CFA and Market Strategist Paul Wong sees the gold correction nearing its end, according to the latest from Sprott Insights.

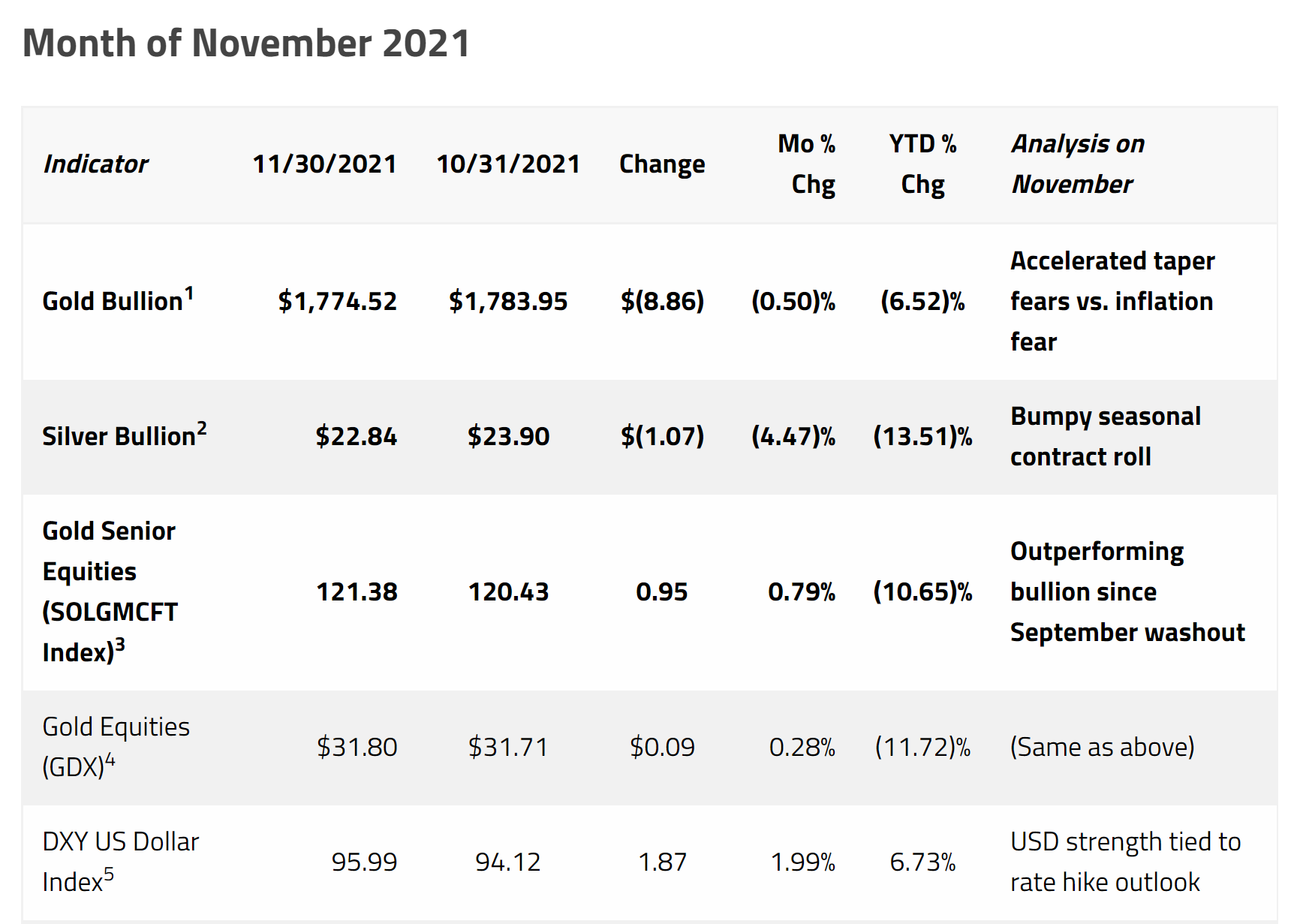

Gold bullion ended November at $1,775, $8.86 under its October finish. Overall, the yellow metal is down 6.52% year-to-date. Gold equities nudged up 0.79% but are still down 10.65% on the year. Silver, meanwhile, is down 13.51%.

Source: Sprott Insights

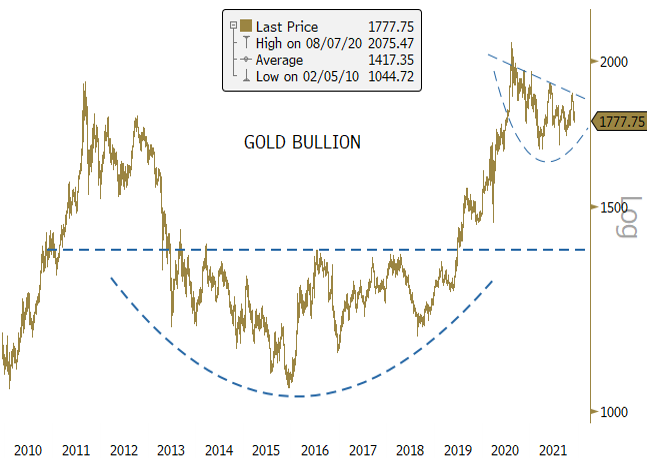

There was a brief rally following the November 2nd through November 3rd Federal Open Market Committee meeting, and gold climbed as high as $1,867 when inflation news heated up. According to Wong, “We believe the end of gold bullion’s consolidation is near (goodbye to Groundhog Day $1,800 at last?). Since gold’s August 2020 peak (see Figure 1), the metal has been consolidating the breakout from the multi-year base pattern highlighted with the dotted blue lines. Though the past year has seen many price swoons and exhausting trading, gold was never in danger, technically, of breaking its secular bullish pattern.”

