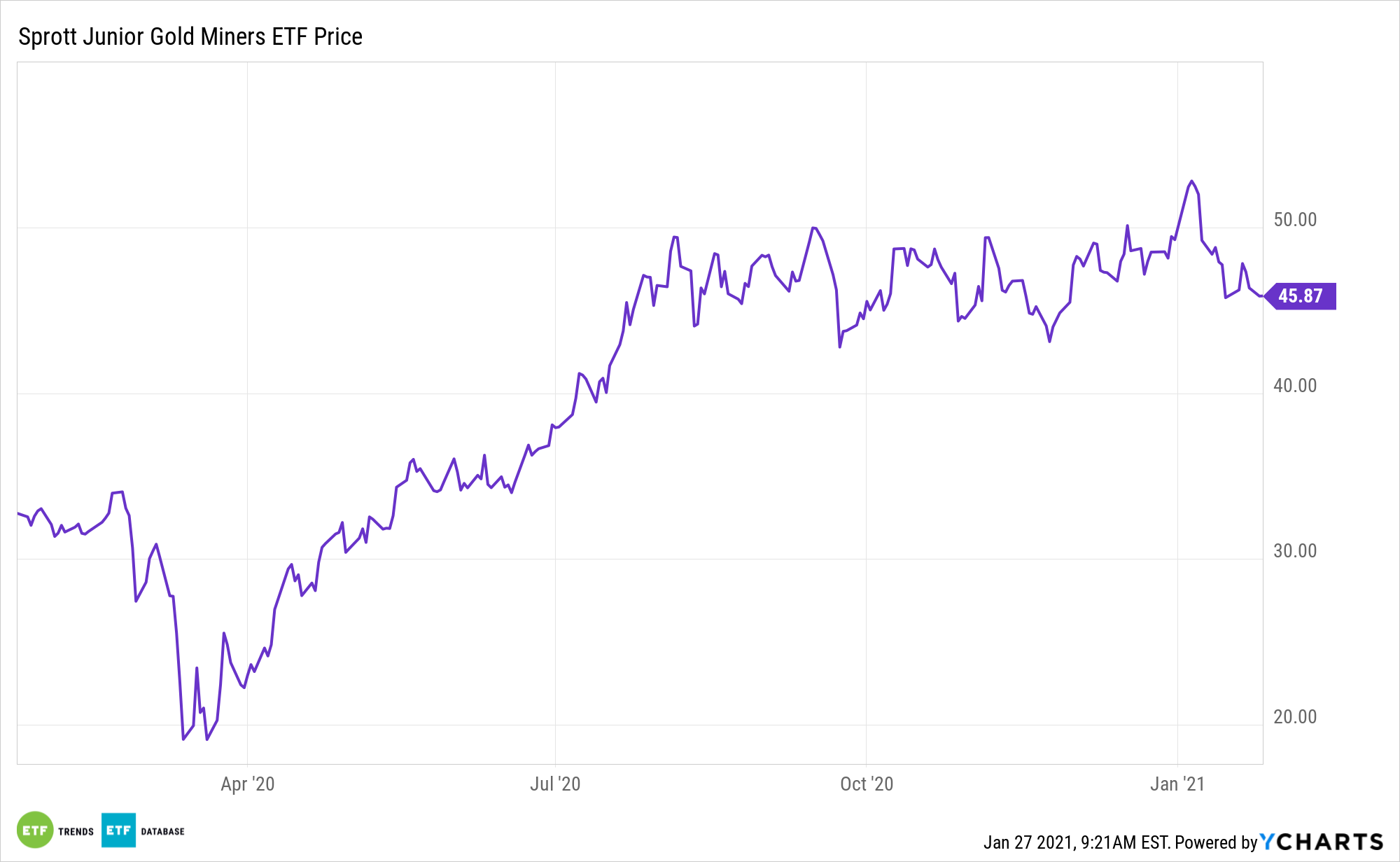

Gold prices have been lethargic of late, but many market observers believe that scenario is about to change. Rising safe haven prices will benefit junior miners and the Sprott Junior Gold Miners ETF (NYSEArca: SGDJ).

SGDJ tracks small cap gold miners, but weighs its components based on revenue growth and price momentum. SDGJ focuses on price momentum, which helps identify leading junior gold miners driven by factors like new discovery, mine development, or joint ventures.

“Gold prices edged lower on Monday and continued to experience lackluster price action. After forming a doji day on Monday, which is is a sign of indecision, prices edged lower, despite a declining greenback. Prices are sandwiched between support near the 10-day moving average at 1,850 and resistance, which is seen near the 50-day moving average at 1,858,” writes David Becker for FXEmpire.

SGDJ Ready to Shine Anew

Looking ahead, we can expect the Federal Reserve’s monetary policy to affect ongoing gold demand. Real interest rates have historically created an accommodative environment for gold bullion. Gold returns during periods of negative real rates have been double their historic average.

It’s no secret that gold has been a major beneficiary during the coronavirus pandemic. It has served as a viable safe haven asset amid all the uncertainty in the capital markets.

The price gains have been supported by strong growth in global investment. Additionally, the lower demand for jewelry has shown signs of recovery, which may add another layer of demand ahead. Meanwhile, year-to-date inflows into gold-backed ETFs have hit record levels.

We may continue to see multiple factors come into play to support the gold market in the coming months. For starters, economic expansion has historically been supportive of jewelry, technology, and long-term savings. Risk and uncertainty could further support safe-haven gold demand. The price of competing assets like bonds, currencies, and other assets may also influence investor attitudes toward gold. Lastly, capital flows, positioning, and price trends may ignite or dampen gold’s performance.

SGDJ is up 41% over the past year.

For more on precious metals, visit our Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.