With the capital markets turning the page on the first quarter of 2019, investors are regaining their confidence from a rebound in the capital markets after a tumultuous end to 2018. Heading into the early beginnings of Q2, it’s necessary for investors to remain strategic when it comes to deploying capital in the current market environment, especially with respect to selecting exchange-traded funds (ETFs) for their portfolios.

Helping to navigate through the seemingly vast ocean of ETF opportunities are three market experts — Yasmin Dahya, Head of Americas Beta Specialists at JP Morgan Asset Management; Samantha Azzarello, Global Market Strategist at JP Morgan ETFs; and Douglas Yones, Head of Exchange Traded Products at NYSE.

Each brings their unique perspective in the ETF space as part of the In The Know segment filmed at the “Inside ETFs” conference in Hollywood, Florida.

Remaining Strategic in 2019

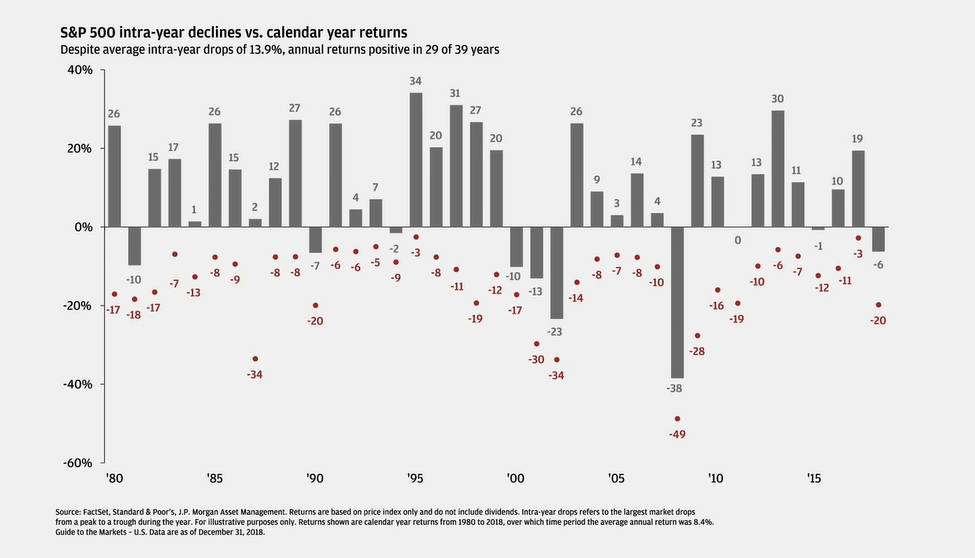

Why get strategic in 2019? One only has to look back to the last quarter of 2018 to know the reason why–the Dow Jones Industrial Average fell 5.6 percent, while the S&P 500 was down 6.2 percent and the Nasdaq Composite declined 4 percent.

All in all, 2018 marked the worst year for stocks since 2008 and only the second year the Dow and S&P 500 fell in the past decade. That said, the strategy for 2019 is eponymously as such–getting strategic.

What investors are feeling in terms of their sentiment when it comes to the current market landscape doesn’t necessarily correlate to what the data suggests. This dichotomy was certainly evident in the fourth quarter of 2018 when the capital markets were racked by a heavy dose of volatility.

“So, I think we’re going to have to go back to 2018, which people don’t really want to do because that was a bad year for markets,” said Azzarello. “But last year, the data was so good, but the sentiment was so bad.”

Earlier this month, the IMF cut its global growth forecast to the lowest level since the financial crisis, citing the impact of tariffs and a weak outlook for most developed markets. According to the IMF, the world economy will grow at a 3.3 percent pace, which is 0.2 percent lower versus the initial forecast in January.

In addition, the global volume of trade in goods and services will increase 3.4 percent in 2019, which represents a drop from the 3.8 percent gain last year. The IMF, however, did mention that recent policy implementations like the U.S. Federal Reserve keeping interest rates steady are positive signs moving forward.

