As the broad economy and the equity markets continue to heal in 2021, investors should not forget about bond exposure. Whether it’s for income or safe haven purposes, bond ETFs from Invesco offer attractive options.

Here are five funds from Invesco to consider, including an active management option:

Invesco Total Return Bond ETF (GTO): GTO an actively managed intermediate-term bond ETF for investors seeking monthly income and total return opportunities. The fund will invest at least 80% of its total assets in fixed income instruments of varying maturities and of any credit qualities.

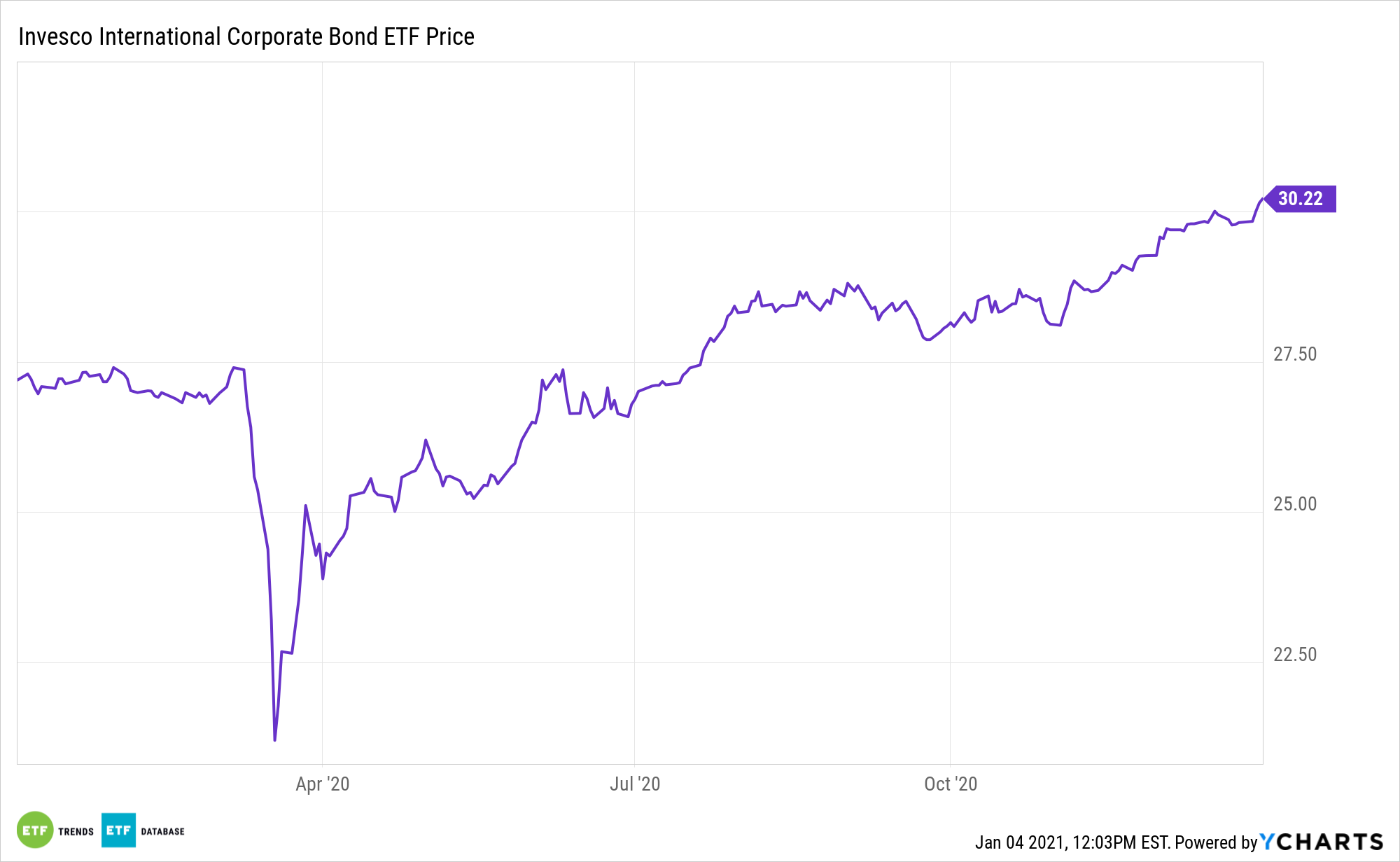

Invesco International Corporate Bond ETF (PICB): PCB seeks to track the investment results (before fees and expenses) of the S&P International Corporate Bond Index®. The fund generally will invest at least 80% of its total assets in investment-grade corporate bonds that comprise the underlying index. The underlying index measures the performance of investment-grade corporate bonds issued in the following currencies of Group of Ten countries, excluding the U.S. Dollar (USD): Australian Dollar (AUD), British Pound (GBP), Canadian Dollar (CAD), Euro (EUR), Japanese Yen (JPY), New Zealand Dollar (NZD), Norwegian Krone (NOK), Swedish Krona (SEK) and Swiss Franc (SFR).

