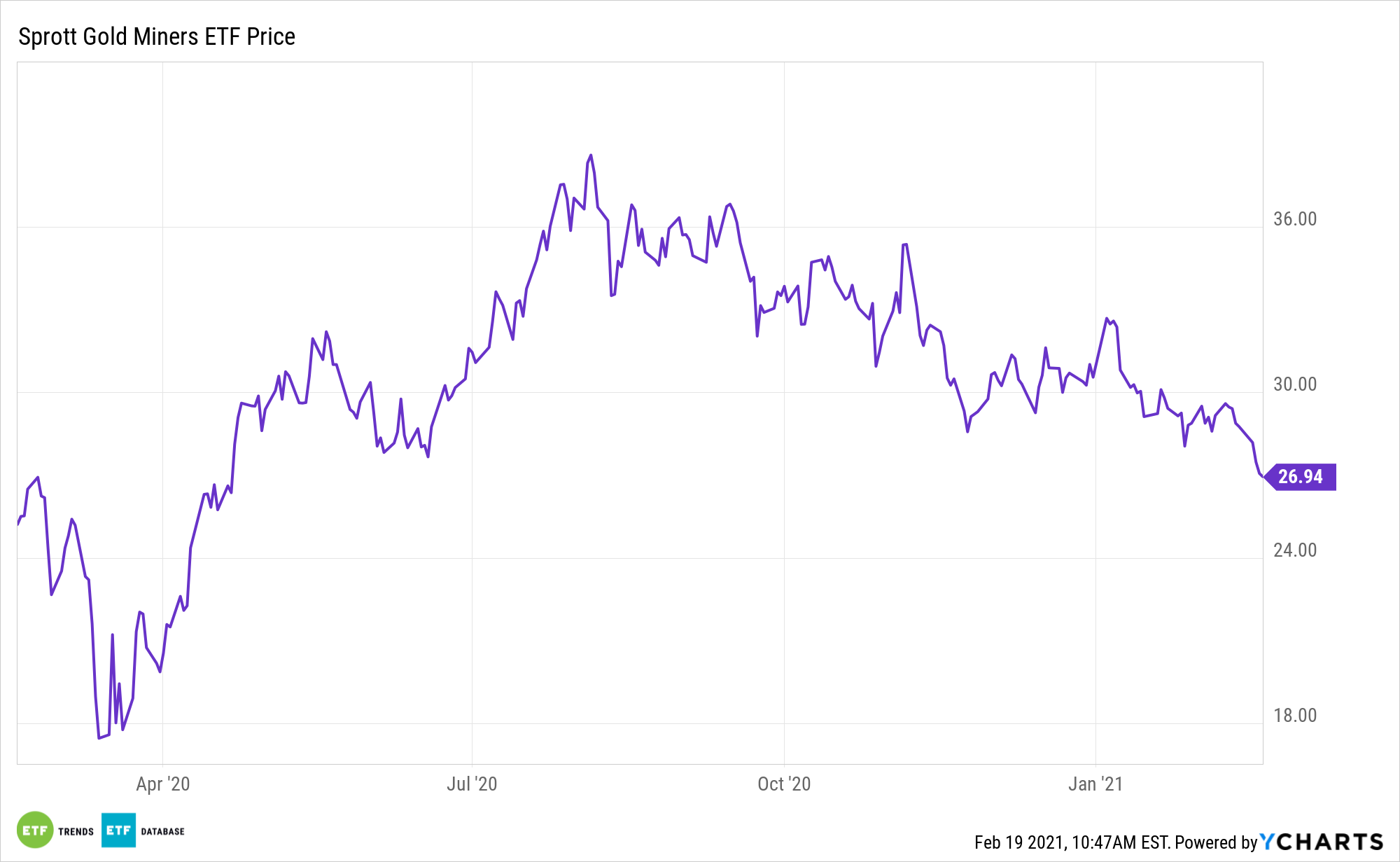

Gold prices are pulling back, which usually isn’t good news for miners, but patient investors should keep an eye on the Sprott Gold Miners ETF (NYSEArca: SGDM).

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Despite the rough near-term backdrop for gold, some positive news recently emerged for SGDM.

“Canadian miner Barrick Gold Corp reported a quarterly profit on Thursday that beat analysts’ estimates, helped by a jump in gold prices due to coronavirus-induced economic uncertainty,” reports Reuters. “Gold prices touched record highs in 2020, as investors flocked to the safe-haven asset while the covid-19 pandemic roiled the global economy. In the fourth quarter, market prices averaged $1,875 per ounce, 26.4% higher than a year earlier.”

Barrick is SGDM’s largest holding at nearly 13% of the ETF’s roster.

The SGDM ETF Can Reward Patient Investors

Last year’s safe haven scramble saw gold rise to new highs, with silver tethering to gold’s success. It could be the other way around in 2021.

SGDM follows mid- to large-cap gold miners, but the underlying index weighs components based on quarterly revenue growth on a year-over-year basis and the quality of their balance sheets as measured by long-term debt to equity. By focusing on balance sheet strength, the fund has greater exposure to companies with a lower long-term debt to equity ratio, which have a greater ability to weather downturns.

“Barrick said its all-in sustaining costs (AISC) for the reported quarter, an important metric for miners, rose to $929 per ounce from $923 last year,” according to Reuters. “For 2021, the company expects AISC to be between $970 and $1,020 per ounce, compared with $967 in 2020.”

Gold certainly had its run during the uncertainty of the Covid-19 pandemic, but as more economies around the world look to return to normal, the precious metal could start to lose its luster. That, however, could pose a buying opportunity for investors looking for gold exposure. Adding to the case for SGDM is improving cash flow for many gold miner companies.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.