“Now, fast forward into 2019, we’re seeing a little bit of a reversal. We actually think sentiment is better, people are feeling better, but we’re now starting to see a bit of a softening in the data, just a little bit in the GDP data, more so in global GDP data, which is slowing down,” said Azzarello.

How to Approach Fixed Income

The bond markets threw a curve ball at fixed income investors earlier this year with an inverted yield curve, sending the capital markets overall on another volatile ride–something they may or may not have been accustomed to during the fourth quarter of 2018. The short-term 3-month and longer-term 10-year yield curve inverted–an event that hasn’t been seen since 2007–just ahead of the financial crisis.

The spread between the 3-month and 10-year notes fell below 10 basis points for the first time in over a decade. This strong recession indicator contrasted a more upbeat central bank , but investors were quick to add more caution to their capital allocation.

“You could argue in a tightening cycle normally the yield curve does flatten, we’ve seen that historically,” Azzarello said. “However, it normally doesn’t flatten to this degree. So, I would argue, and our fixed income team would argue, that the short end of the yield curve is not talking to the long end of the yield curve.”

Given this latest obstacle, fixed income investors now have to get strategic when it comes to the bond markets as well. One area that investors can look to is investment-grade debt issues with a prime focus on quality.

“Within investment grade, we like higher quality,” said Azzarello. “So, we’re saying go up the quality spectrum, if you’re going to do your investment grade piece, we want better quality, better balance sheets, all of that.”

For investors who want to satiate their appetites for yield, Azzarello and her team actually like high yield of lower quality ratings. One thing to avoid, however, is investment-grade debt that is on the cusp–BBB or BBB+–which has the danger of falling into junk status.

“Within high yield, we’re liking lower quality, believe it or not,” said Azzarello. “So, within high yield, what we don’t like right now is the things that are right on the cusp. So, we think there might be some problems there.”

The default bond play to get broad-based exposure might be the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), which tracks the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index. The AGG gives bond investors general exposure to the fixed income markets, but there are times when current market conditions warrant a deconstruction of the AGG to extract maximum investor benefit.

Dahya cites active management and factor-based funds as viable options for fixed income.

“A lot of managers are bringing their active strategies into fixed income and they fit in the wrapper,” said Dahya. “And not it just means if you liked them in mutual funds, you can like them in the ETF ecosystem. But secondly, factor based fixed income. Improving upon the indexes within the fixed income world. Factors like value, quality and momentum can be used to pick better bonds, similar to how they are in equities.”

Keeping an Eye Out Overseas

Strength in U.S. equities thus far in 2019 is translating to strength abroad as emerging markets (EM) are gaining after a 2018 to forget. Nonetheless, for investors who are still hesitant when it comes to international market exposure, now is the time with a possible trade deal between the United States and China looming as the main trigger event that could send EM through the roof.

“So, we do really like emerging markets, but there’s so much fatigue,” said Azzarello. “I think, from clients and investors talking about it because it obviously has not worked year after year after year. So, it’s really hard to keep making the case for it. But I’m going to anyways.”

While the majority of investors might have been driven away by the red prices in EM during much of 2018, savvy investors who were quick to see the opportunity viewed EM as a substantial markdown. From a fundamental standpoint, low price-to-earnings ratios in emerging markets ETFs have made them prime value plays as capital inflows continue.

One suggestion, before investors deep-dive into EM, is buying with the objective of a long-term hold in mind.

“We do like them, but we’re saying you’re going to have to hold for at least five years,” said Azzarello. “And I would add, they’re on super sale. Like, they are so unbelievably cheap, these markets.”

Cookie Cutter Funds Can’t Always Cut It

No more are the days when ETFs like the SPDR S&P 500 ETF (NYSEArca: SPY) for U.S. equities and the iShares Core US Aggregate Bond ETF (NYSEArca: AGG) for fixed income was all an investor needed to gain broad-based exposure to the markets via a 60-40 portfolio. While this may still be the case in certain instances, the market landscape is constantly changing and warrants adjustments to fit a case-by-case scenario.

