In 2019, investors are looking to play more defense against volatility, but at the same time, don’t want to do so at the expense of higher costs–a case for a pair of low volatility ETFs with low expense ratios– Invesco S&P 500 Low Volatility ETF (SPLV) and the Invesco S&P MidCap Low Volatility ETF (NYSEArca: XMLV).

Thus far, both funds are yielding positive gains as a result of strength in the S&P 500 reaching an all-time high. SPLV is up 13.52 percent year-to-date while XMLV is up 12.17 percent.

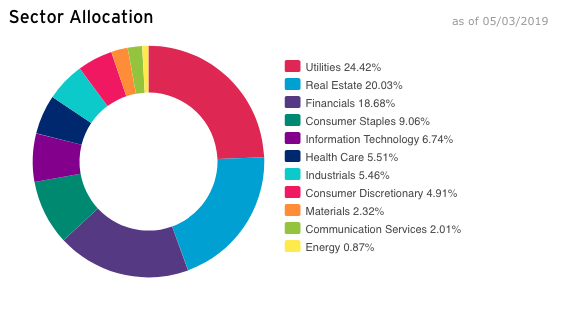

SPLV seeks to track the investment results of the S&P 500 Low Volatility Index. Strictly in accordance with its guidelines and mandated procedures, the index provider selects 100 securities from the S&P 500 Index for inclusion in the underlying index that have the lowest realized volatility over the past 12 months as determined by S&P DJI.

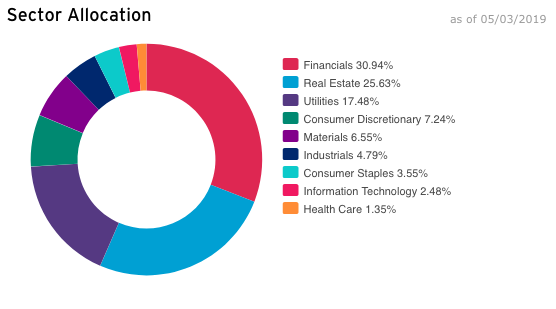

As for XMLV, it seeks to track the investment results of the S&P MidCap 400 Low Volatility Index. Strictly in accordance with its procedures and mandated guidelines, the index provider selects for inclusion in the underlying index the 80 securities that it has determined have the lowest volatility over the past 12 months out of the 400 medium capitalization securities that are contained in the S&P MidCap 400 Index.

Both funds come at a low expense ratio of 0.25 percent.

“Following a sharp selloff late last year, equity markets rebounded in the first quarter of 2019,fueled by optimism about a potential US/China trade deal and the Federal Reserve’s indication that there would be no interest rate hikes in 2019, a surprising shift in monetary policy,” an Invesco information sheet noted. “The Fed’s more accommodative stance provided a supportive environment for equities and fixed income, even as US economic data were mixed and overseas growth appeared to be slowing.Against this backdrop, the S&P 500 Index posted its best first quarter since 1998.”

Global Growth Shield

Fears of a global economic slowdown saw the Dow Jones Industrial Average post five losing sessions in a row last week, which is a reminder to investors that the volatility that racked the markets in the fourth quarter of 2018 could return at any time.

According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January. While this could lead to a spike in volatility, there are opportunities to be had sifting through the markets with a low volatility screener.

“So unfortunately, that’s not great news for global growth, but it does give you an edge–if volatility is going to be high on the equity side, low volatility equity screens have traditionally been an excellent way to position for that.” said Jason Bloom, Invesco’s Director of Global Market Strategy.

For more market trends, visit ETF Trends.