Anytime we get economic disruption, the market does two things: look for someone to blame, and consolidate. In the asset management business, we’re seeing both of these things happening at once. The consolidation needs no more proof than the announcement today that S&P Global is buying IHS Markit.

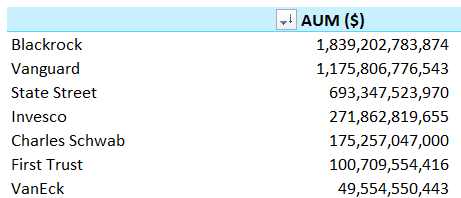

But where we’ve seen consolidation really slow down is in the ETF space. Invesco made the last set of big pushes, rolling up first Guggenheim’s and then Oppenheimer’s Fund & ETF businesses. We now have a $5.2 trillion ETF industry, with the top of the leaderboard looking like this:

With this concentration, the knee-jerk reaction from pundits and academics alike will be (and is already): “let’s prove this is a problem.”

The latest salvo in this battle is a paper from the American Economic Liberties Project titled “The New Money Trust: How Large Money Managers Control Our Economy and What We Can Do About It.” The title sums up the bias going in. The paper doesn’t purport to do new research; it simply summarizes work done by academics and journalists to make an overarching point. Which is fine; I do the same all the time. It’s worth the read, even just as a bibliography on the subject.

The bias of the paper isn’t veiled — the stated purpose of the recently founded AELP is to be an anti-monopoly group. So it’s no surprise their conclusion is the same as their premise:

“Policy makers must heed Jack Bogle’s warning about the inherent dangers of the rise of a group of Big Three asset managers that controls a slice of the financial markets and corporate America that is ever-increasing, and steadily reaching a size nearly equivalent to the size of our entire economy.”

Breaking Down the Arguments

Collusion & Competition?

Anti-monopoly activity is built around a compelling case for anticompetitive behavior. The idea is that firms with monopoly power can price however they like and deliver whatever value they like. Without enough competition, they will over-price and under-deliver. We’d expect the individual consumer to be hurting badly, overpaying for bad products. Here the paper — and every version of this argument I’ve read — tries to skim through quickly, because the numbers aren’t on their side. It’s clear that the rise of indexing and the fee wars associated with it have been good for consumers. According to Morningstar, the average fee paid by all mutual fund and ETF investors has plummeted from 0.87% in 1999 to just 0.45% in present times. Savvy investors can do even better: our “cheapest ETF portfolio” is now just an all-in 0.04%.

One complaint many small ETF issuers used to have — that they couldn’t access the commission free platforms at places like Fidelity and Schwab — has dissolved as well. The major brokers have all dropped their commissions to zero on ETF trades. With the passage of the ETF rule, the reality is that it has never been easier for an ETF issuer to launch. And many have, with numerous examples of small up-starters rocketing up the league tables in a few short years. ARK Invest, Pacer, and Innovator to name three independents, and countless established brands have joined in as well: Goldman, Fidelity, First Trust, and JP Morgan come to mind.

While the frantic pace of net-new launches has slowed, that’s actually a sign of health: Investors don’t need 100 different versions of the S&P 500. The dozen or so variants available now at institutional prices get the job done.

Does this make the market “anti-competitive?” I can’t make that case. Not when innovation is still consistently rewarded with asset flows. Commoditized beta exposure may be hard to penetrate, but then again, so is the market for countless commoditized goods and services. It’s hard to break into copy-paper too.

Common Ownership

If the traditional collusion and pricing argument falls flat, most research hangs its hat on common ownership. The “big three” collectively own somewhere between 20 and 25% of the shares of most large- and mid-cap companies. One can certainly create a set of circumstances where this could be bad news. If issuers got together and started voting as a block for highly controversial shareholder votes, I could see the concern.

One angle that academics have been trying to “prove” is that because the big players own all the competitors in most industries, they have incentive to keep those companies from competing, creating de facto monopolies in related industries. The biggest paper on this by Azar et. al. in 2014 tried to create a connection between pricing of airline tickets and their ownership by big common owners. The authors theorize that the mere fact that, because two large airlines are in big index funds means they’ll supernaturally arrive at non-competitive ticket prices (without every showing exactly how this would happen, from a real world perspective).

But the point remains that the incentive is there, even if there’s no evidence anything bad is happening. Certainly any evidence in the proxy voting record would be easy to find (say, shareholder proposals to all the airlines suggesting they raise prices). We don’t see that. Which leads us to …

Voting Power

The Big Three have a big voice when it comes time to vote at shareholder meetings. So let’s just take this as a given: it could be an issue. But we have a lot of reasons to think it’s actually not. At least not yet:

- Asset managers aren’t voting their shares; they’re voting my shares and your shares. The votes in question belong to the shareholders of their mutual funds, ETFs, and their separate account clients.

