Getting value exposure in today’s market is a must given a 9% rise in the S&P 500 Value index year-to-date. Investors can get just that with assets like the Invesco S&P 500 Enhanced Value ETF (SPVU).

SPVU seeks to track the investment results of the S&P 500 Enhanced Value Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is designed to track the performance of approximately 100 stocks in the S&P 500® Index that have the highest ‘value score’, which the index provider calculates based on fundamental ratios of a company’s stock. A value stock tends to trade at a lower price relative to such fundamentals and thus may be considered undervalued by investors.

Value is beating out growth thus far in 2021.

“The changing of the guard in the stock market could stay in place for years,” a Barron’s article said.

“Value stocks—more sensitive to changes in the economy than growth stocks—have outperformed growth since Sept. 23: That’s when markets seemed to become more optimistic about the U.S. economy recovering sharply from the Covid-19 pandemic,” the article added further.

Under the Hood of ‘SPVU’

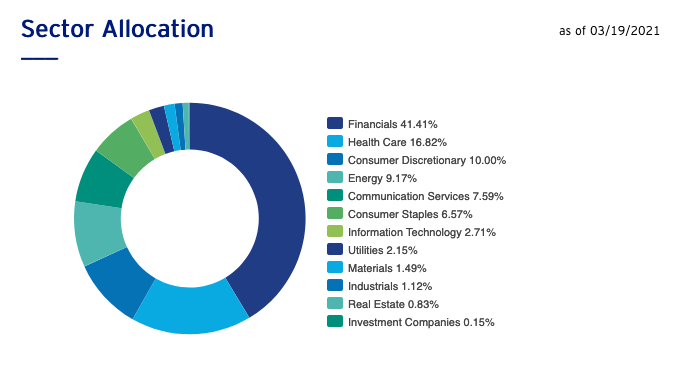

Under the hood of SPVU, ETF investors get the heaviest exposure to the financials sector. This is a sector where rising rates could benefit the space, particularly when it comes to revenue from loan products.

Right now, the Federal Reserve seems steadfast in its view to keep rates low, but a healing economy could make interest rate policy change course. Rounding out the top three sectors for SPVU are healthcare and consumer discretionary, which are safe haven sectors that provide stability in a country still battling Covid.

Large cap value is the primary focus with over half the exposure of the fund, while mid cap value also gets a decent portion at about 25%.

Top holdings include a mixed bag of large caps, including Exxon Mobile, Bank of America, Berkshire Hathaway, and AT&T. Cost-conscious investors will be happy to note that SPVU’s expense ratio comes in at a paltry 0.13%.

For more news, information, and strategy, visit the Innovative ETFs Channel.