With 2018’s year-end sell-offs in U.S. equities, investors are giving value investing a closer look in 2019. A byproduct of a shift to value is a focus on the quality of investments–being selective and using due diligence as screeners to find the best-performing investments.

With 2019 well underway, investors need to know where this value lies and how to position their portfolios to capitalize on quality in the latest “In The Know” update. Josh Rogers, Beta Specialist at JP Morgan Asset Management, is well aware of this shift to quality and value overall.

The 2019 Value Comeback

While investors are flocking to safe haven assets like bonds, there’s still a need for products that capture the upside potential in U.S. equities. At the same time, however, there’s also a need for strategies that offer downside protection built into the product.

“When you think about profitability, financial risk, earnings quality–seeing those consistent profits coming through–stocks like that will not only be able to capture upside, but also if the markets go down, they tend to do very very well,” said Rogers.

As a result of 2018’s bull market run, the quality factor often goes overlooked compared to growth and value, but with market volatility still a primary consideration and many investors favoring defensive sectors, quality stocks and the related ETFs are worth examining in 2019.

Even during the volatile moments of the market, investors were quick to react to news–trade wars, inverted yield curves and now government shutdowns. It’s the type of noise that muddies the minds of investors and disconnects them from the fundamentals of an asset.

As a result, value investing overall is making a proverbial comeback in the markets.

“Speaking of value, I would also say though that for investors who actually are looking for a true kind of play in the factors space,” said Rogers. “We’ve been talking a lot about value. It’s been beaten down pretty hard, a lot of people see the relative valuation as an opportunity going forward.”

One ETF in particular that captures the essence of value investing via quality is the JP Morgan US Quality Factor ETF (NYSEArca: JQUA), which tracks the performance of the JP Morgan US Quality Factor Index. The underlying index is comprised of U.S. equity securities selected to represent quality factor characteristics.

For an overall value play, Rogers recommends investors look at the JP Morgan US Value Factor ETF (NYSEArca: JVAL), which tracks the JP Morgan US Value Factor Index. The underlying index is comprised of U.S. equity securities selected to represent value factor characteristics.

Fixed-Income in a Cautious Landscape

Part of the investor noise affecting the capital markets in 2018 was rising interest rates. The Federal Reserve didn’t show much dynamism in 2018 with respect to monetary policy, obstinately sticking with a rate-hiking measure with four increases in the federal funds rate.

That appears to have changed given the current economic landscape, and especially in the capital markets as Fed Chair Jerome Powell is now preaching patience and adaptability. Powell’s latest comments come as U.S. equities finished their worst year in over a decade–the Dow fell 5.6 percent, while the S&P 500 lost 6.2 percent and the Nasdaq Composite fell 4 percent.

This has posed challenges for not only equities, but the fixed income markets–specifically areas that were tried-and-truel safe-havens when stock markets go awry.

“Think about investment grade, high duration–that’s seen a lot more volatility than many investors had expected,” said Rogers. “We believe that not only is that a challenge it’s also an opportunity, especially when you look at the ultra short side of the curve where you can actually get paid now. Whereas if we rewound the clock two years ago you weren’t getting anything.”

