Healthcare sector-related exchange traded funds provide access to a market segment that is constantly innovating to improve our quality of life.

“Health care presents the opportunity to invest in companies that are constantly innovating to improve quality of life and raise productivity. It is hard to put a value on vaccines, cancer drugs, joint replacements, and pacemakers. At the same time, health care names do not dominate the market like big tech,” Nick Kalivas, Senior Equity Product Strategist, Invesco, said in a research note.

“Despite its underrepresentation in the S&P 500 relative to technology, I believe health care continues to offer investors valuable long-term opportunity potential,” Kalivas added.

Kalivas highlighted five reasons why healthcare exposure provides long-term growth opportunities. For starters, the sector offers the potential for strong earnings growth. In the five years ended March 31, 2020, profit growth in the S&P 1500 health care sector rose at a compounded annual rate of 8.1%, with earnings growth at nearly 3.5x faster than that of the entire S&P 1500, or the third-fastest sector growth rate behind information technology and financials.

5 Reasons Why

Health care is a play on demographics and an aging population. An older population will likely spend more on health as their bodies age, and medical care is needed to maintain their well-being.

The coronavirus pandemic highlights the importance of health care as part of the country’s national security. Government policy could take a more proactive approach to health care or become more friendly toward health care companies that have the resources and know how to innovate and combat the health care issues which threaten society.

The growing medtech industry offers the ability to blend technology with health care and drive future growth opportunities. Medtech improves the delivery and usage of health care products and services through artificial intelligence, digitization, robotics, monitoring devices, and 3D printing, providing a new frontier for the health care sector and investors.

Lastly, Kalivas argued that health care earnings could hold up in economic downturns, with less volatility. The S&P 500 health care sector has demonstrated earnings growth during periods where earnings for the S&P 500 have contracted.

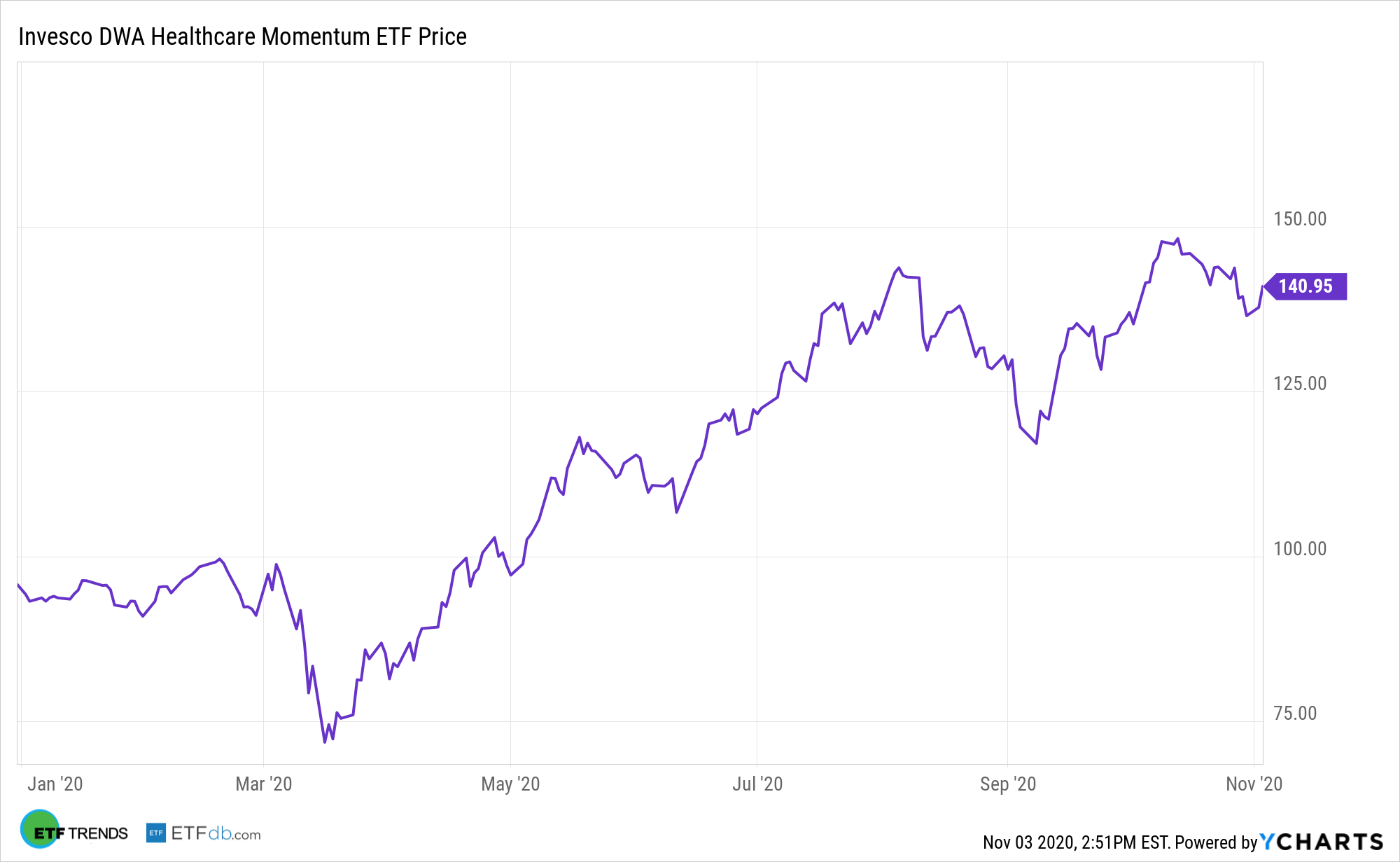

As a way to harvest this growth opportunity, investors looking to capture trends in the health care sector can turn to the Invesco DWA Healthcare Momentum ETF (PTH). PTH focuses on relative strength in its stock selection process, focusing on companies demonstrating the strongest performance in the health care industry.

PTH will invest at least 90% of its total assets in the securities that comprise the Dorsey Wright Healthcare Technical Leaders Index, which is composed of at least 30 securities of companies in the healthcare sector that have powerful relative strength or “momentum” characteristics. Relative strength is the measurement of a security’s performance in a given universe over time as compared to the performance of all other securities in that universe

“A momentum-driven strategy has the potential to capture stocks which are demonstrating emerging strength and eliminate stocks that are showing relative weakness,” Kalivas added.

For more news and information, visit the Innovative ETFs Channel.