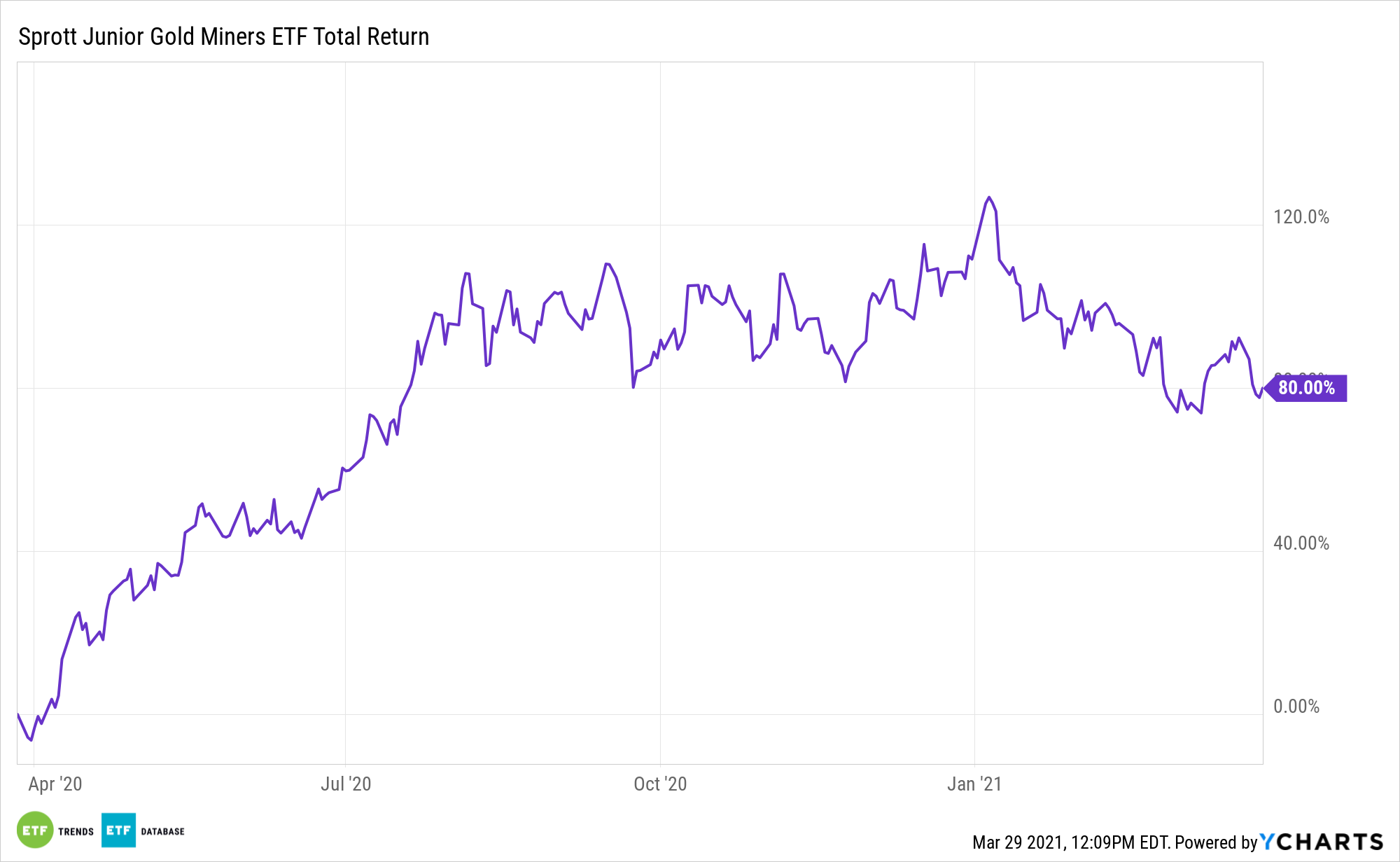

Gold prices hit a rough patch in the first quarter, but that’s not stopping junior miners from pushing ahead with their own projects, and that could work in the long-term favor of the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ).

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. The ETF focuses on price momentum, which helps identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures.

“Even though the gold price has fallen, junior gold miners are moving forward with numerous projects, many of which are fully funded for this year. RBC has met with several exploration-stage companies focusing on regional projects,” reports Michelle Jones for InvestorPlace.

Juniors Offer Big Potential

Gold has also found greater support from safe-haven demand and a more dovish outlook from major global central banks, notably the Federal Reserve’s shift toward interest rate cuts to combat slowing growth. Importantly, miners are proving adept at managing costs.

“Pushing forward with more and more gold mining projects could be good or bad for the junior gold miners. On one hand, it could prepare them for a much higher gold price down the road. After all, it makes sense to mine while the price is lower to take advantage of a higher price later. However, if the gold price doesn’t rebound, junior gold miners could take a hit from all of these capital-intensive projects,” according to InvestorPlace.

SGDM tracks the Solactive Gold Miners Custom Factors Index. That benchmark features stocks listed on major domestic and Canadian exchanges.

“Many factors affect the gold price at any given time, and this year could bring some big changes to several of those factors. For example, gold often rises during times of inflation. It seems logical to expect some level of inflation in the wake of the large amounts of stimulus that have been pumped into the economy. However, some economists don’t expect significant inflation despite all the stimulus,” concludes InvestorPlace.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.