The case for gold assets, including the Sprott Gold Miners ETF (NYSEArca: SGDM), remains intact despite a turbulent start to the year.

Investors considering SGDM over the near-term don’t need to look far for an ally because they’ve got one in the Federal Reserve. The Fed’s bond buying is seen as a catalyst for bullion, which could turn into a spark for SGDM.

“In the process, the Fed’s Treasury bondholdings zoomed past those of foreign nations parked at the U.S. central bank, which have remained flat around $3 trillion. And overall foreign holdings of Treasuries fell by $591 billion in the latest 12 months,” reports Randall Forsyth for Barron’s. “The Fed’s massive securities purchases fueled a $4.2 trillion explosion in the broad M2 money supply in the year through February. That, in turn, helped send the U.S. Dollar Index tumbling 13% from its peak last March to the turn of the year. Since then, it’s recovered by about 3%.”

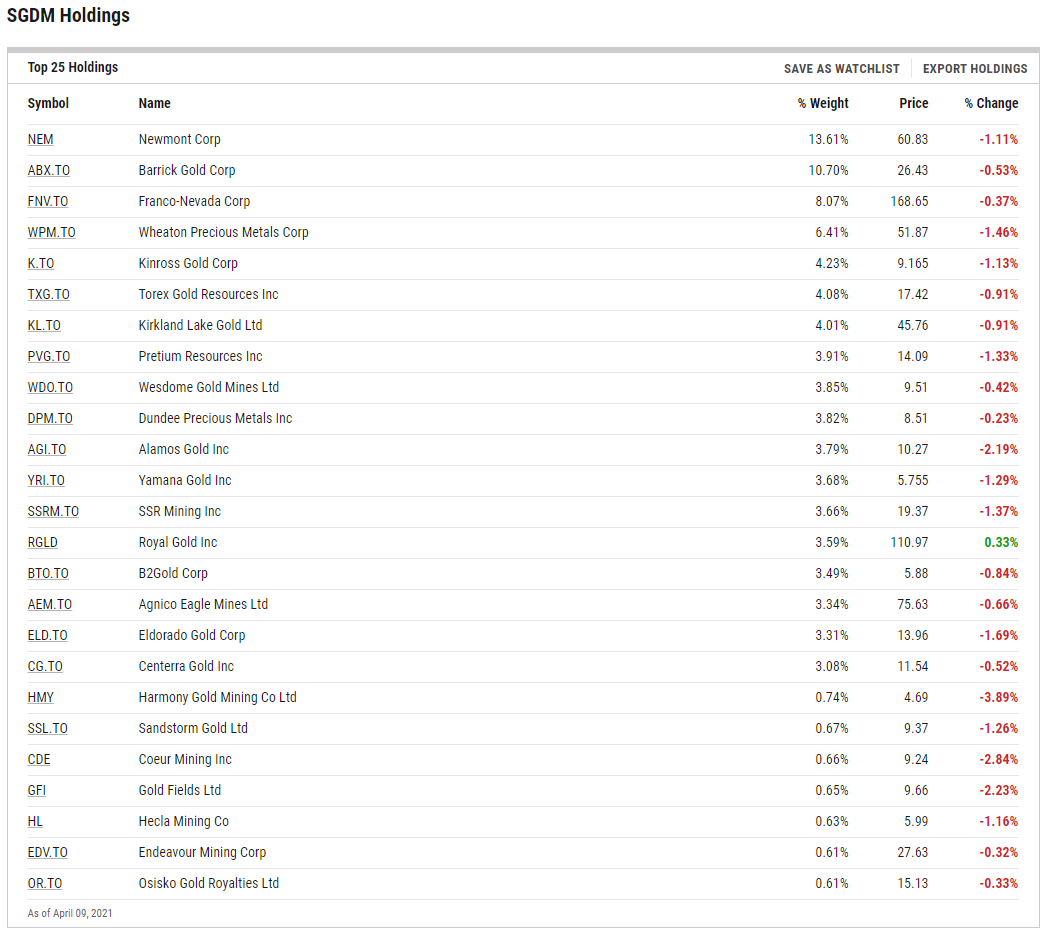

SGDM tracks the Solactive Gold Miners Custom Factors Index and “emphasizes gold companies with the highest revenue growth and free cash flow yield, and the lowest long-term debt to equity ratio,” according to the issuer.

Good Reasons to Back SGDM

Some also point to a weakening U.S. dollar that could further support gold as a better store of wealth. The aggressive fiscal and monetary stimulus measures, along with a shift toward riskier assets, could weigh on the dollar. Since gold is priced in the greenback, a weak dollar makes it cheaper for foreign gold buyers

“That brings the discussion back to gold, which should be viewed as a currency, but one that can’t be printed. From its pandemic nadir, the metal rallied 36.6%, to $2,028 an ounce in early August, before slumping 13.6%, to $1,752.90,” adds Barron’s. “One would have thought that the Fed’s rapid monetary expansion to help spur the economy’s recovery would have lifted gold.”

See also: Top 14 Gold Miners ETFs

Supporting the case for SGDM, we may also continue to see multiple factors come into play to support the gold market in the coming months. For starters, economic expansion has historically been supportive of jewelry, technology, and long-term savings. Risk and uncertainty could further support safe-haven gold demand. The price of competing assets like bonds, currencies, and other assets may also influence investor attitudes toward gold. Lastly, capital flows, positioning, and price trends may ignite or dampen gold’s performance.

“Just to attract the capital needed to fund the twin deficits (budget and current account) requires a cheaper dollar. The best means to hedge the risk of an inflationary dollar decline could be gold or mining stocks such as Barrick Gold (ticker: GOLD), which aren’t themselves already inflated,” concludes Barron’s.

Barrick is one of the largest components in SGDM.

For more news, information, and strategy, visit the Gold & Silver Investing Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.