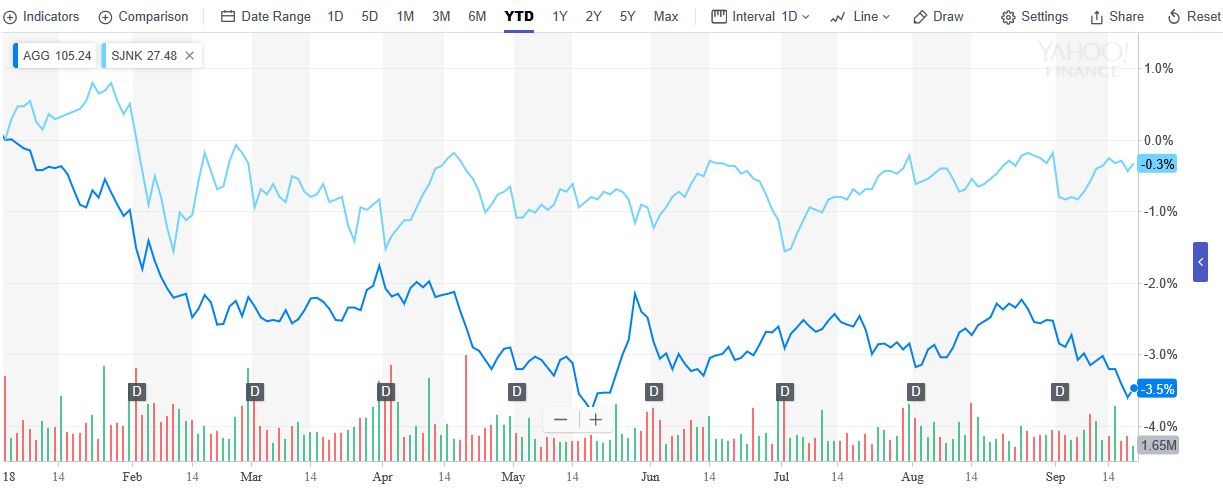

The iShares Core US Aggregate Bond ETF (NYSEArca: AGG) tracks the investment results found in the Bloomberg Barclays U.S. Aggregate Bond Index, which can give fixed income investors broad exposure to the bond markets. However, there are times when higher yields can be extrapolated from looking at options like the SPDR Blmbg BarclaysST HY Bd ETF (NYSEArca: SJNK), which has been outdueling the AGG on a year-to-date basis.

SJNK has returned 3.12% year-to-date, 4.09% the past year and 5.53% the last three years, while AGG is down 1.11% YTD. Additionally, AGG is down 1.26% within the past year, but up 1.70% in the last three years–a case that deconstructing the AGG to corner specific areas of the bond market, high-yield in this particular case, could be more profitable.

![]()

SJNK seeks to provide investment results that correspond generally to the price and yield performance of the Bloomberg Barclays US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index. SJNK invests its total assets in the securities comprising the index, which is designed to measure the performance of short-term publicly issued U.S. dollar-denominated high yield corporate bonds. The short-term maturities will help hedge some credit risk due to the lesser exposure, but holdings are still less than investment-grade.