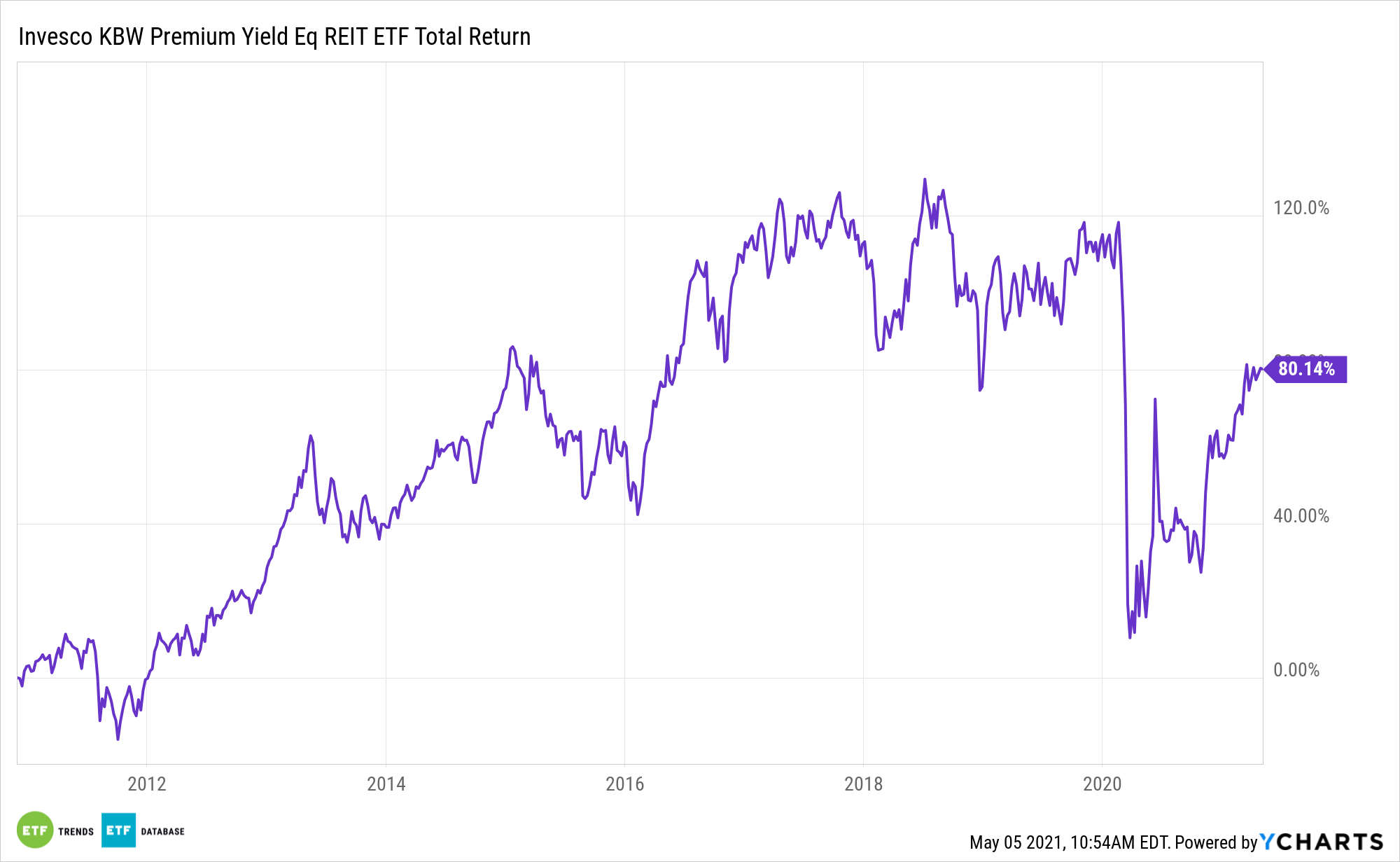

A seller’s market and relatively low interest rates have helped to fuel real estate ETFs in spite of the pandemic. ETF provider Invesco has a few funds investors may want to consider for real estate exposure.

Real estate ETFs give investors exposure to the asset class without the necessary startup capital necessary to purchase property. Additionally, investors can avoid the headaches that can come with being a property manager or landlord.

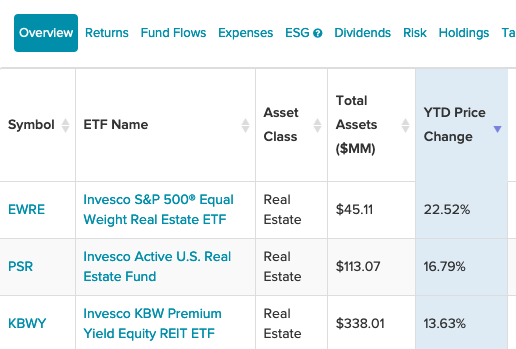

An Equal Weight Performer

The best performer thus far this year has been the Invesco S&P 500® Equal Weight Real Estt ETF (EWRE). EWRE seeks to track the investment results of the S&P 500® Equal Weight Real Estate Index. The fund generally will invest at least 90% of its total assets in the securities that comprise the underlying index.

