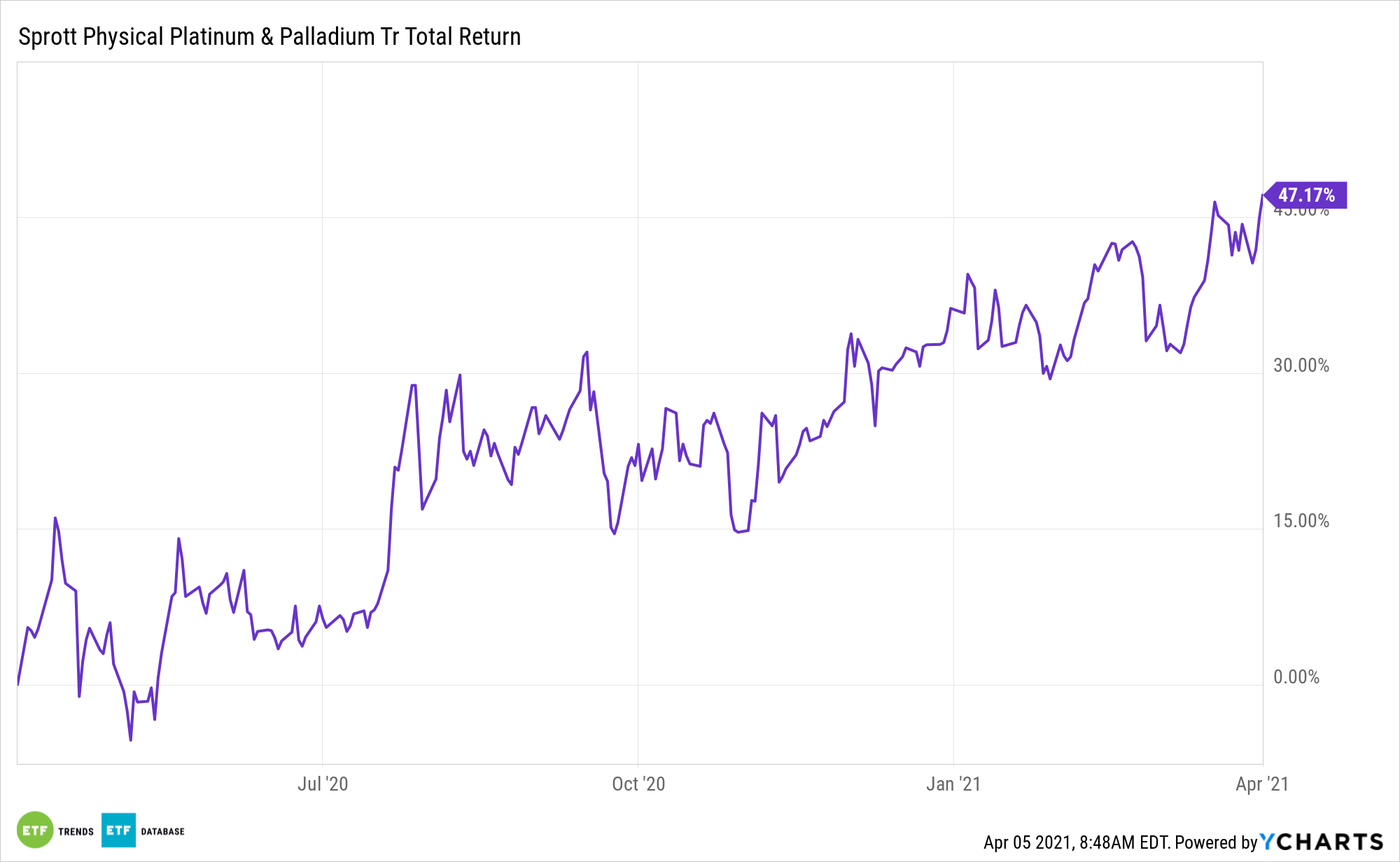

Palladium could be on the cusp of a dramatic leg higher, increasing the allure of the Sprott Physical Platinum and Palladium Trust (NYSEArca: SPPP).

SPPP provides “a secure, convenient and exchange-traded investment alternative for investors who want to hold physical platinum and palladium. The Trust offers a number of compelling advantages over traditional exchange-traded platinum and palladium funds,” according to the issuer.

With the global economy shaking off the ill effects of the coronavirus pandemic, palladium could be a winning precious metal in the back half of 2021. Some commodities market observers are already forecasting more upside for the metal.

“Palladium did a return to point of breakout, close to the November and January highs at 2516.51/2511.03, before heading back up again,” according to Commerzbank. “Since the decline from the current March high at 2758.00 looks corrective and can be subdivided into three smaller waves a, b and c, we expect the current advance to rise above the 2758.00 high towards the 2020 peak and all-time high at 2878.04.”

SPPP: A Positive Outlook

Palladium and platinum are incorporated by automakers in catalytic converter manufacturing to clean greenhouse exhaust fumes. Furthermore, Axi chief global market strategist Stephen Innes, argues in a Reuters report that with consumers looking at more single-family vehicles over public transport, platinum group metals will benefit from the recovery in global automobile sales, tightening emission standards, and strong Chinese imports.

“Only an unexpected slip below the 2491.10 February high would make us re-evaluate our bullish view and may lead to further sideways trading around the 2278.99 March low and above the September-to-January lows at 2202.99/2184.67 to be witnessed,” adds Commerzbank.

Platinum initially gained momentum on the improving industrial consumption of the precious metal, notably in automobile catalytic converters that limit harmful greenhouse gases from exhaust fumes. The metal is now riding the broader market rally as investors chase after rising markets on expectations of higher returns.

Adding to the 2021 case for SPPP is that both palladium and platinum are forecast to be in supply deficits amid aforementioned robust demand.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.