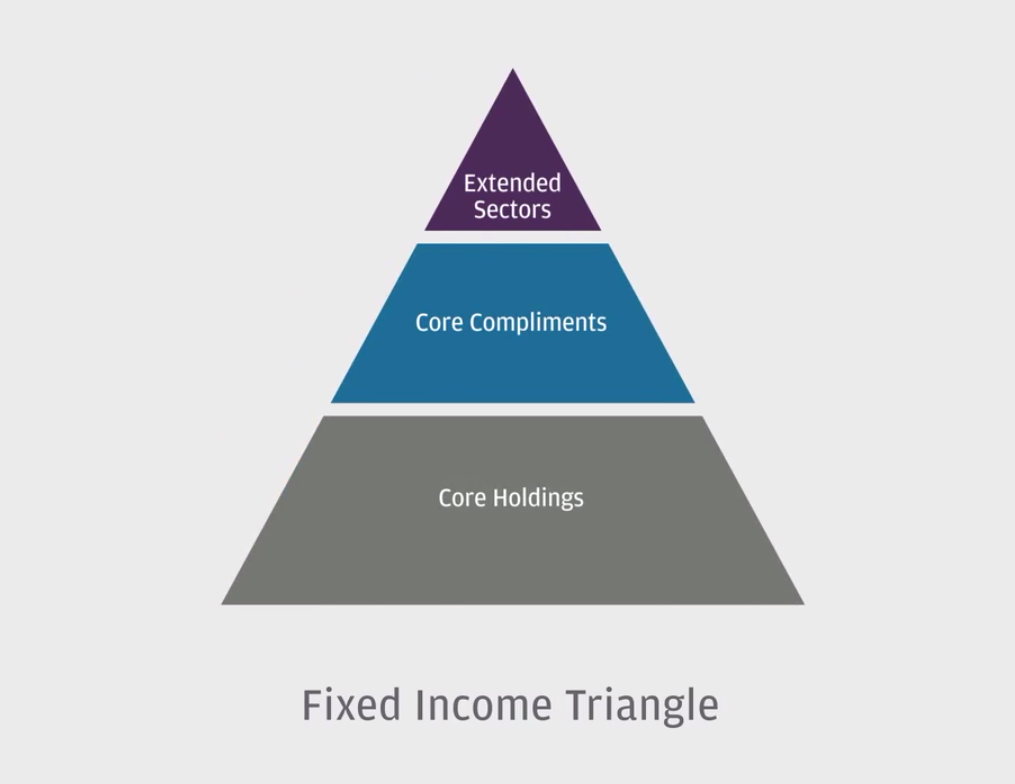

The Fixed Income Triangle

When it comes to building a fixed income portfolio, Rogers cites the “Fixed Income Triangle” as an exemplary framework investors should follow in order to extract the most out of these portfolios.

“It’s three components–your core, which is kind of like the base of your triangle which gives you that correlation benefit to equities,” explained Rogers. “The middle which we call ‘Core Complements.’ That’s exactly where those ultra short duration type of strategies play. Then the top which is the extended sectors. Those are ways where you can sprinkle in a little high yield, a little emerging market debt to get a little bit more income.”

Investors can look at actively-managed funds like JP Morgan Ultra-Short Income ETF (BATS: JPST), which can serve as a flexible tool during times when rates are decreasing or rising. The floating rate component of bonds in JPST’s debt portfolio would effectively hedge against interest rate risk and capitalize on any short-term rate adjustments the Fed decides to make through in 2019.

Furthermore, the fund seeks to maintain a duration of one year or less, thereby limiting prolonged exposure to the fluxes of the capital markets and reducing volatility. This is effective for investors who want to avert the risk associated with holding on to debt securities with a longer duration.

The default bond play to get broad-based exposure might be the iShares Core US Aggregate Bond ETF (NYSEArca: AGG), which tracks the investment results of the Bloomberg Barclays U.S. Aggregate Bond Index. The AGG gives bond investors general exposure to the fixed income markets, but there are times when current market conditions warrant a deconstruction of the AGG to extract maximum investor benefit–one way is through factor-based methodologies inherent in the JP Morgan US Aggregate Bond ETF (NYSEArca: JAGG).

JAGG seeks to provide long-term total return by principally investing in corporate bonds, U.S. treasury obligations and other U.S. government and agency securities, and asset-backed, mortgage-related and mortgage-backed securities–all of which are rated investment grade by a nationally recognized statistical rating organization or that are unrated but are deemed to be of comparable quality.

With the AGG having changed so much within the last 10 years, a fund like JAGG can keep up with the changing times in the bond markets.

“I think one of the key points of that, that we are seeing actually is that within the corporate part of the Barclays AGG, we have seen so much issuance in the lower end of the investment grade spectrum,” said Rogers. “Think of the BBBs–those are the issuers who might have a little trouble if rates start to rise more and they need to refinance debt.”

“We believe that using value, quality and momentum within issuer quality for corporate (bonds) can make a world of difference,” Rogers added.

To watch the entire latest “In the Know” show, click here.