Last week, Vanguard entered the world of actively managed ETFs with the launch of 6 ETFS. This begs the question if the “fee wars” have now spread to active ETFs. In this week’s TETFindex update, we will explore the revenue generated by the expense ratios charged by the ETF industry. That said, in the previous issue, we explored other interesting ways issuers have maintained and improved margins while aligning with clients through ETFs.

Currently, the average expense ratio of the 2160 US listed ETFs is .43%, but weighted for assets the average decreases to .22%. This shows that most investors gravitate to the ETF client alignment factor of low cost. At .22%, the implied forward-looking revenue generated by ETF fees is estimated at $7.4 billion per year. The direct revenue growth is increasing in line with the growth of assets.

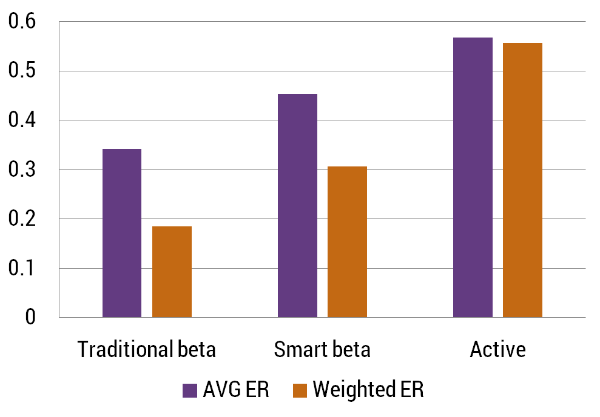

Considering the bold moves by Vanguard, we decided to look at the expense ratio break down by investment approach:

Expense Ratio By Investment Approach

![]()

As expected, Traditional beta is the cheapest offering and Active is the most expensive.

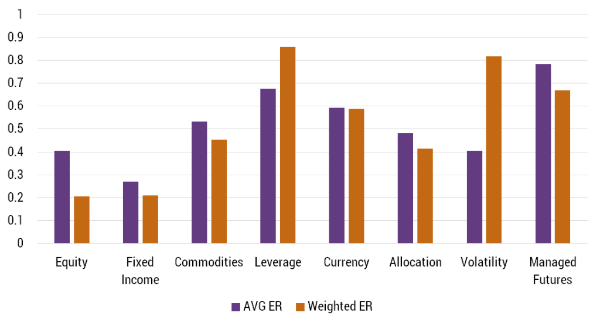

Expense Ratio By Asset Class