- Managers actually compete on how they vote. Blackrock has made huge waves for focusing on sustainability. State Street has crowed about board diversity. So the idea that they are somehow collectively voting in a way that destroys the competitiveness of their holdings seems wildly off track.

- Large asset managers can afford to staff large proxy departments. That means they are actually more likely to take a thoughtful position on important shareholder votes, rather than simply outsource to a third party. Just a decade or so ago, firms like ISS had enormous direct influence over how almost all proxies were voted. With governance in the headlines, today’s script has flipped.

But if we agree there *could* be an issue, let’s solve this issue, not imaginary monopoly topics. This issue of common ownership has several potential solutions. Let’s start with the bad ones.

What We Shouldn’t Do

1: Capping? Seriously? Several quite rational people I know think the answer is to say that a firm can never vote more than X% of the shares of a company. This strikes me as 100% non-starter. The whole point of shareholder voting is to give shareholders a voice. You’re seriously going to tell me that because I invest through a fund, my voice no longer matters? This would disenfranchise individual investors, leaving only large institutions at the table.

2: Split-the-baby. There are legitimate issues when a particular fund gets too big. If you invest only in small-cap stocks, your fund has a natural cap before you start owning too much of your target companies. T. Rowe Price just calved off it’s small-cap group for just this reason — to create alternatives under different umbrellas with more flexibility. It’s precisely for this reason that ETFs aren’t the best fit for low-capacity strategies, because the right thing to do is usually close your fund when you get “too big.”

But let’s not confuse that with what “breaking up” the big-three would mean. You can’t just do it based on number of funds — you’d effectively have to create micro-businesses and split funds. Any logical division of a firm like BlackRock — say, splitting out active from index, splitting data & software out, breaking up by asset class — none of those actually solve this problem. You would have say “this ETF is too big” and somehow force it to become smaller.

Good luck figuring out how to do that. Funds are not “owned” by issuers. “Issuers” have contractual obligations with the actual companies-that-are-the-funds, which themselves are run by (theoretically) independent boards. Are you really going to tell the fund board of, say Vanguard’s S&P 500 ETF (VOO) that they need to split the fund into a bunch of competing S&P 500 index funds? Who determines who goes with which fund? It’s a nightmare, and an impractical one at that. Not to mention how each fund would have larger fixed costs fees to cover, reversing decades of progress on reducing costs to end investors.

Solutions?

There are quite a few ways one could understand and then mitigate the concentrated voting problem Off the top of my head, here are three:

1: Surveillance. If there’s one thing I agree with, it’s that the proxy process is far too opaque. Yes, the big firms publish documents about how they manage the proxy process (here’s Blackrock’s).They also have generic guidelines on how they’ll vote common issues (here’s Blackrock’s). The first step in any remediation of the common ownership issue should probably be SEC surveillance and reporting on what companies are actually doing in an aggregate, easily-surfaced way. Ideally, I should be able to punch in “TSLA” and see how my fund’s shares were voted on at the last annual meeting.

2: Board responsibility. In an open-ended fund, the actual responsibility for how a specific fund votes the shares it holds on behalf of investor comes down to the fund board itself. Forcing boards to more directly engage at the fund level would be a simple first step. I would expect the board of my Energy Sector ETF to have different policies than the board of my Climate Change ETF after all.

3: Pass-through voting. If I own shares in an fund, it’s my vote. While I don’t want to personally weigh in on every shareholder vote in the S&P 500, it’s not ridiculous that my fund should ask me for my opinion on a few hot button topics. This could be done in any number of ways: perhaps an annual survey of what matters to me, intermediated by my broker? Certainly asking my opinion is less draconian a solution than breaking up the entire business, or worse, telling me my vote no longer counts because my fund is “too big.”

Focus on The Issue, Not the Optics

My point here (and I do have one) is actually pretty simple. First, let’s define where the problem may lie. Then let’s come up with solutions for that problem. In the wake of this recent wave of press around “breaking up the big three,” we’re not doing either. We’re conflating all sorts of things that could be a problem, maybe, someday, while simultaneously recommending the most dramatic solutions.

Instead, lets focus on the one thing most of us can agree is an issue at least in the long-term: too much voting power in too few hands.

I don’t even think we have to burn anything down to do it.