Blockchain technology is set to transform all business sectors, and what better way to capture that growth potential than with a pair of Invesco ETFs, the Invesco Alerian Galaxy Blockchain Users and Decentralized Commerce ETF (BLKC) and the Invesco Alerian Galaxy Crypto Economy ETF (SATO)?

The impacts of blockchain technology are wide-ranging when it comes to business sectors. For example, Forbes described how the tech could transform the way that buyers and sellers interact during real estate transactions.

“Blockchain platforms associated with the real estate sector provide an answer in terms of speed and safety that can considerably reduce the risk of fraud,” a Forbes article said. “All stages of the real estate transaction are concerned by this innovative technology and its implications for simplifying the transmission of data and reducing the time between the signing of the preliminary sales agreement and the deed of sale before the notary.”

BLKC will aim to track the Alerian Galaxy Global Blockchain Equity, Trusts & ETPs Index. The index is comprised of stocks of companies that are materially engaged in the development of blockchain technology, cryptocurrency mining, cryptocurrency buying, or enabling technologies, exchange traded products (ETPs), and private investment trusts traded over-the-counter that are linked to cryptocurrencies.

Looking under the hood, 15% of its allocation goes to the Grayscale Bitcoin Trust, giving investors indirect exposure to the leading cryptocurrency, bitcoin. This indirect exposure can be of benefit when it comes to investors who are still hesitant to invest directly in digital currencies. Bitcoin hit an all-time high last week before pulling back in a natural price consolidation, which is something that risk-averse investors may not be quite ready to experience.

Getting Indirect Bitcoin Exposure

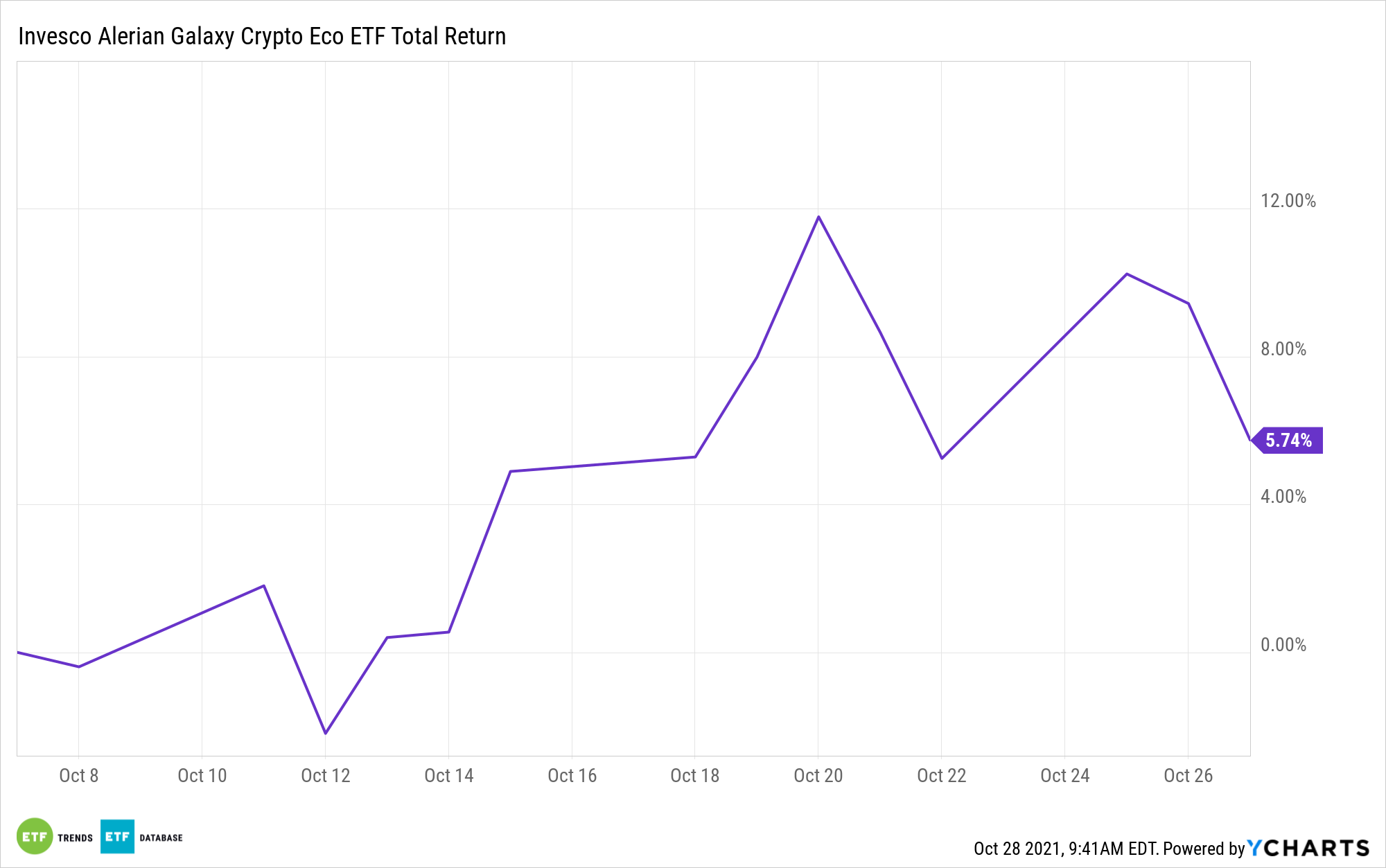

As per its fund description, SATO will aim to track the Alerian Galaxy Global Cryptocurrency-Focused Blockchain Equity, Trusts & ETPs Index and provide exposure to companies participating in both the cryptocurrency and blockchain space, including businesses such as cryptocurrency miners, cryptocurrency infrastructure technologies, and cryptocurrency buyers. Like BLKC, SATO also has its highest allocation (14%) in the Grayscale Bitcoin Trust.

In terms of market cap and style allocations, 60% of the fund goes to small-cap growth companies that operate within the blockchain sphere. The next highest allocations speak to the tilt towards growth with a 20% allocation into large-cap growth holdings.

For more news, information, and strategy, visit the Crypto Channel.