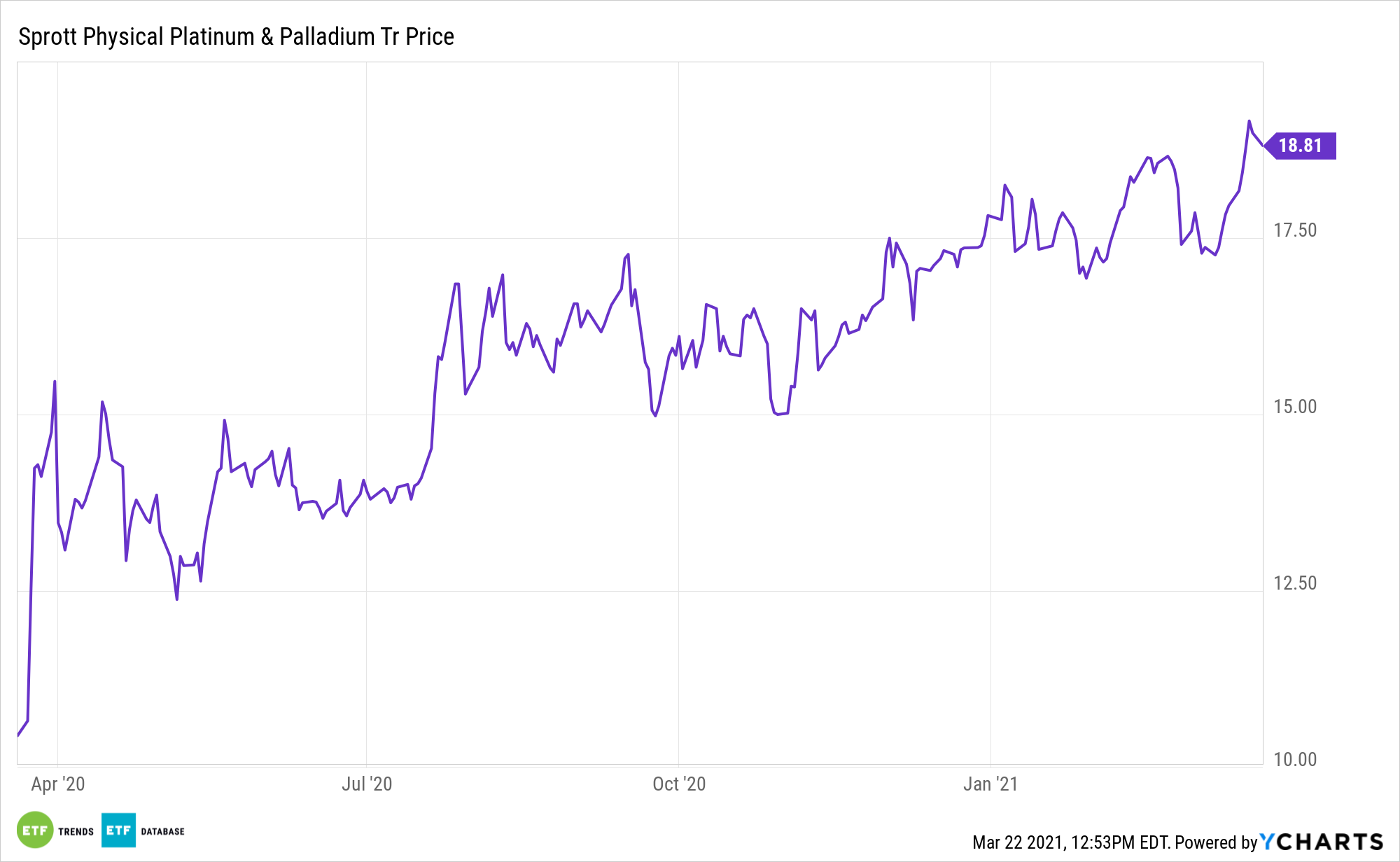

With a global economic recovery taking shape, investors may want to consider more economically sensitive fare, including palladium and platinum.

Both are accessible in the Sprott Physical Platinum and Palladium Trust (NYSEArca: SPPP).

SPPP provides “a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The Trust offers a number of compelling advantages over traditional exchange-traded platinum and palladium funds,” according to the issuer.

Power Up with ‘SPPP’

Axi chief global market strategist Stephen Innes argues that with consumers looking at more single-family vehicles over public transport, platinum group metals will benefit from the recovery in global automobile sales, tightening emission standards, and strong Chinese imports, Reuters reports.

“Platinum and palladium have surged in recent weeks. As the global economic recovery continues and global pollution standards tighten, the recent mine site disruptions suggest hefty deficits and a path toward $3,000/oz for palladium and $1,350/oz for platinum over the next twelve months, strategists at TD Securities report,” according to FX Street.

Analysts at Metals Focus also argued that fundamentals are in palladium’s favor. The analysts projected the metal to see its 10th annual supply deficit next year.

“The palladium market should record a massive defect of some 1.16 million oz in 2021 and some 600kz in 2022, with platinum showing a deficit of 250koz and 16koz over the same period. This suggests that palladium could again challenge the pre-COVID high of $2,883/oz recorded back in March 2020, with a path to $3,000/oz very much in the cards,” according to TD Securities. “Platinum should trade at the highest level in well over seven years, topping $1,350/oz over the next twelve months. Traders should also expect very robust jumps in lease rates, as the front end of these markets tighten up.”

Though it’s not an exchange traded fund, SPPP offers tax benefits too. SPPP “offers a potential tax advantage for certain non-corporate U.S. investors. Gains realized on the sale of the Trust’s units can be taxed at a capital gains rate of 15%/20% versus the 28% collectibles rate applied to most precious metals ETFs, coins and bars.”

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.