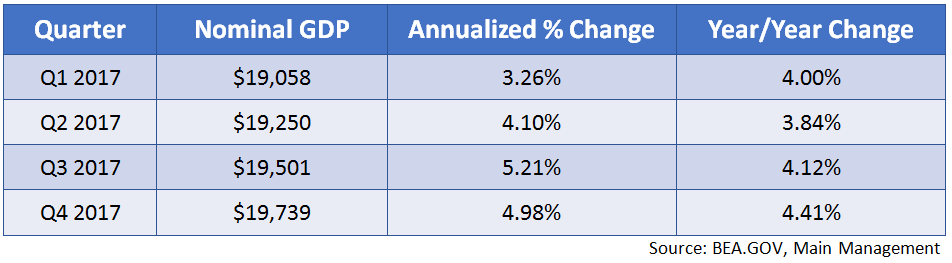

It appears to us that the third and fourth quarter of 2017 may finally be a turning point for Nominal GDP as the quarter-over-quarter annualized growth for both periods has approached or exceeded 5% and the annual growth was beginning to lift as evidenced by a year over year growth of 4.41% in the final quarter of 2017.

![]()

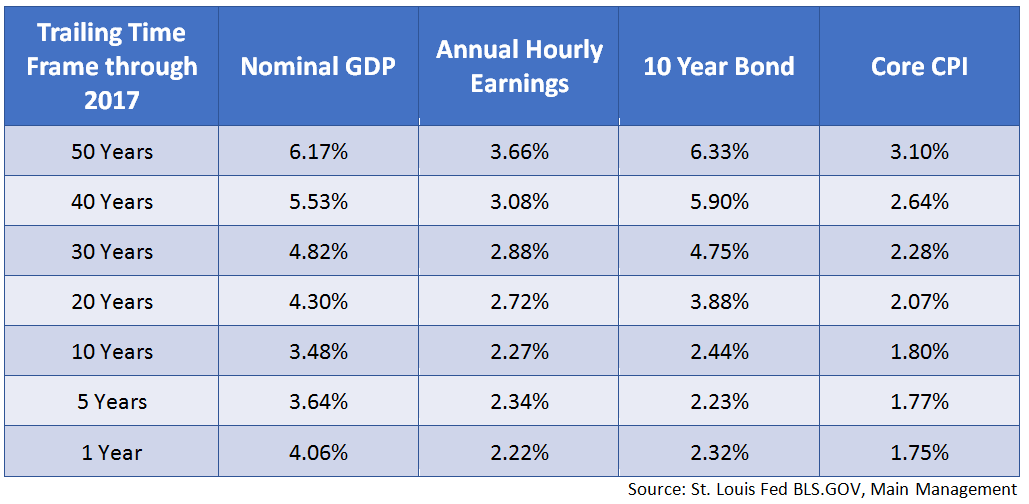

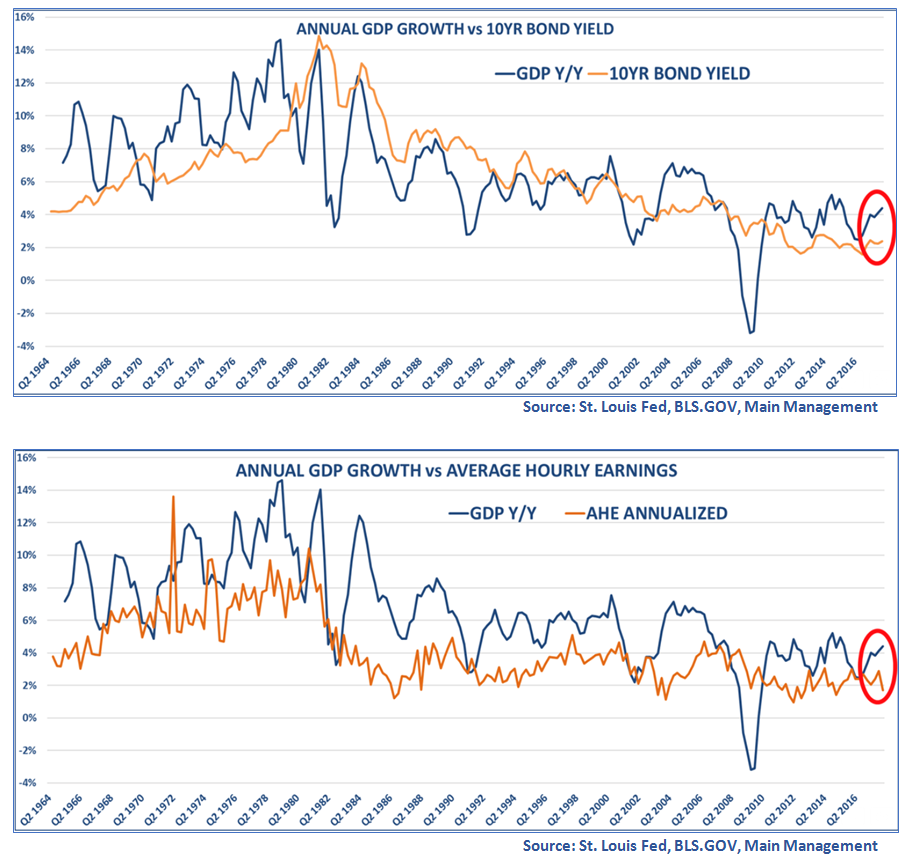

Because of the higher levels of Nominal GDP growth, we believe interest rates and wage gains have bottomed. It should be no surprise that corporations are hard pressed to lift wages (Average Hourly Earnings, or AHE) at a faster pace than revenues. That has been historically true and can be seen below. The following charts and table indicates that relationship over time. One can see that whether one looks at year over year changes during the past 50 years since 1967, or the past 40, 30, 20, 10, 5 or 1 year periods, the rate of change in Nominal GDP always exceeds the change in average hourly earnings, interest rates, and core inflation (by definition, Nominal GDP includes inflation so it will always be higher).

While we have delineated nominal GDP against AHE, 10-year interest rates, and Core CPI, what is not as obvious when viewed this way is that during the mid-1960s and throughout the 1970s, outsized nominal GDP was the catalyst for historically high interest rates and inflation. We don’t expect a repeat of those numbers by any means for the current cycle, but we do expect the higher nominal GDP to accelerate which will once again feed into higher rates and higher wage growth.

Since Nominal GDP typically leads moves in inflation by 6 months to a year, we expect inflation to head towards a 2-2.5% level by year end and higher yet in 2019. At this point, we feel this is a good outcome, as the tax bill will probably extend the economy, which has been exhibiting late stage characteristics, out until late 2019 or 2020 before we experience a recession.

The question for the stock market will then become whether the increased interest rates will be accepted as a byproduct of a good economy or whether the levels will act as an agent to choke off growth and lead us to a recession. Our own view, for now, is that the economy has a fairly clear runway until the 10-year bond hits 3.5%, at which time the market will have stronger competition from bond yields and investors will have to reassess.

J. Richard Fredericks is founding partner at Main Management, a participant in the ETF Strategist Channel.

A pioneer in managing all-ETF portfolios, Main Management LLC is committed to delivering liquid, transparent and cost-effective investment solutions. By combining asset allocation insights with smart implementation vehicles, Main Management offers a unique approach that translates into distinct advantages for our clients, including diversification, cost efficiency, tax awareness and transparency. http://www.mainmgt.com.