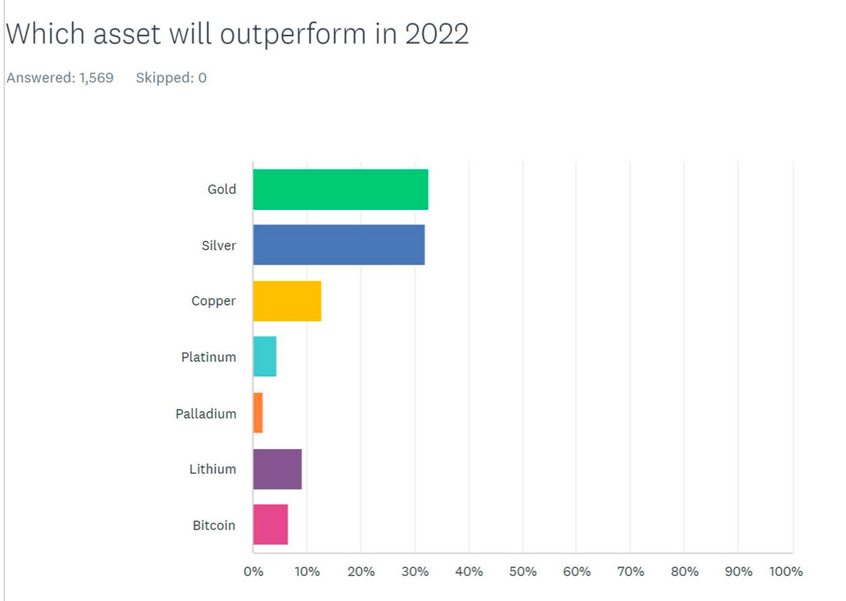

A Kitco online survey took the pulse of retail investors when it came to the outlook for gold and silver in 2022, resulting in a bullish sentiment for Main Street.

The survey was conducted on 1,569 respondents, and over 32% selected gold as the precious metal that’s set to outperform in 2022. Coming in second was silver, which also has a higher use case than gold, which is seen more as a store of value and an inflation hedge.

As far as what Wall Street thinks, they appear to share the same sentiment, based on analysts’ views.

“After facing numerous headwinds in 2021, we believe gold’s path higher looks clearer in 2022. Moderating equity market returns and inflation concerns may bring the market’s focus and flows back to the yellow metal next year. [The] greenback will not be a substantial headwind in 2022 as it was in 2021,” said Wells Fargo. “While we are optimistic that gold could finally move higher in 2022, a stronger price trend may take some time to develop, which prompts us to lower our year-end 2022 target range to $2,000-$2,100.”

As Wells Fargo mentioned, gold will have to contend with rising interest rates. That could potentially prop up the U.S. dollar as inflation continues to run hot.

“A primary question for 2022 might be what stops gold from regaining the upper hand vs. most commodities, and our bias is for enduring trends (notably since the financial crisis) to prevail, which favors precious metals more than industrial and the metals sector over broad commodities,” said Bloomberg Intelligence senior commodity strategist Mike McGlone. “Since the end of 2007, gold’s roughly 115% gain has underpinnings from an unlimited supply of fiat currency. Greater supply elasticity is a copper headwind. Indicating the difference for investors, the Bloomberg Copper Subindex Total Return is about 20% vs. 40% for the spot.”

A Dual Precious Metals Option

An option for investors who also want to add silver to their portfolio mix along with gold is the Sprott Physical Gold and Silver Trust (CEF). CEF is a closed-end trust that invests in unencumbered and fully-allocated physical gold and silver bullion in London Good Delivery bar form.

The goal of CEF is to provide a secure, convenient, and exchange-traded investment alternative for investors who want to hold physical gold and silver without the inconvenience that is typical of a direct investment in physical bullion.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.