I’ve been interested in option strategies for a long time and their ability to shape the risk and return of my portfolio but I just have not found the time to execute them in a safe way. There are a number of concepts that give me heartburn, like leverage, margin calls etc…

These can go wrong if you don’t spend the time understanding the potential pitfalls. However there are definitely some benefits to options and you can give up some upside in exchange for protection on the downside. Given the recent market gyrations this could be pretty attractive.

Have you read the important notes before proceeding any further?

Selling put options

Over the last couple of years I’ve been looking at one particular strategy – selling put options.

If you sell a put option then you earn a premium. You earn that premium come rain or shine. Whether the market goes up or down, you get that premium. But it’s not without risk…

Let’s recap the reasons why selling put options might be helpful:

-

- You earn the option premium whatever the weather, and in down-markets it will help cover equity losses. Selling a straight put option does truncate the upside returns but the benefits on the downside can help smooth the ride. It is possible to leverage the strategy, where the payoff is magnified, but in our case here we will consider a straight put option.

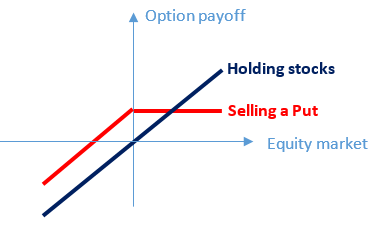

- The chart below shows the payoff of selling a put option compared to holding the stock. You can see that when the market shows very strong growth you make money by selling the put, but less than if you held the stocks (red line lower than blue). However in a strong downturn you lose less than if you had held the stock (blue line lower than red).

![]()

Option payoff profile

Owning a put option provide you with equity protection and therefore demand for put options is high since everyone is frightened of the recent market falls and general over-valued nature of the equity market.

However, there are very few natural sellers of put options since banking regulations effectively stopped banks and hedge funds playing hard in this space.