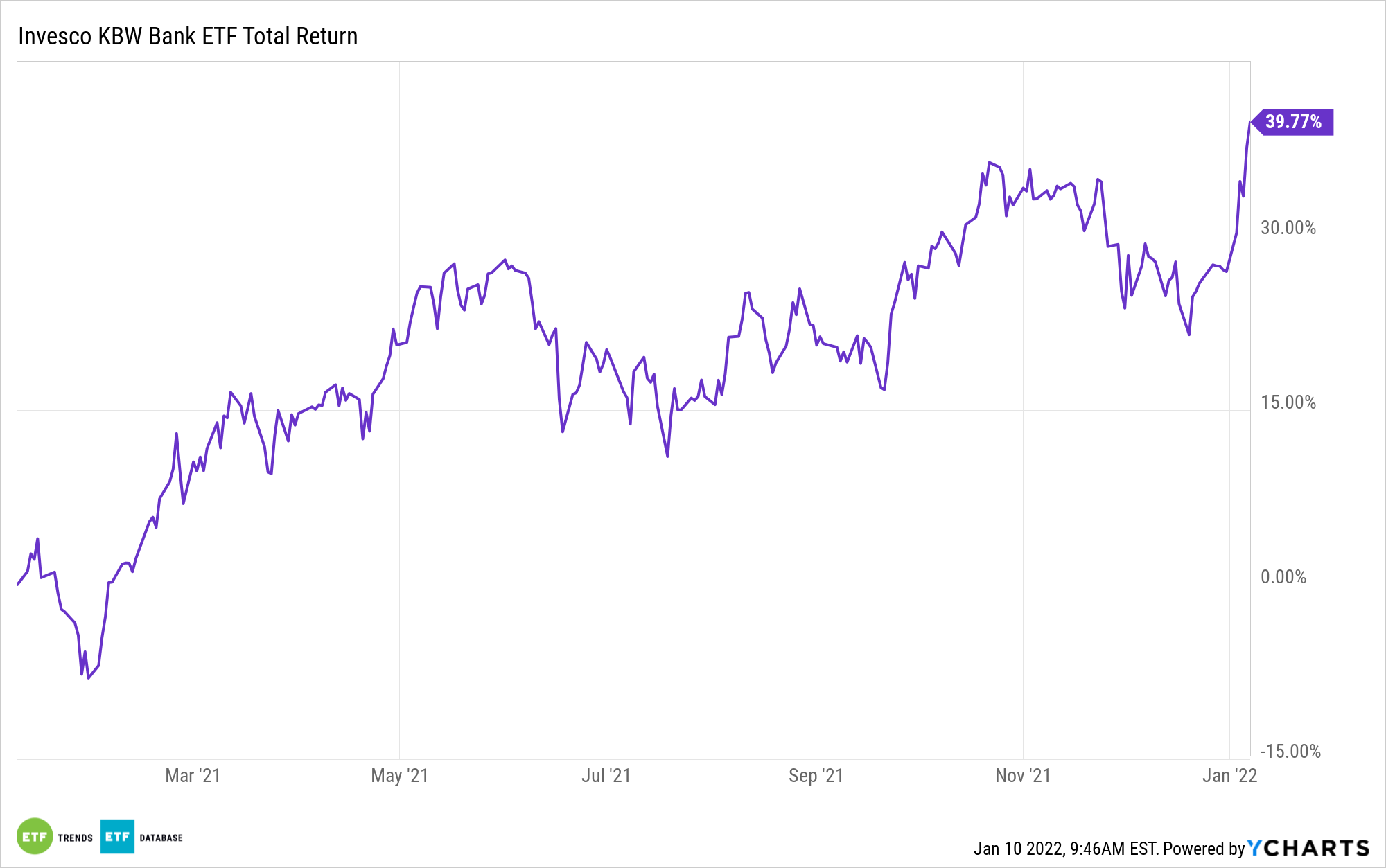

When it comes to lending products, consumers may not like the idea of rising rates, but for banks, it could translate to higher revenues and gains for the Invesco KBW Bank ETF (KBWB).

The Federal Reserve may potentially become more aggressive with its rate hikes with inflation running hot, as the consumer price index could reach 7%. It’s already started to taper off bond purchases amid an improving economy and has signaled rate increases for 2022.

Certain business sectors may not like the idea of rising interest rates. However, banks that rely on lending products for a bulk of their revenue don’t mind.

“The stock market is on pins and needles as interest rates have shot higher,” a 24/7 Wall Street article says. “While a huge increase would be dangerous for some sectors, the reality is that it looks like the Federal Reserve will begin to raise rates this year and will speed up the tapering of the quantitative easing program much faster than earlier expected.”

“One industry that loves rising interest rates is banking,” the article adds further. “When interest rates are higher, banks make more money, by taking advantage of the difference between the interest banks pay to customers and the interest the banks can earn by investing.”

Diversified and Skewed Towards Value

With so much market uncertainty abounding right now, value is almost necessary. That said, KBWB’s holdings focus primarily on large-cap value exposure, while still maintaining exposure to mid-caps that can capture growth-oriented upside.

Familiar names like Wells Fargo, Bank of America, and Citigroup may dominate holdings, but there are also smaller-cap names. This helps to capture amplified gains that can come with small- to mid-cap equities investing.

“KBWB’s underlying portfolio is unique from the most popular ETFs in the Financials Equities ETFdb Category; this ETF is comprised of common stocks of national money centers, leading regional banks, and thrifts,” an ETF Database analysis says. “Moreover, it should be noted that while bellwether companies make an appearance, there are a fair amount of small cap, regional-based firms that have significant representation.”

“Small banks often maintain risk/return profiles that differ considerably from their large cap peers; though impacted by some of the same factors, smaller banks generally depend more heavily on traditional banking functions to drive profits,” the analysis adds further.

For more news, information, and strategy, visit the Innovative ETFs Channel.