, are effectively short these underlying commodities, as their business models are sensitive to the prices of the inputs required.

To avoid the complication of directly managing futures in client portfolios, advisors can look to commodity futures-based ETFs, like the KraneShares Electrification Metals Strategy ETF (KMET) and the Harbor Energy Transition Strategy ETF (RENW).

Gordon: Commodities futures are absolutely a way to play the energy transition, but if you ask me, the last thing advisors are going to be looking to do this year is up their clients’ exposure to risk, given the general consensus of an impending recession.

Commodities futures’ low correlation to equities and bonds comes with pretty hefty risks. Using commodity futures is essentially double-stacking your risk profile. Advisors need to understand the specific risks to each commodity (an agricultural commodity has a different risk profile from energy, and so on), in addition to the inherent speculative risk associated with futures investing.

Another big risk is contango. As global renewables capacity ramps up, futures contracts linked to the energy transition will likely see prices increasing. For investors that want to maintain exposure to a commodity over a longer time horizon, the increased cost of rolling over expiring contracts will create drag as you get caught in a loop of selling lower and buying higher. That’s a lot of risk and I just don’t think advisors and investors really have the appetite for it right now.

Caruso: While the effect of carry in commodity futures has historically been a drag on returns, this has varied significantly by both sector and individual commodity, reflecting storage costs and supply and demand balances.

However, we can expect tighter supply and demand dynamics going forward, meaning that it’s reasonable to expect buyers will bid up spot prices due to concerns about limited supply. The effects of this can outweigh storage costs, resulting in backwardation — where spot prices are higher than deferred, becoming a negative drag (positive addition) to investor returns. This was observed in the S&P GSCI in 2022, as returns outperformed spot prices by nearly 15% between January 1 and November 30.

Based on the tight supply of commodities needed for the energy transition, coupled with insatiable demand, I don’t see contango being an issue.

Opting for a fund with actively managed futures exposure, such as the Invesco Electric Vehicle Metals Commodity Strategy No K-1 ETF (EVMT), may offer investors peace of mind.

There are also overlooked risks in getting energy transition exposure via commodity equities. These risks include:

- Equity market risk, which arises from sentiment and investment flows broadly impacting equity markets

- Commodity output risk, due to changes in the price of the commodity being produced by the company

- Management risks (financial risk or reputational or legal)

- Commodity input risk if input costs rise for raw materials or labor; and

- Country risks, which arise from the region in which the company operates.

Gordon: Equities do carry risks, but they largely have a much more familiar risk profile for advisors than futures and can be a lot easier to justify within a portfolio, particularly when times are challenging. This year looks to be another uncertain year for markets and equities; the World Bank just lowered its outlook for the global economy to growth of just 1.7% in 2023, down from earlier estimates of 3%. The U.S. is forecast at just a 0.5% growth rate this year.

Speaking to the risks you mention, the other side of the investment coin when it comes to risk is an opportunity, and one country to consider this year, especially for energy transition commodity equity exposure is China. Its forecast to hit a 4.3% real GDP this year according to the World Bank and remains the global leader in renewable energy. For advisors looking to capture recovery potential and foundational policy support for renewables within China, the KraneShares MSCI China Clean Technology Index ETF (KGRN) is a strong play on the space and is up 19% YTD.

I think no matter which way you slice it, the future looks bright for any asset class related to the energy transition, but I believe equities might be the more appealing slice of that particular commodity pie for advisors and investors. Elle, thanks so much for chatting with me today and have a great time in Miami at Exchange!

Caruso: Karrie, it’s always a pleasure. And while the markets look dim, let’s not forget that commodities are poised for a third consecutive year as the top-performing asset class. Goldman Sachs economists expect commodities to return 43% this year, making now an ideal time to consider adding to or initiating a commodities position, regardless of whether you opt for equities or futures-based exposure.

For more news, information, and analysis, visit the Innovative ETFs Channel.