“What I think it means for advisors who are building portfolios is you need more in your toolkit for that kind of environment, both on the, as we’ve talked about, declining return expectations, but also, the reality of volatility,” said Dahya. “And 2018 was the year that reminded us and reminded our clients of what it’s like to stay though equity markets.”

This calls to mind the need for multi-factor investing where investors are shielded from large drawdowns like the ones witnessed during the fourth quarter of 2019. In addition, funds that offer this built-in protection can also capture any upside when the markets rise.

This calls to mind the need for multi-factor investing where investors are shielded from large drawdowns like the ones witnessed during the fourth quarter of 2019. In addition, funds that offer this built-in protection can also capture any upside when the markets rise.

“I genuinely believe that 2018 was the year that proved why you’d maybe want to consider something different than a pure market cap exposure,” said Dahya. “Now, that fits in the broader context of this, it did really well for you for the last 10 years, what’s it going to do for you for the next 10 years?”

The multifactor strategy can also work for diversification overseas as in the case of funds like the JPMorgan Diversified Return International Equity ETF (NYSEArca: JPIN) and the JPMorgan Diversified Return Emerging Markets Equity ETF (NYSEArca: JPEM).

So why hasn’t the capital markets embraced multi-factor funds wholeheartedly?

Part of the resistance for multi-factor investing that Dahya experiences stems from a lack of historical data. However, Dahya points out that these funds are starting to get longer in the tooth and have years of live testing behind them to fortify their results.

“They’re hitting four, five years, six years worth of live data. And now we’ve been able to see them in both up-markets and down-markets,” said Dahya.

For Dahya, a multifactor-based portfolio makes much more sense versus one that relies on a single factor. Given certain market conditions, investors need more than just a passive index that goes beyond a one-size-fits-all template that uses market cap weighting.

While these indexes provided simple, low-cost solutions, the need for even greater scrutiny is necessary in the quest for more alpha–a case for multifactor funds.

Maintaining the Structural Integrity of Exchanges

The number of exchange-traded funds (ETF) continue to grow at a rapid pace. Currently, there are over 2,200 ETFs in the marketplace with year-to-date inflows of over $70 billion.

A majority of ETF business goes through the New York Stock Exchange. In fact, just last year, trading volume in ETFs went from almost 30 percent to 40 percent.

The final quarter of 2018 was a low point for U.S. equities, particularly during Christmas Eve, but Yones witnessed something out of the ordinary on a typically slow day–the volatility actually drove volume for ETFs as investor were quick to get in and out of the marketplace.

When markets are experiencing heavy doses of buying and selling, it’s the exchange that helps ensure transactions take place efficiently. It’s this “behind the scenes” activity that keeps the ETF marketplace running smoothly via accurate pricing methodologies.

“If we have significant volatility, which we saw in December, that it all works properly so that no one starts questioning things,” said Yones. “And to give you a feel for how much volume came through, on Christmas Eve of last year, so typically a day in the exchanges that are usually our low point of the year, Christmas Eve was the highest volume we did on the floor in the history of the floor.”

“Historically up until 2018, ETFs weren’t even traded on the floor, they were always done electronically. On Christmas Eve, we traded something like 53 million shares of ETFs on the floor of the New York Stock Exchange,” Yones added.

As investors were flocking from U.S. equities into safe-havens like bonds, fixed-income ETFs were the beneficiary of this migration. Whether it was short duration, municipal, broad exposure, or other areas of the bond market, capital inflows were continuing.

“We saw tremendous volume in a lot of these fixed income ETFs,” said Yones. “1000%, 1,200% of daily volume were going through these ETFs without even creation redemptions in some cases.”

More importantly, volume into these fixed-income ETFs didn’t negatively affect liquidity–a notion floating around the capital markets that ETFs would harm liquidity during heavy buying and selling during a sharp downturn.

To watch the entire latest “In the Know” show, click here.