The underlying index is composed of all of the components of the S&P 500® Real Estate Index, an index that contains the common stocks of all companies included in the S&P 500® Index that are classified as members of the real estate sector, as defined according to the Global Industry Classification Standard (“GICS”). With an equal weight index, investors get a nice balance of real estate names without one particular stock dominating the rest.

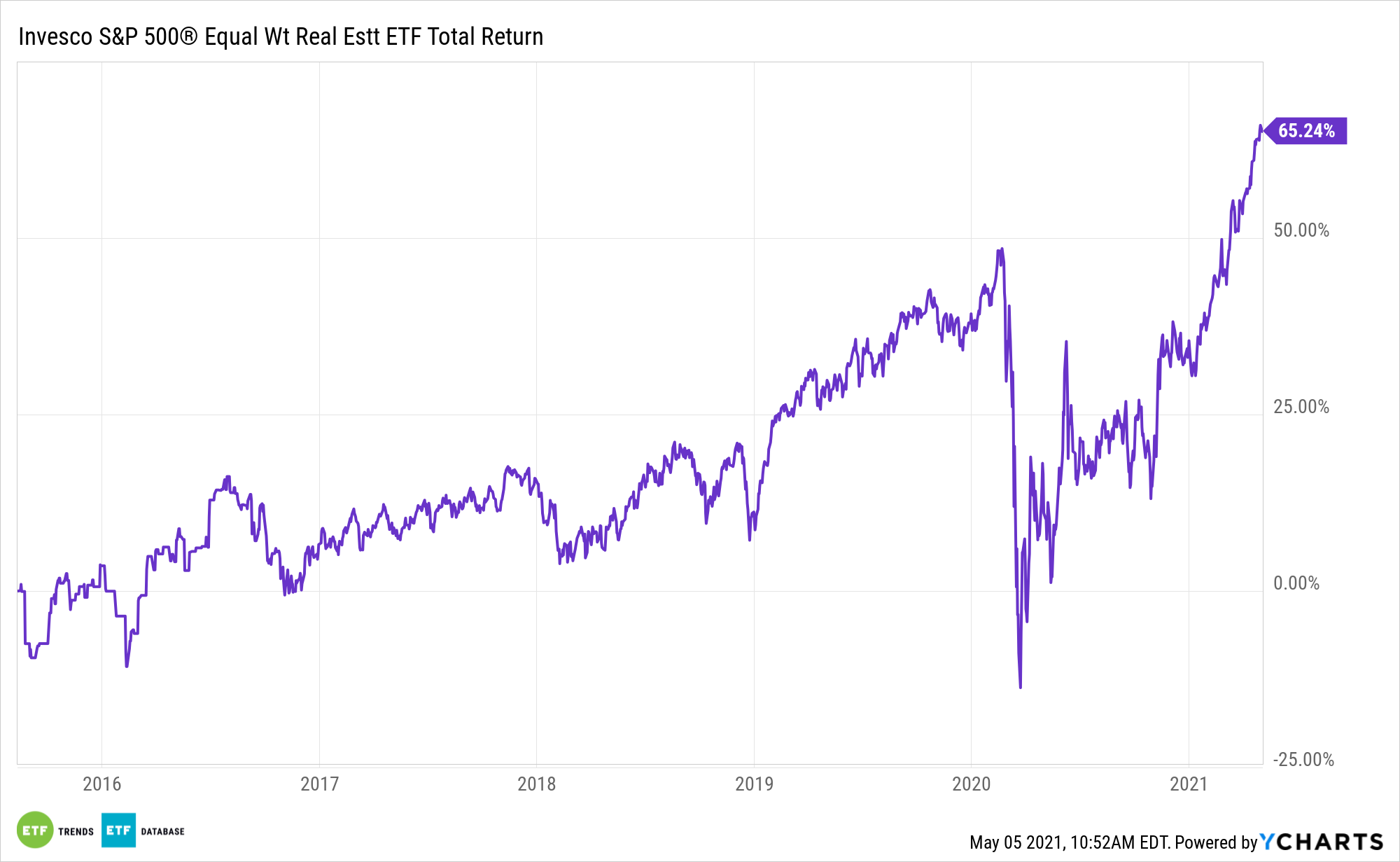

Active Management and Premium Yield

For investors looking for actively managed ETF exposure, there’s the Invesco Active U.S. Real Estate ETF (PSR). PSR structures and selects its investments primarily from a universe of securities that are included within the FTSE NAREIT All Equity REITs Index at the time of purchase.