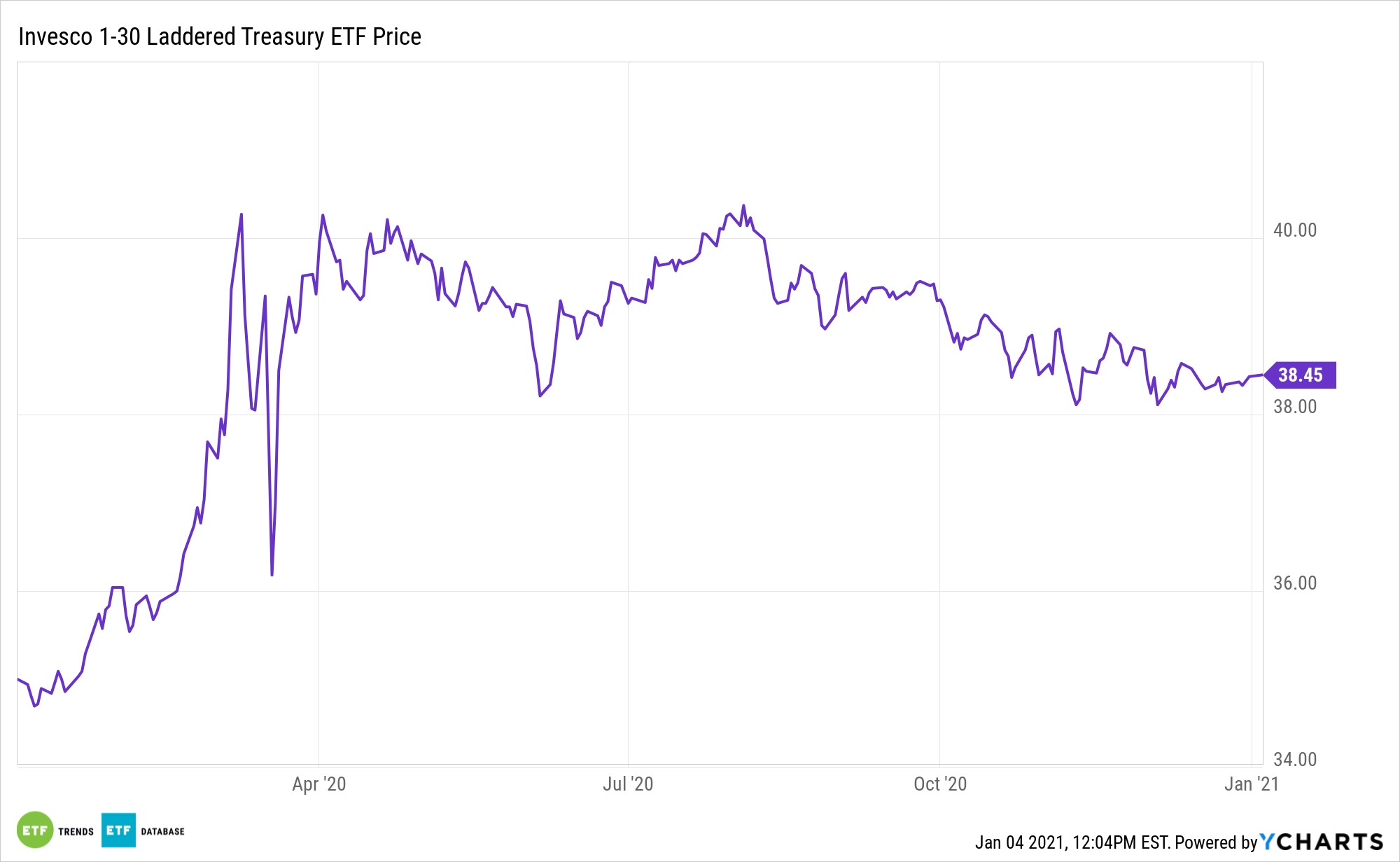

Invesco 1-30 Laddered Treasury ETF (PLW): bond laddering made easy; this fund seeks to track the investment results (before fees and expenses) of the Ryan/NASDAQ U.S. 1-30 Year Treasury Laddered Index. The fund generally will invest at least 80% of its total assets in the components of the index. Strictly in accordance with its guidelines and mandated procedures, Nasdaq, Inc. oversees the index, which seeks to measure the potential returns of a theoretical portfolio of U.S. Treasury securities with a yield curve based upon 30 distinct annual maturities.

