Gold had made modest gains lately, but it has recently been struggling to hold on to the $1800/oz price point despite increasing fears about inflation.

The number of jobless claims dipped to their lowest average since October 25th, 1969. Some economists believe that this low jobless claim will give the Fed confidence to quicken its reduction of monthly bond purchases.

JPMorgan forecasts rising bond yields as long-term inflation expectations remain. “Given the resilient economic environment, the curve has room to steepen for a short period in early 2022, and 10-year yields are projected to rise to 2% by mid-year and 2.25% by the end of 2022. Finally, long-end yields are expected to rise as well, but only barely retracing to the highs observed earlier this year by late-2022,” said Jay Barry, head of USD and Bond Strategy, to Kitco News.

Gold Could Get Its Shine Back in 2022

Traditionally a second half inflation heavyweight, gold’s 2021 was disappointing, but there’s plenty of reasons to assume that the yellow metal could be on course for a big 2022. CommTrendz co-founder and CEO Gnanasekar Thiagarajan said to CNBC, “Falling stock markets and gold’s inflation hedge status should keep it well supported on the downside. Meanwhile, if any geo-political tensions were to erupt, that could again boost sentiment. We expect prices to move in the range of $1,700-1,900 an ounce in the first half of 2022 and cross $2,000 in the second half.”

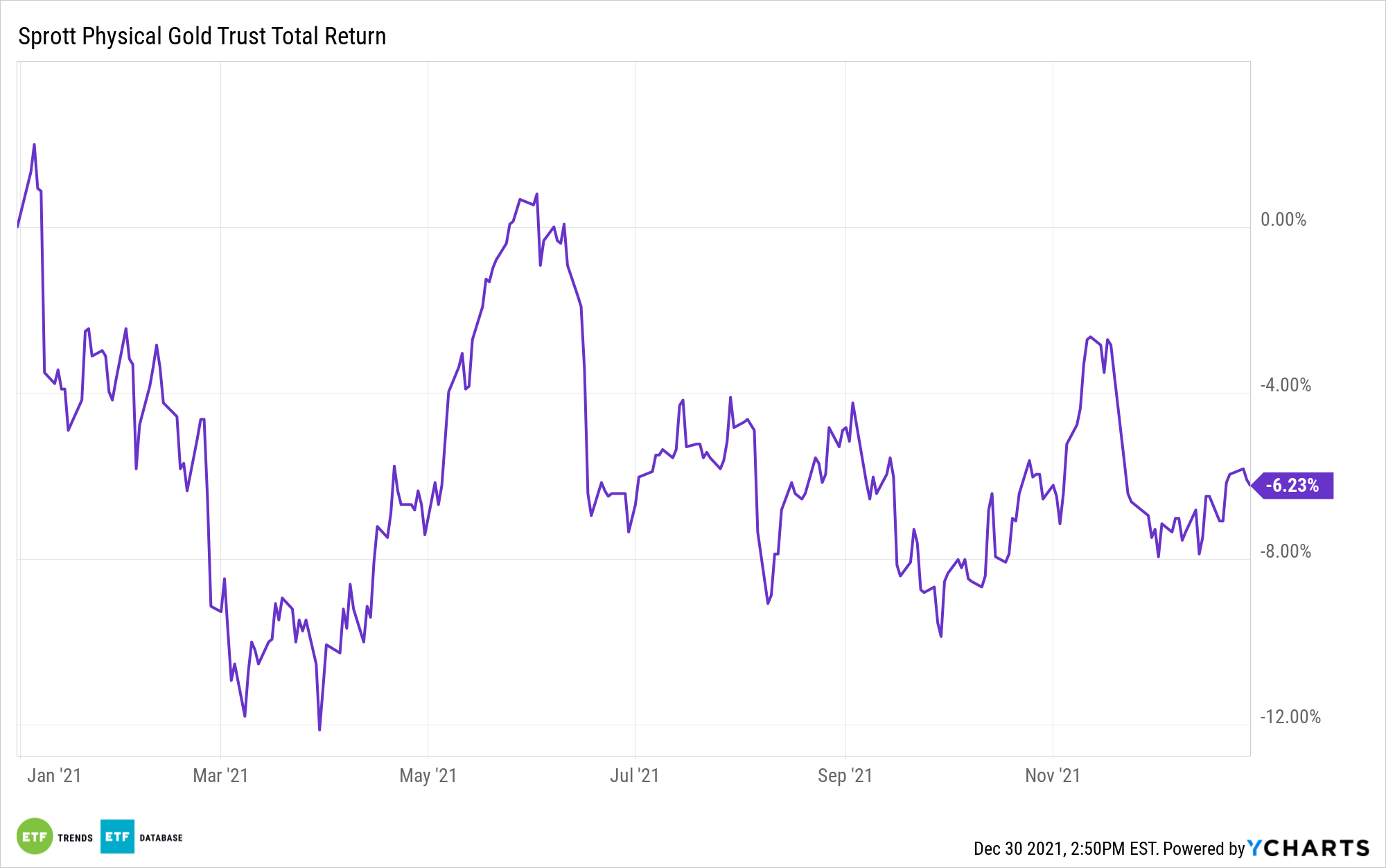

Investors can take advantage of gold’s return to form through the Sprott Physical Gold Trust (PHYS). PHYS is fully allocated to gold that is safely stored, easy to buy or sell, and redeemable. The Sprott Physical Silver Trust (PSLV) offers exposure to silver. Meanwhile, gold equities exposure can be gained through the Sprott Gold Miners ETF (SGDM) and the Sprott Junior Gold Miners ETF (SGDJ).

For more news, information, and strategy, visit the Gold & Silver Investing Channel.