The selection methodology uses quantitative and statistical metrics to identify attractively priced securities and manage risk. The Fund will invest principally in equity real estate investment trusts (REITs). Portfolio management generally conducts a security and portfolio evaluation monthly.

Of course, when it comes to active management, the question of cost is always apparent. PSR’s expense ratio comes in at just 0.35%.

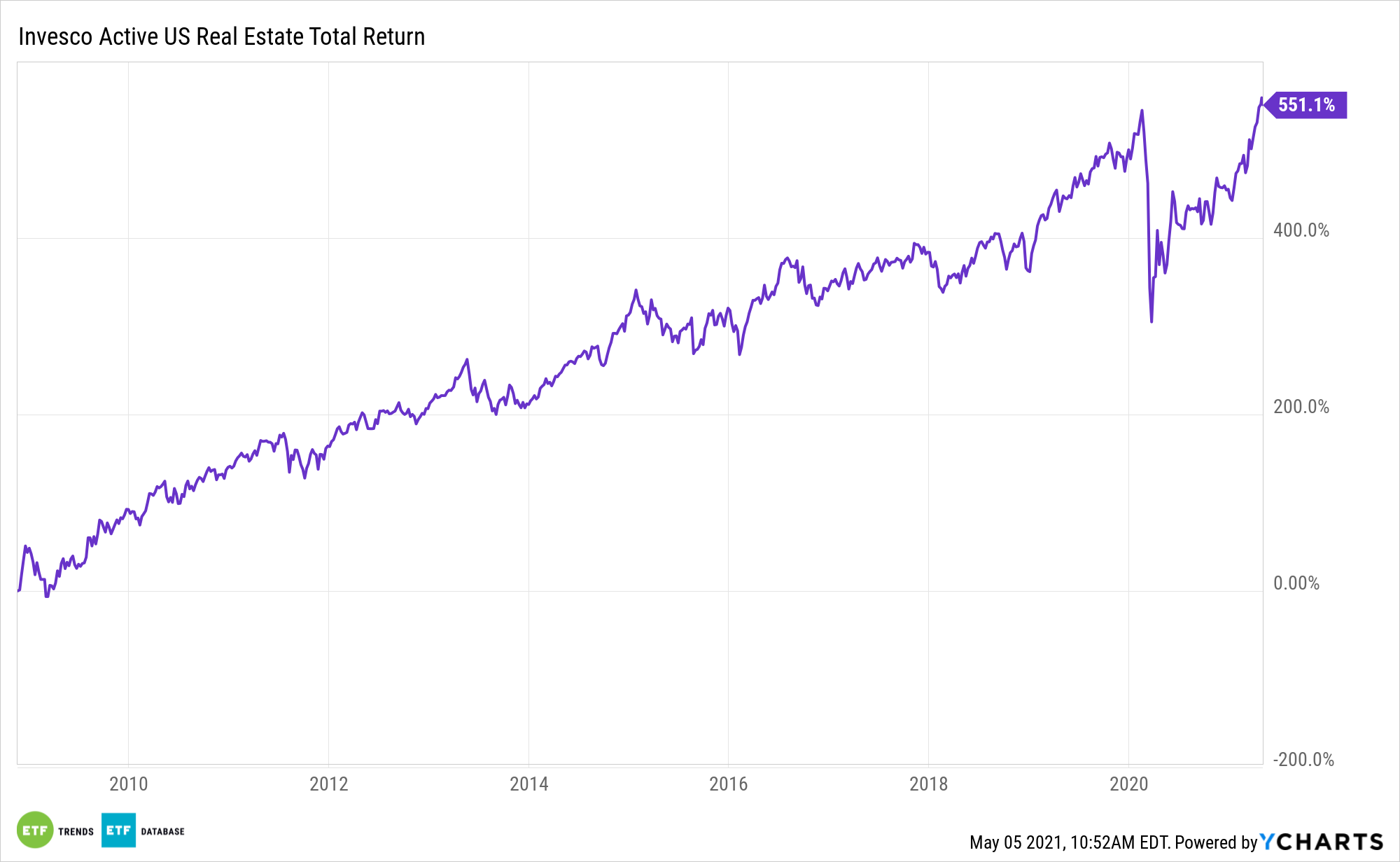

Lastly there’s the Invesco KBW Premium Yield Equity REIT ETF (KBWY). REITs can offer investors fixed income benefits. This ETF is one to consider for passive income with higher yields than government debt.

KBWY seeks to track the investment results of the KBW Nasdaq Premium Yield Equity REIT Index, which is a modified-dividend yield-weighted index of domestic equity real estate investment trusts (REITs) of small- and mid-capitalization, as determined by the index provider. The underlying index is designed to track the performance of small- and mid-capitalization equity REITs that have competitive dividend yields and are publicly-traded in the U.S.

For more news and information, visit the Innovative ETFs Channel.