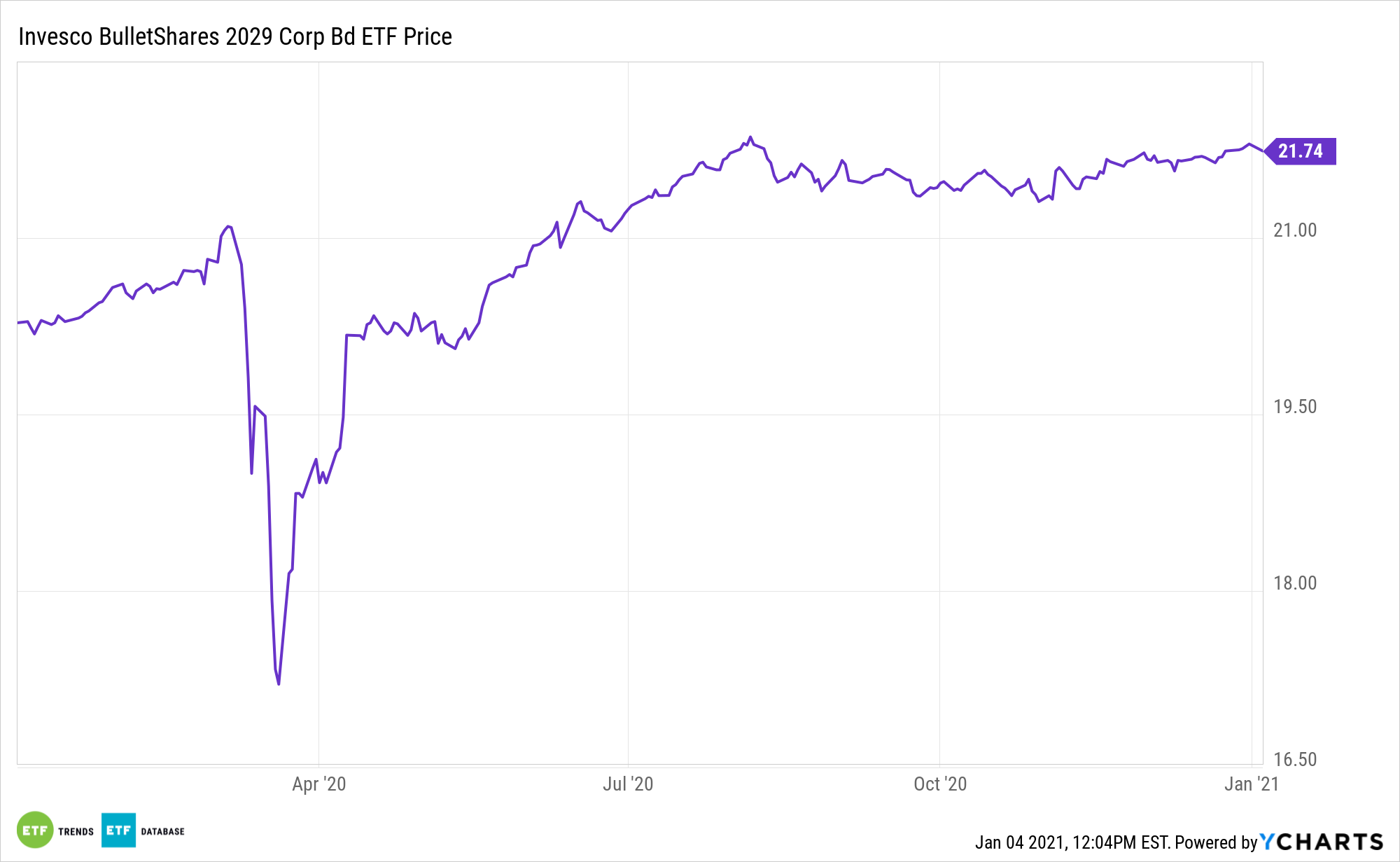

Invesco BulletShares 2029 Corporate Bond ETF (BSCT): seeks to track the investment results (before fees and expenses) of the Nasdaq BulletShares® USD Corporate Bond 2029 Index (the “underlying index”). The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated investment grade corporate bonds with maturities or, in some cases, “effective maturities” in the year 2029 (collectively, “2029 Bonds”).

