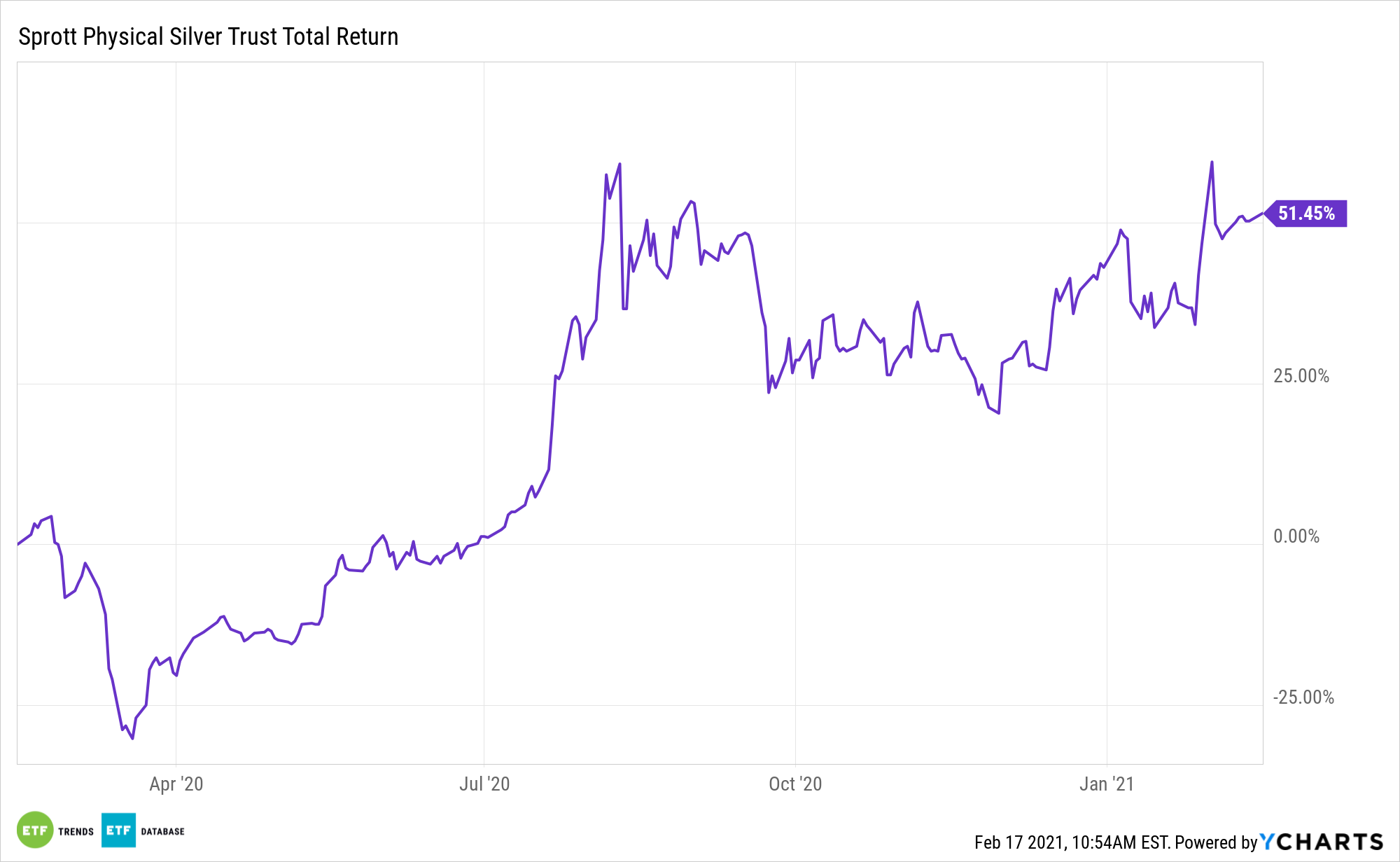

Silver exchange traded funds and trusts such as the the Sprott Physical Silver Trust (NYSEArca: PSLV) are growing, as more market participants turn to the metal as a store of value.

PSLV is a closed-end fund that lets investors redeem large blocks of shares in exchange for delivery of silver bullion. PSLV “provides investors with exposure to physical silver at a time when demand is high, causing excessive premiums for coins and bars,” according to Sprott.

“While silver has a variety of industrial uses, the metal’s price is still heavily influenced by its use as a value store, similar to gold, industry analysts at Moody’s say,” reports Mining.com. “Based on this view, the credit ratings firm has set a price sensitivity range of $17-$21/oz for silver, which will be used to evaluate risk when analyzing credit conditions of mining companies in the sector.”

A Shiny Outlook for the Illustrious Metal

With a deluge of retail traders jumping off of GameStop stock and into silver, prices were recently doused with heavy volatility. Bank of America is looking through the smoke, and remains bullish on the metal as things die down.

“Analysts are expecting silver spot prices to remain at or above the top end of this new range through the first half of 2021, based on recent spot silver prices of more than $26/oz. Silver miners cannot rely on those high prices persisting, though, because silver has averaged $18/oz — close to the $19/oz midpoint of the price sensitivity range — since 2013, and closer to the low end of the range since 2016 ($17.40/oz),” adds Mining.com.

Easy monetary policies and the weak greenback are clearly beneficial to commodities prices, particularly precious metals, but there are other reasons to believe PSLV will continue shining well into this year.

Amid increased adoption of renewable energy sources, new, fast-growing end markets are emerging for silver. In other words, the expected influx of cash to the renewable energy industry thanks to Biden’s victory is seen as benefiting silver prices.

“Yet because of its long history as a medium of exchange and store of value, similar to gold, silver’s price will most often move in response to global macroeconomic factors, market sentiment and speculation, Moody’s says, adding that price is also volatile because of silver’s smaller, less liquid market, relative to other commodities,” concludes Mining.com.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.