Source: Sprott Insights

Inflation Is No Longer Transitory

Wong notes that the Fed tacitly acknowledged that inflation is no longer “transitory” by omitting its use of that word. Additionally, the taper announcement arrived without a whole lot of fanfare. “With the Fed now admitting that the risk of persistently higher inflation has increased and is likely to be broader in scope, we wonder if the market will start to price the possible end of the ‘great moderation’ of the past few decades?”

Though consumers are experiencing and anticipating more inflation, Wong wonders the degree to which expectations have been cemented. Consumer mindset is notoriously difficult to forecast, but if consumers start reacting as if inflation is entrenched, it’ll grow increasingly challenging for the Fed to reign in expectations. Wong notes that “The current degree of uncertainty and the surprisingly high levels of inflation are not helping.”

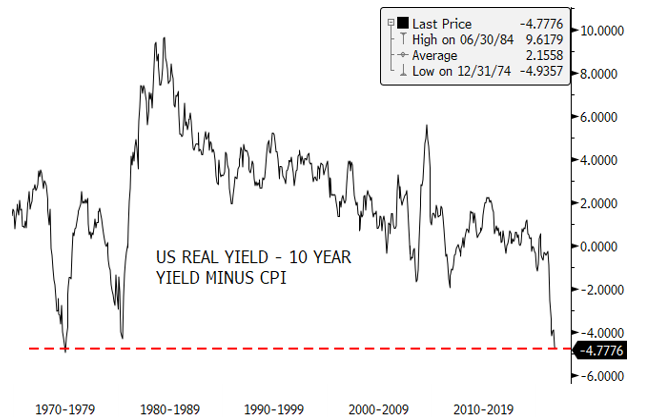

Real Interest Rates Are Showing Real Non-Transitory Inflation

The correlation between inflation and interest rates appears to be broken when compared to historical norms.

Source: Sprott Insights

Wong points out that “ U.S. 10-year Treasury yields, despite U.S. CPI at 6.2% and PCEPI (personal consumption expenditure price index) inflation at 4.1% (both well above the Fed’s 2% target), remain below 1.50%. Using any number of regression fit calculations, 10-year yields would be expected to be above 8% at current inflation levels.”

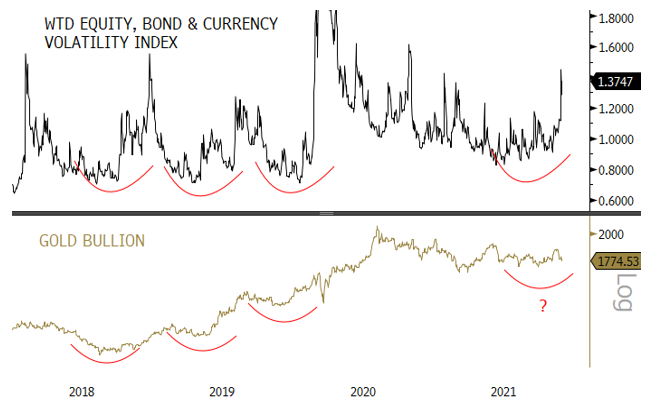

Volatility on the Rise Across All Asset Classes

Bond volatility has been on the rise, outpacing both equity and currency measures to reign it in. As a hedge against volatility, bullion tends to perform well in times like this.

Source: Sprott Insights

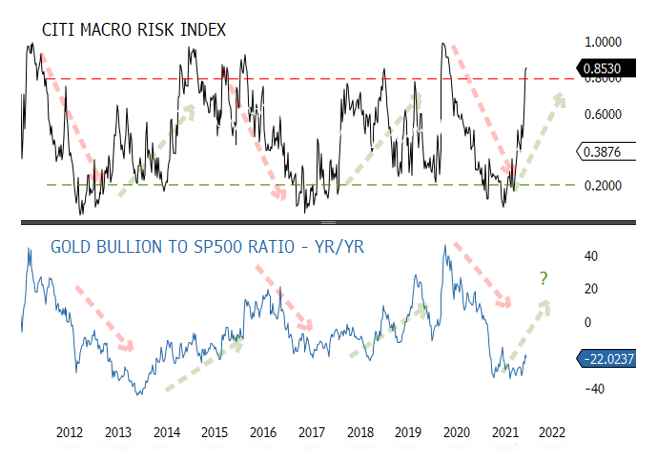

Wong also remarks that information around the Omicron variant remains limited, and that means there are a wide range of possible outcomes to its impact on the markets. There is a chance it can wreak havoc on market growth and accelerate downside forces. Wong continues, “Not surprisingly, when macro risk rises, gold (as a safe haven) relative to equities outperform… The gold to S&P 500 ratio will likely rise if any combination of inflation pressures, Omicron risk, tapering or the slowdown worsens the macro risk picture.”

Source: Sprott Insights

Wong sees the degree to which risks and headwinds are piling up as a sign that gold’s years-long correction is ending. The yellow metal is likely to have continued importance and could very well see new highs soon.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.