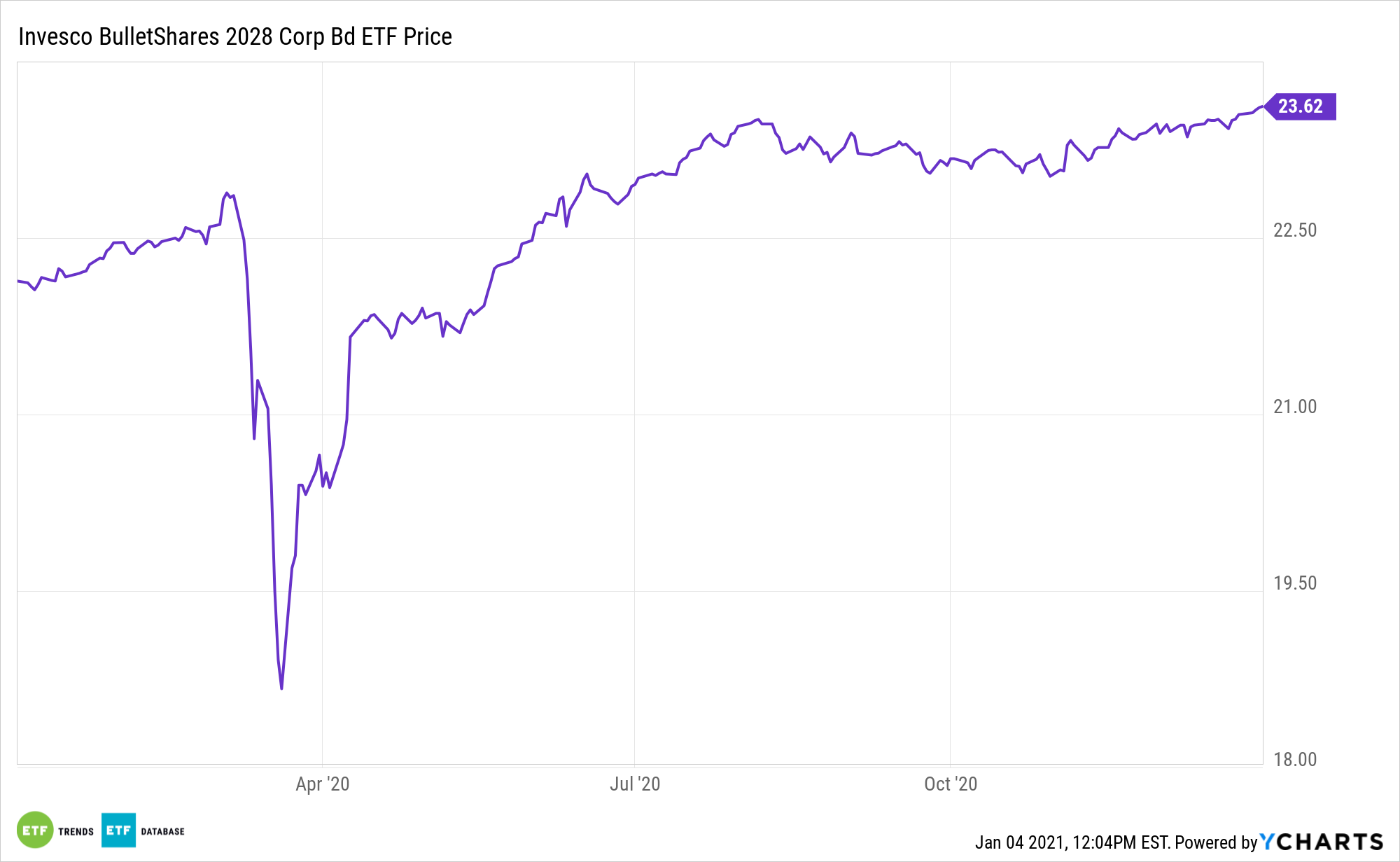

Invesco BulletShares 2028 Corporate Bond ETF (BSCS): seeks to track the investment results (before fees and expenses) of the Nasdaq BulletShares® USD Corporate Bond 2028 Index (the “underlying index”). The fund generally will invest at least 80% of its total assets in securities that comprise the underlying index. The underlying index seeks to measure the performance of a portfolio of U.S. dollar-denominated investment grade corporate bonds with maturities or, in some cases, “effective maturities” in the year 2028 (collectively, “2028 Bonds”).

For more news and information, visit the Innovative ETFs Channel.