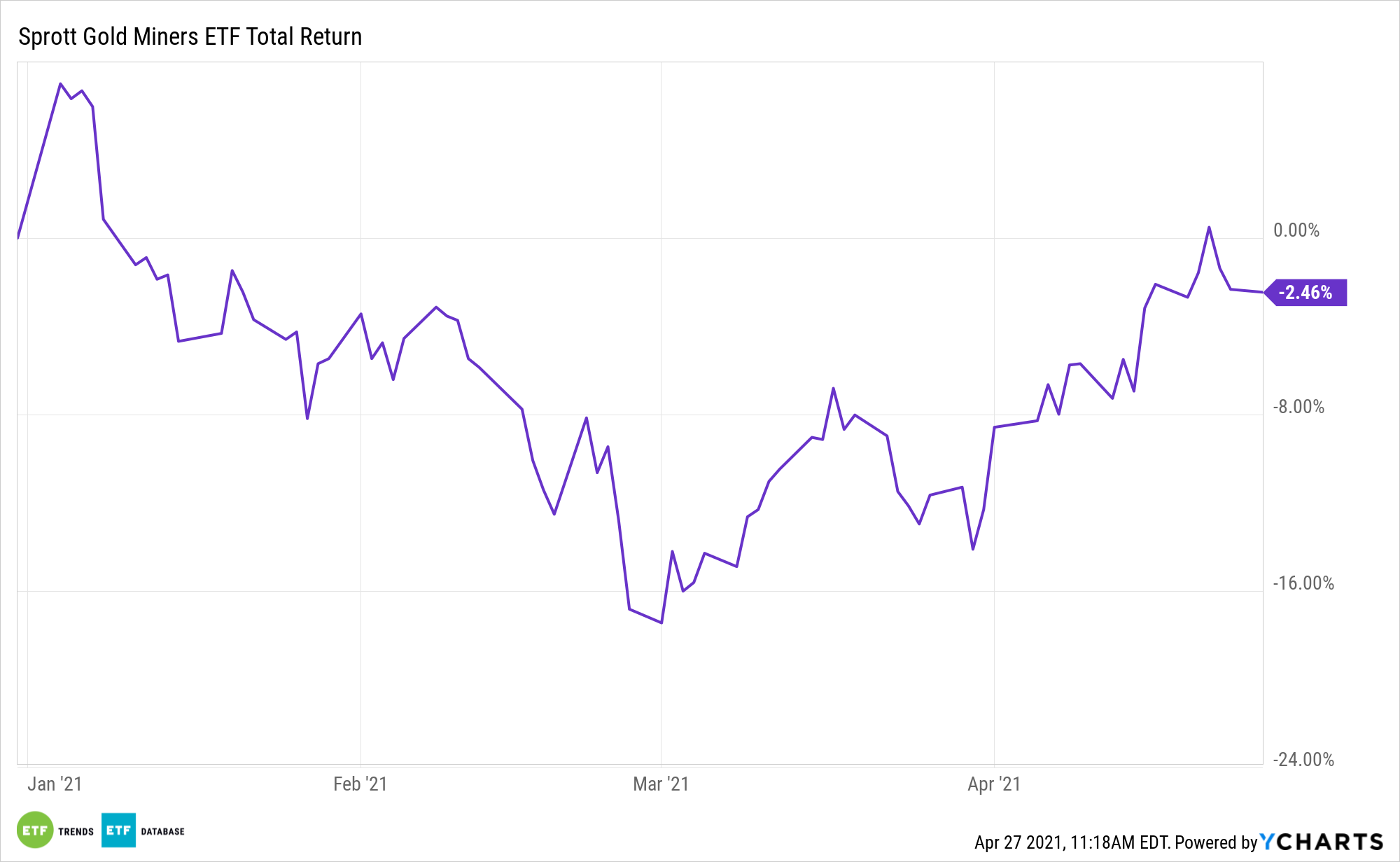

Gold fundamentals remains sturdy, and the same can be said for gold mining assets like the Sprott Gold Miners ETF (NYSEArca: SGDM). Recent struggles for the asset class could be an opportunity for investors to capitalize on stout fundamentals.

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Some good news for investors considering SGDM is the fact that mining stocks are attractively valued.

“Gold stocks remain undervalued, relative to both their underlying profits and prevailing gold prices. Despite gold’s recent correction, the gold miners are still earning money hand over fist,” reports Seeking Alpha.

SGDM’s factor-based methodology, including a focus on miners with lower long-term debt to equity ratios, is compelling in any environment, but even more so when gold miners are trading at discounts.

“Those great fundamentals will only improve as this gold bull’s next upleg continues powering higher. Gold miners’ stock-price gains will amplify their metal’s advance like usual,” added Seeking Alpha.

Investors shouldn’t underestimate the potency of gold miners and SGDM trading at discounted valuations.

“That gives gold stocks big potential to power much higher during gold’s next bull-market upleg, which is already underway. Miners’ stocks way outperform the metal they mine, as their major inherent profits leverage to gold amplifies their gains,” continues Seeking Alpha.

It’s also important to note that while gold prices corrected over the past several months, they’re still high relative to recent history.

“And this epic gold-miner earnings growth will persist through Q1’21, which will be reported over the next month or so. While gold spent most of last quarter correcting, it still averaged $1,793. That remains the third-highest on record, only behind the preceding couple quarters. And that is still up a hefty 13.4% YoY from Q1’20,” concludes Seeking Alpha.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.